Advanced Grid Trader

- Experts

- Adrian Patrascu

- Versão: 1.0

- Ativações: 5

The ADVANCED GRID TRADER Expert Advisor (EA) is an automated trading system designed to capitalize on price fluctuations in all currency pairs and metals (XAU/XAG). It can be used in any timeframe however the best results were achieved in the Daily timeframe with EMA 178, reversed trades.

The EA employs a grid trading strategy, where buy and sell orders are placed at regular grid points. The user sets its take profit step as well to best take advantage from market movements.

The ADVANCED GRID TRADER uses an Exponential Moving Average (EMA) filter to align trades with the trend, enhancing profitability.

If the drawdown steps outside a percentage of the balance, it dynamically adjusts lot sizes optimizing risk management.

The EA operates within user-defined time windows, ensuring trades occur only during specified periods to align with market conditions.

By setting take profit and drawdown levels, the EA aims to lock in gains and mitigate losses.

This strategic approach allows the EA to exploit both trending and ranging markets, potentially yielding consistent profits by systematically capturing price movements within its grid structure.

The EMA RANGE gives it a direction according to the distance from the EMA. If the price is within the range it trades as usual; if the price is outside of the range it places opposite trades. For a range of 500 points and not reversed…it will place buy trades for that range, once it passes the range it will place sell orders. This setting can either improve or affect your drawdown, please test it before changing it.

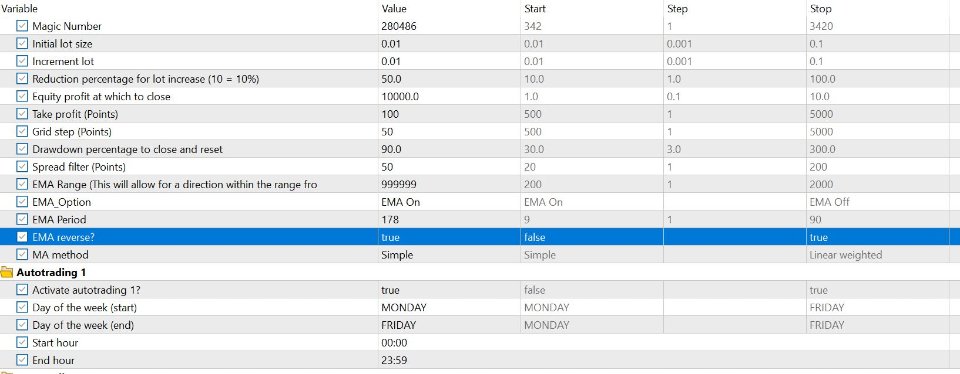

The ADVANCED GRID TRADER offers several key user inputs that can be optimized to achieve the best trading results:

1. **Magic Number**: A unique identifier for trades executed by the EA, ensuring it manages only its own trades.

2. **Lot Size**: Initial lot size for each trade. Optimizing this based on your account size and risk tolerance is crucial.

3. **Increment Lot**: Determines how much is added to the lot size once a % drawdown is achieved.

4. **Grid Step**: Defines the distance between each grid level. Fine-tuning this can impact how quickly trades are opened and closed within the grid.

5. **Take Profit**: Sets the profit target for each trade. Optimizing this based on historical performance and market conditions helps in locking in profits efficiently.

6. **EMA Settings**: If using EMA (Exponential Moving Average) for trend filtering:

- **EMA Option**: Enables or disables EMA filtering.

- **EMA Period**: Adjusts the period of the EMA. Finding the optimal period that aligns with market trends is crucial.

- **EMA Reverse**: Allows the EA to trade in the opposite direction of the EMA trend if enabled.

7. **Trading Schedule**: Define specific days for automated trading. This helps in aligning trading activities with market volatility and liquidity.

8. **Equity Management**:

- **Increment to Close**: Specifies the equity increase at which the EA closes all trades. Adjusting this ensures profits are locked in at desired levels.

- **Drawdown Percentage**: Sets the maximum allowable drawdown percentage before the EA resets or closes trades. Optimizing this protects capital during market downturns.

By carefully adjusting these parameters based on historical data analysis, market conditions, and risk appetite, users can optimize the Grid Trader EA for the best trading results.

Regular monitoring and adjustment of these inputs in response to market dynamics further enhance performance and profitability.

For more info send me a message on my profile!