Richter mt5

- Experts

- Yvan Musatov

- Versão: 2.4

- Atualizado: 20 janeiro 2025

- Ativações: 5

A Richter Expert is a professional market analyst working using a specialized algorithm. By analyzing prices over a specific time period, it determines the strength and amplitude of prices using a unique indicator system based on real data. When the trend and its direction change, the expert closes the current position and opens a new one. The bot's algorithms take into account signals about overbought and oversold markets. Buying occurs when the signal falls below a certain level and then rises above, confirmed by the main signal system. Selling occurs when the signal rises above the level and then falls below, also when confirmed by the main signal system. Richter manages risk reliably and can work effectively with capital from $1000, but for best results it is recommended to use capital of $3000 and above. The functionality includes trailing start, trailing stop, stop loss and take profit, both real and virtual.

To understand how the bot works, you need to carefully study its parameters. A detailed description of the parameters plays a key role in understanding the work of the expert. This helps users fully understand which instrument they are choosing and determine if the bot suits their trading style and broker. Basic settings allow you to create optimal conditions for the expert to work effectively. Money management options offer two options: using a fixed lot or calculating the lot depending on the deposit, which is important for determining the entry algorithm.

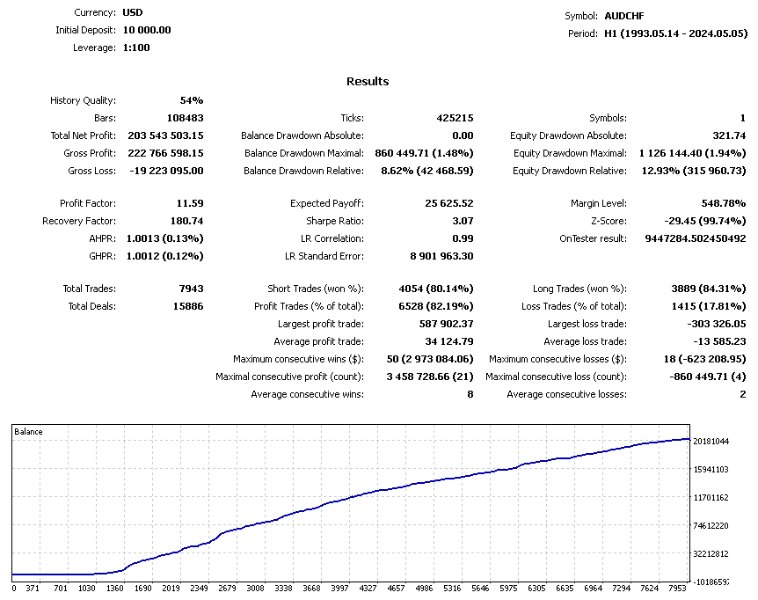

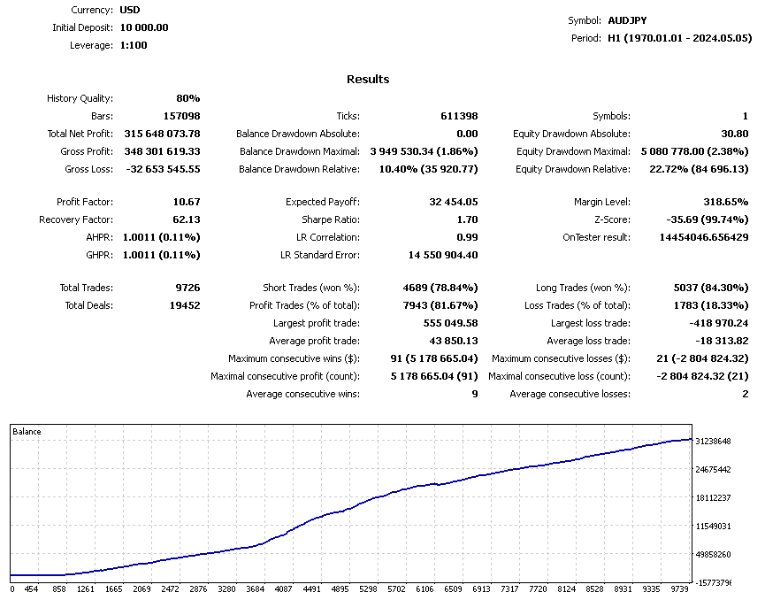

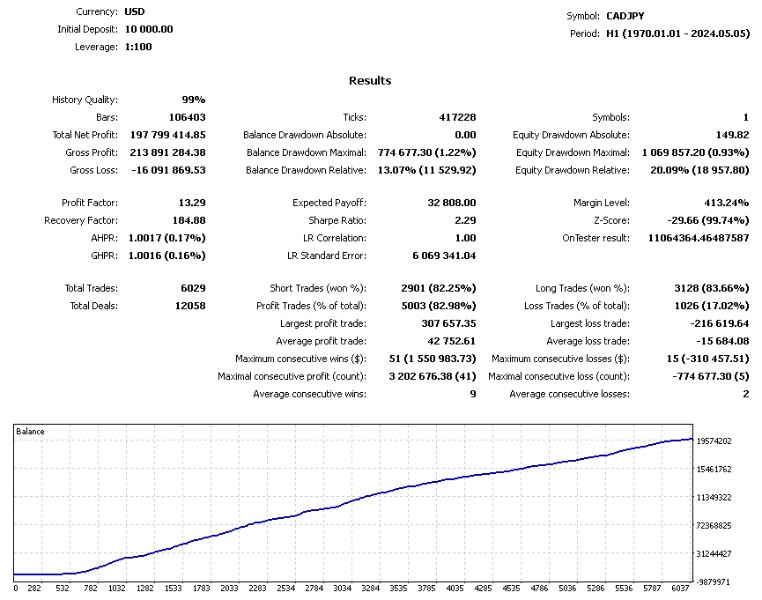

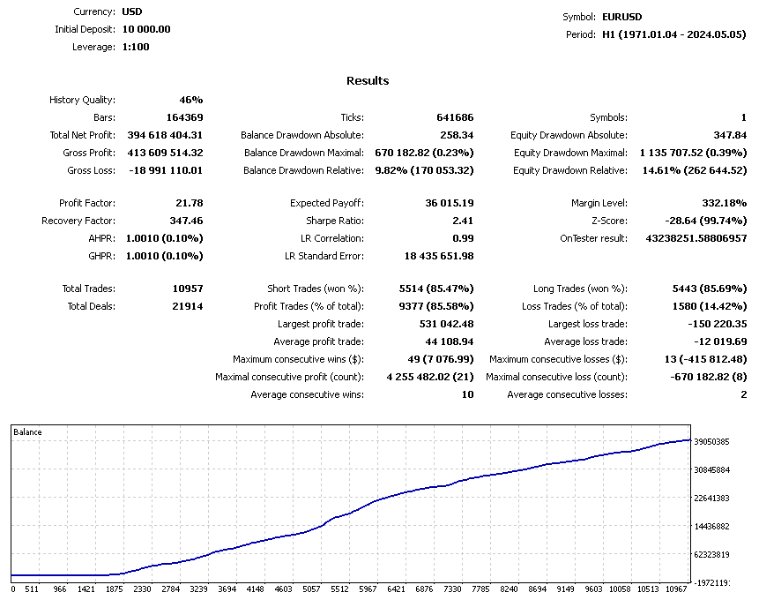

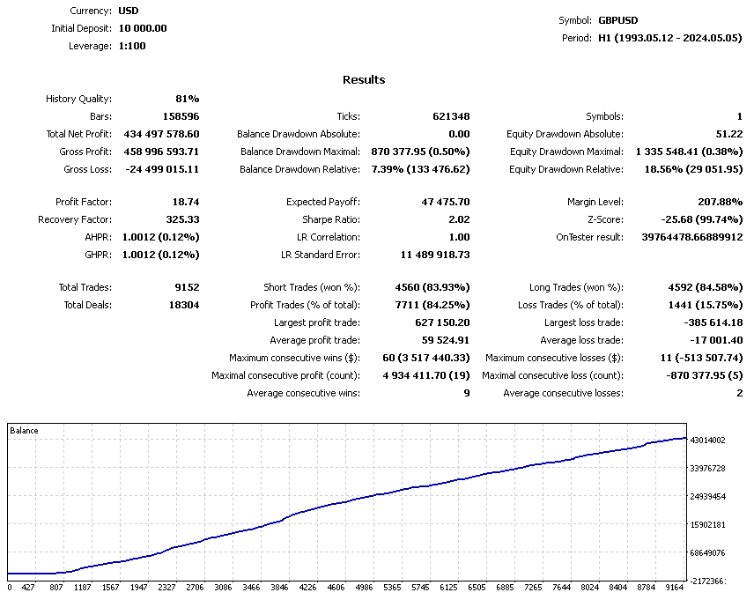

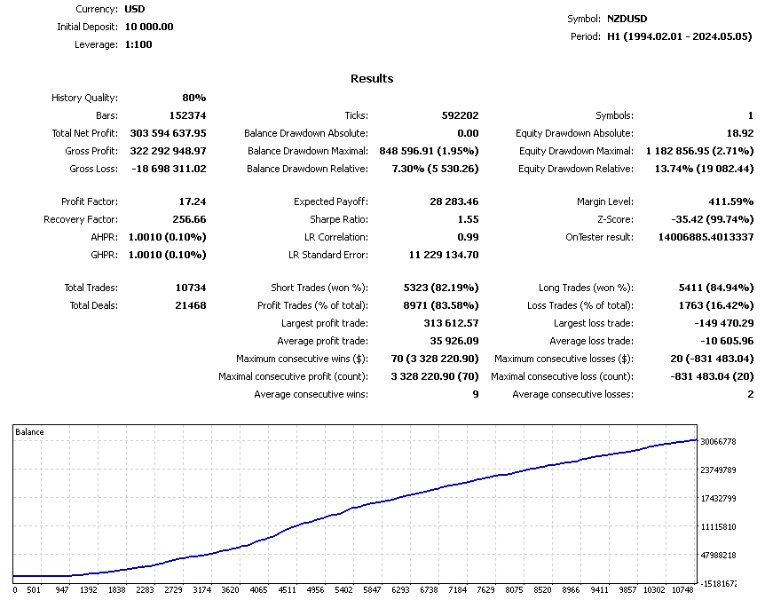

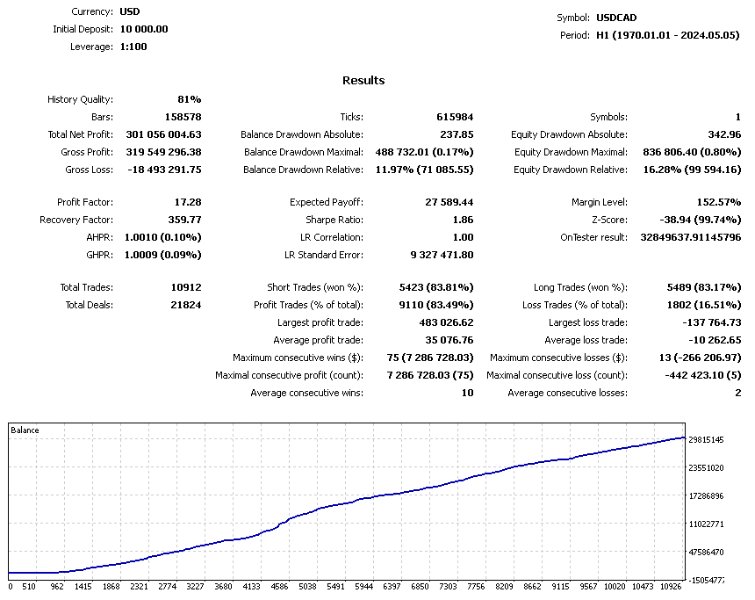

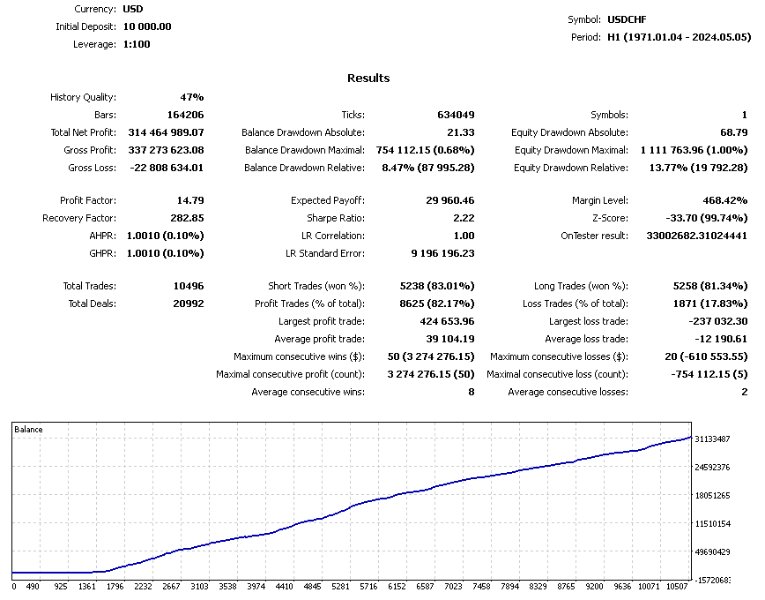

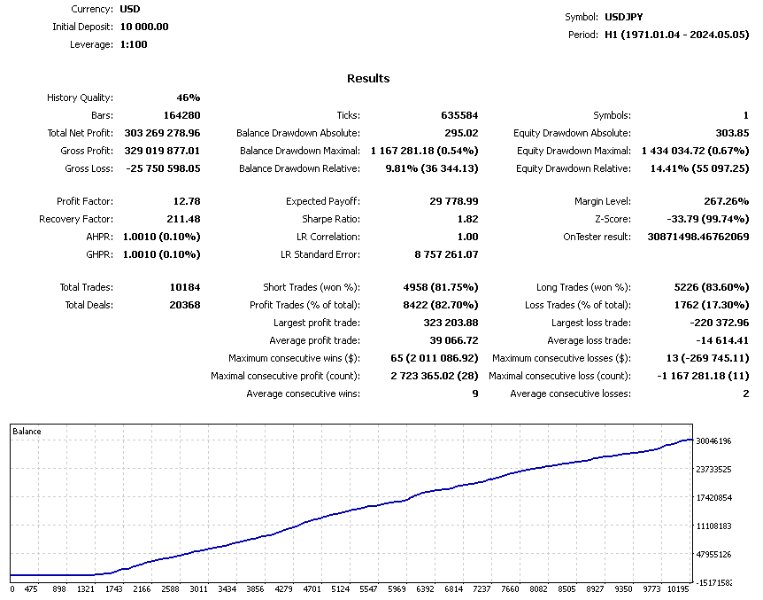

Richter is a professional analytics tool that uses a specialized algorithm to analyze the market. It works with various currency pairs on an hourly chart (H1) with a leverage of 1:100.

List of supported currency pairs:

EURUSD

AUDCAD

AUDCHF

AUDJPY

AUDNZD

AUDSGD

CADJPY

GBPSEK

GBPSGD

GBPUSD

NOKSEK

NZDCAD

NZDCHF

NZDJPY

NZDUSD

SGDJPY

USDCAD

USDCHF

USDCNH

USDCZK

USDDKK

USDHKD

USDHUF

USDJPY

USDMXN

USDNOK

USDPLN

USDSEK

USDSGD

USDTHB

USDZAR

USDRON

Options:

MagicNumber:

This parameter is used to identify orders belonging to a specific expert or trading strategy. The unique MagicNumber allows you to distinguish orders of this expert from orders of other strategies.

