QuantFiTech Pound and Euro

- Experts

- QFT L.L.C-FZ

- Versão: 1.1

- Atualizado: 4 setembro 2024

- Ativações: 5

Trade Forex using QuantumFinancialTech with confidence instead of with some expensive random number generator that gobbles up lots of your money with nothing to show for it at the end of the day.

QuantumFinancialTech is a FOREX trading tool that places automatic trades in the market based on established cause as resolved from immediate asset price characteristics.

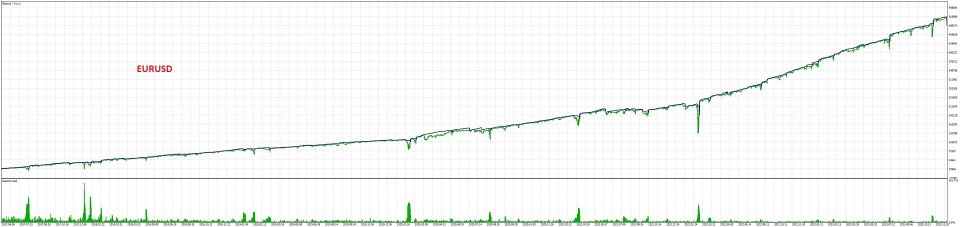

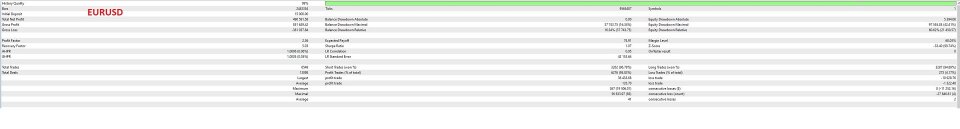

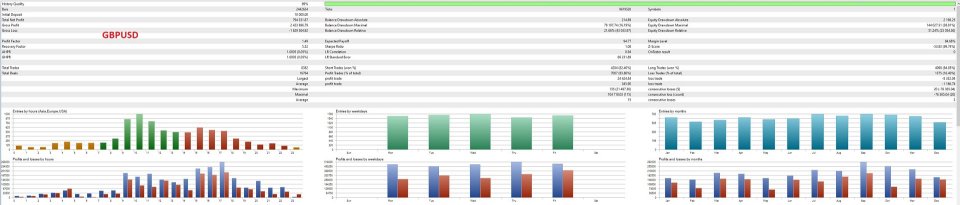

QuantumFinancialTech was designed to trade EURUSD and GBPUSD on M1(1 minute) timeframe. That is Two Symbols with one EA, other EA in the market are designed to trade only one symbol, so with QuantumFinancialTech you are effectively getting two EA in one neat package.

The over-arching concern involved in the development of QuantumFinancialTech is high predictive accuracy. QuantumFinancialTech involved gaining a deep understanding of how as well as why certain immediate asset price behavior is related to strong future price action. Predictive accuracy is an absolute must-have for any successful FOREX trading tool and no combination of money-management/loss-control schemes can make up for poor predictive accuracy. Co-incidentally, building a trend model with good predictive accuracy also happens to be the most difficult part of the construction of a successful FOREX trading tool. Other expert advisors simply integrate indicators of dubious value with some martingale/hedge type money management scheme, such systems typically feature over-reliance on risky money-management schemes and because there is no real price action prediction being performed, such expert advisors are akin to a ticking time bomb, eventually blowing out accounts.

Some other systems substitute A.I. in place of good analytical work, as if A.I. is some sort of panacea. The trouble with most A.I. based E.A. is over-fitting. Such E.A. often feature back-test results that promise impossible returns only to show up dead-on-arrival in live trading.

QuantumFinancialTech on the other hand depends on a high accuracy predictive model that has been in development for more than 4 years and tested in live market for more than one year.

QuantumFinancialTech features a unique loss recovery system that takes effect in the event that positions enter loss. In the loss recovery system, a number of possible systems are exploited.

Indicator Based Loss Recovery

The first system is based on the likelihood that the underlying indicator is still accurate, in which case, the indicator constitutes the basis of loss recovery, on this likelihood, when a position moves into loss by a sufficient amount, the indicator based loss recovery is initiated which involves holding the losing position and opening new positions according to the signals that are issued by the trade indicator, only in this case the lot size of new positions are doubled as long as the loss recovery group is still opened. When the price of the asset moves in such a way that the net profit of the loss recovery group surpasses a threshold profit then the recovery group is closed. The advantage of performing loss recovery in this way instead of choosing some arbitrary "distance" to open loss recovery positions, which most loss recovery systems employ, is that the loss recovery system would be exploiting the predictive power of the indicator to recover from loss. If the indicator is indeed accurate, which we have with QuantumFinancialTech, then loss recovery occurs comparatively quickly and the associated draw-down is minimized.

Pathology Based Loss Recovery

The second system is based on the likelihood that the market has entered into unusually volatile period, mainly caused by unfavorable news events. In situations like this, the pathology based loss recovery is activated. When the EA detects price patterns that are consistent with news events then the indicator based loss recovery is terminated and subsequent position, sized to the maximum lots in the indicator based loss recovery group, are opened along with the trend. The advantage of this method is reduced risk in recovery along with the exploitation of news driven price action.

Recommendations:

· Currency Pairs: EURUSD, GBPUSD

· Timeframe: M1(1 minute)

· Minimum Deposit: $1000

· Account Type: ECN, very low spreads.

· Account Type: Hedge

· Recommended Brokers: IC Markets or FP Markets

· Use a VPS for the EA to work 24/7

An on-chart panel is available to enable the trader to close positions manually, depending on the position type.

Contact us through private message for any questions or issues on setting up the expert advisor.

I made the decision to purchase this algo after my discussion with the developer who seemed to be genuine and very supportive. I don’t regret it at all and I’ve very satisfied with the performance and accuracy. I had some trades hit SL but overall portfolio is in green and recovery model works as detailed in the description. In terms of price, it’s very competitive given you get two EA’s which I’m taking advantage off and running both EURUSD and GBPUSD.