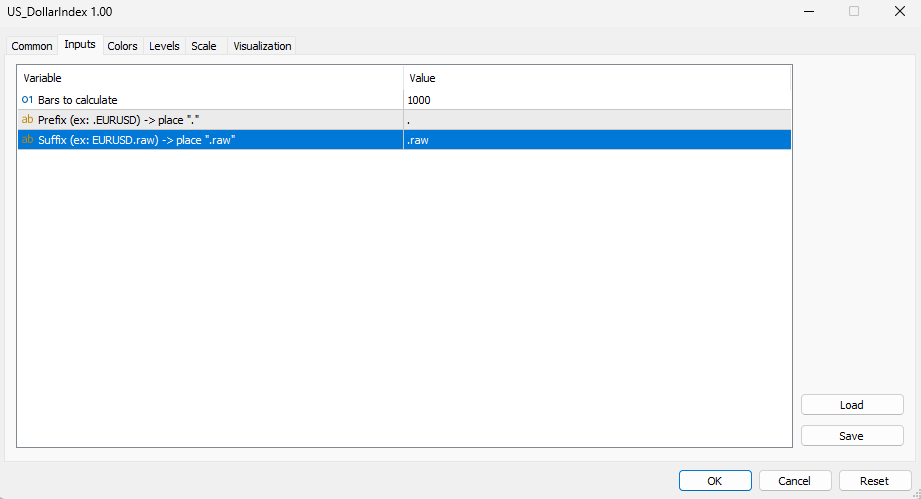

US Dollar Index MT5

- Indicadores

- MASTERBROK NEXUS SRL

- Versão: 1.0

Overview: The US Dollar Index (DXY) is a key financial indicator that measures the strength of the US Dollar against a basket of six major world currencies. This index is crucial for traders and investors as it provides a comprehensive view of the overall market sentiment towards the US Dollar and its relative performance.

Composition: The DXY's composition is as follows:

- Euro (EUR): 57.6%

- Japanese Yen (JPY): 13.6%

- British Pound (GBP): 11.9%

- Canadian Dollar (CAD): 9.1%

- Swedish Krona (SEK): 4.2%

- Swiss Franc (CHF): 3.6%

This weighted geometric mean of the dollar's value compares it with the aforementioned currencies, with the Euro having the most significant influence due to its high weighting.

Usage:

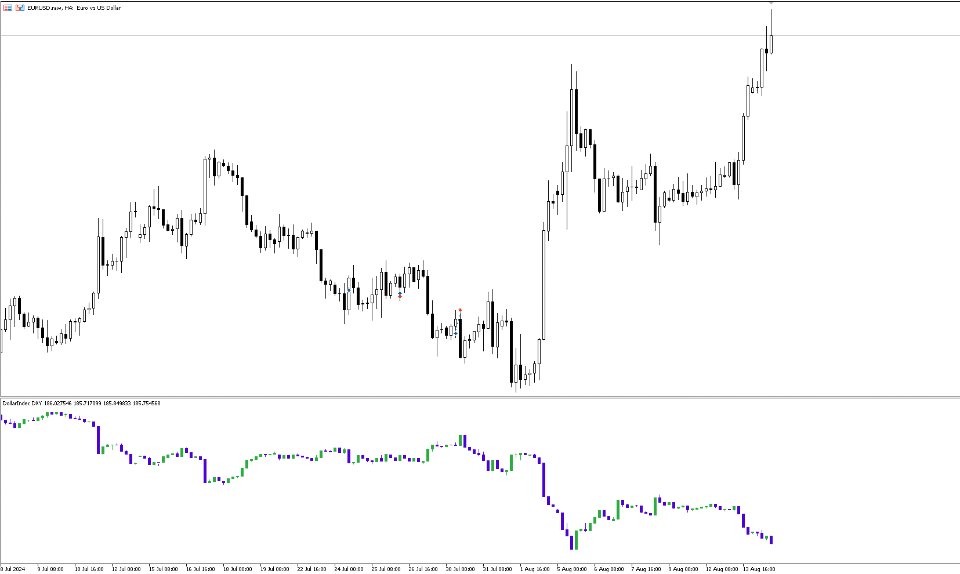

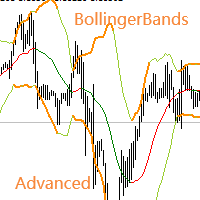

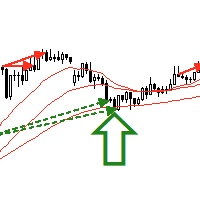

- Trend Identification: Traders use the DXY to identify the general trend of the US Dollar. A rising index suggests strengthening of the dollar, while a declining index indicates weakening.

- Strategic Trading: Investors involved in forex trading, commodities, and international stock markets use the DXY to make informed decisions. For example, a stronger dollar could mean lower prices for commodities like gold and oil, which are priced in dollars.

- Hedging: Economic stakeholders hedge against the risk of currency fluctuations. A clear understanding of DXY trends helps in creating effective hedging strategies to protect other investments.

Benefits:

- Market Insight: The DXY provides a snapshot of the dollar's performance, which is crucial for any trading strategy involving USD pairs.

- Predictive Power: Because of its broad representation, changes in the DXY can forecast potential moves in other financial markets and the global economy.

- Diversification: Investors find the DXY useful for diversifying their portfolios by understanding the broader market implications of the dollar's strength or weakness.

Conclusion: The US Dollar Index (DXY) is an indispensable tool for traders and investors who seek to gauge the value of the US Dollar against a group of significant currencies. Its ability to provide a macroeconomic view of the dollar's value makes it essential for strategic financial planning and risk management in global markets.