FixLot:

The FixLot parameter sets a fixed lot size for each trade. For example, if the FixLot value = 0.1, then each trade will be opened with a lot of 0.1.

Money-Management On:

Activating this parameter (true) enables Money Management, which allows you to automatically calculate the trading lot size according to the current balance or other parameters for effective risk management.

Money-Management:

This parameter determines the level of risk depending on the size of the deposit. For example, the value Money-Management = 2 means that the risk for each transaction will be 2% of the current balance.

CountSeria:

The CountSeria parameter determines the number of trades in one series or sequence of trades. For example, if CountSeria = 3, then after opening three trades in a row, a certain action will be performed, for example, closing all open positions.

TakeProfit:

Setting the price level at which a profitable position is automatically closed. For example, if TakeProfit = 100 points, then when the price reaches a level that is 100 points higher than the opening price, the position will be closed with a profit.

StopLoss:

Setting the price level at which a losing position is automatically closed. For example, if StopLoss = 50 points, then if the price reaches a level that is 50 points lower than the opening price, the position will be closed at a loss.

vTakeProfit:

Virtual take profit. Allows you to set a price level to virtually close a profitable position without actually executing an order on the market. This helps to lock in profits and avoid sudden market changes.

vStopLoss:

Virtual stop loss. Similar to virtual take profit, but for setting a price level to virtually close a losing position.

trStart, trStop:

Parameters for trailing stops. Allows you to automatically shift the stop loss level following price movements in a profitable direction.

Filling:

Defines the type of order filling. For example, "Immediate or Cancel" (IOC), "Fill or Kill" (FOK), "Return" (RT).

ModificationPips:

Sets the number of pips to change the stop loss or take profit levels of the order.

CorrectionLong:

Determines the correction level for long series.

CommentOrders:

A text comment attached to the order when it is placed.

EcnMode:

Indicates the operating mode of the broker in the ECN network.

CombinesAllStopsOn:

Combining all stop loss levels of an order into one level.

AsynchronousMode:

Asynchronous order processing mode.

ActivateBuy, ActivateSell:

Activation of a buy or sell order under certain conditions.

LengthJAW, LengthTEETH, LengthLIPS, LengthDEVIATION, CountWARP:

Parameters that define the rules for the bot's operation.