R Factor Essential

- Experts

- Raphael Minato

- Versão: 1.0

- Ativações: 5

After many years of the first R Factor release and its continue portfolio growth with several strategies added every year and hundreds of possible parameters to be explored, it was time to bring some of its essential strategies back to the game.

This version contains some of the oldest and time proven strategies: The Night Mean Reversal, The Breakout and The Weekend Trading strategies. All of them with years of live results showing how it performs in different market conditions in real life. There is nothing to hide and no fancy things. Check the live results of each strategy and see for yourself:

https://www.mql5.com/en/signals/743742

https://www.mql5.com/en/signals/1543577

https://www.mql5.com/en/signals/1454074

One the things that make R Factor unique is its proprietary dynamic portfolio management system that works like a natural selection of the best pairs for each strategy as the time passes. It was inspired by Kelly Criterion management, which automatically adds more weight to the winning pairs, while lessening the impact of losses by losing pairs in the period.

Therefore, according to the developed R Factor algorithm, the winning pairs grow in the portfolio independently, pulling more weight and responsibility over the global portfolio, thus increasing the potential current and future gains, while the losing pairs have their significance and impact on profits reduced. This of course tends to increase the volatility of the portfolio, however the potential profit that is achieved makes the equation much more favorable to take greater risks and consequently greater gains.

To achieve a good performance, we highly recommend the use of brokers with very low spreads and fair commission. PM me for recommendations.

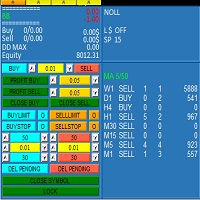

Top Characteristics of the R Factor Essential Strategies:

- One Chart Setup for The Night Mean Reversal and The Weekend strategies

- Defined Stop Loss and Dynamic Take Profit on all trades

- Just One trade per pair at a time. No Averaging, No Martingale.

- Dynamically portfolio balance proprietary algorithm that changes the weight and responsibility of each pair

- Intelligent Trade Exit System

- More than 3 years live proved algorithm

- Low starting capital required (starting at 30 USD for one pair or 100 USD for the complete portfolio w/ 12 pairs)

For R Factor Sets and Recommended Pairs, please check the comments section or send me a private message with your proof of purchase so I can send it directly to you. The default settings don´t have any strategy enabled and won´t work.