SuperTrend Classic

- Indicadores

- Eduardo Mellado Monge

- Versão: 1.0

- Ativações: 5

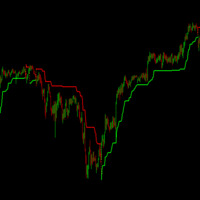

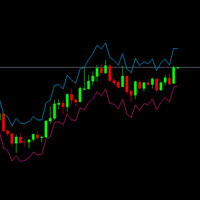

The classic SuperTrend indicator. The best indicator to define trends and small-scale trend changes in any pair and time frame. It is set up in exactly the same way as the TradinView indicator, and can be adjusted and complemented with other indicators to create profitable strategies or expert advisors, or used individually to profit from the market.

Based on the average volatility of the last candles and the price movement, it draws a green line below the price if an bullish microtrend is identified, which becomes a red line above the price if a trend change is identified . It is recommended to combine it with a long EMA, of about 100 - 500 periods to identify the major trend, and operate in its favor.

Parameters:

- ATR Period: Number of previous candles that will be taken into account for the calculation of volatility.

- ATR Multiplier: The higher the value, the greater the distance between the SuperTrend range and the price.

A positive review is appreciated. Thank you. (: