Dynamic Targets

- Indicadores

- Darko Licardo

- Versão: 1.1

- Ativações: 5

Dynamic Range and Target Indicator: Your Reliable Trading Partner

Introducing an innovative indicator that revolutionizes how you analyze markets and make trading decisions. Whether you're a beginner seeking clear guidance or an experienced trader looking to enhance your strategy, this tool is designed to meet your needs.

Key Features:

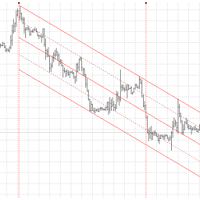

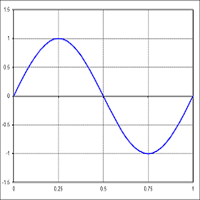

1. Dynamic Range Determination: The indicator continuously analyzes the market, identifying the most recent significant price ranges.

2. Clear Support and Resistance Lines: Visually displays key levels on your chart, allowing you to quickly recognize potential entry and exit points.

3. Smart Target Projections: Based on the current range, the indicator calculates three targets above and below the range, providing you with a realistic view of potential price movements.

4. Adaptive Precision:

- Target 1: The most reliable projection with the highest probability of being reached.

- Target 2: Moderate projection for stronger trends.

- Target 3: Ambitious projection for sudden breakout situations, particularly useful in smaller ranges.

5. **Automatic Updates**: As soon as a new significant range forms, the indicator adapts, ensuring you're always working with the freshest data.

Benefits:

- **Versatility**: Ideal as a standalone tool for beginners or as a complement to existing strategies for advanced traders.

- **Objectivity**: Eliminates emotional decision-making by providing clear, data-driven insights.

- **Time-Saving**: Quickly identifies key levels, allowing you to focus on trade execution.

- **Educational Value**: Helps develop intuition for market movements through visual representation of key levels.

How to Use the Dynamic Range and Target Indicator

Basic Strategy

1. Partial Close: Consider closing part of your position at Target 1.

2. Stop Loss Management: Move your stop loss to break-even after partial close.

3. Full Close: Aim to close the rest of your position at Target 2- 3 or when your preferred trend indicator changes.

Price Action and Targets

- Targets become active when price breaks outside the range (up or down).

- After a breakout and target1 is reached , expect a potential retracement:

- up to the edge of the range

- pull back to the middle doted line of the range before continuing in the breakout direction

- Be aware: Sometimes price may reverse and break on the opposite side of the range.

In most cases price will form new range and new targets after touching target1 or target 2

Enhancing Your Strategy

1. Trend Filter: Use a simple trend indicator like a 100-period Moving Average (MA):

- Trade only breakouts to the upside when price is above MA 100

- Trade only breakouts to the downside when price is below MA 100

2. Higher Timeframe Analysis:

- Check targets on higher timeframes

- Look for confluence between current and higher timeframe targets

3. Target Probability: In the direction of the main trend, there's a higher likelihood of reaching Target 2 or 3 in opposite direction mostly target1.

Realistic Expectations:

While this indicator significantly improves your ability to analyze markets, it's important to remember that no tool can guarantee 100%trading success. Use it as part of a comprehensive risk management strategy and continually refine your skills.

Elevate your trading today with our Dynamic Range and Target Indicator - your reliable partner for informed trading decisions!