The GoldGuarld Bollinger

- Experts

- Ignacio Esteban Barreira Lang

- Versão: 2.0

- Atualizado: 30 maio 2024

- Ativações: 5

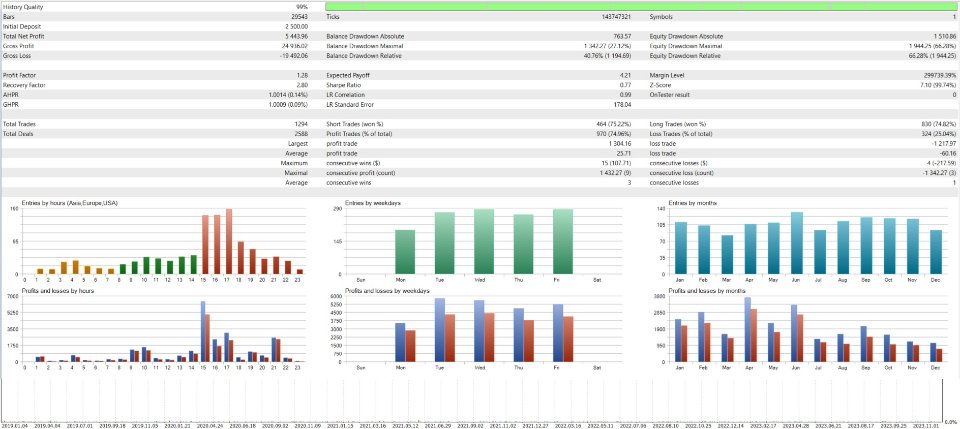

This system is developed and optimized for XAUUSD, H1, although it can be used in any other instrument and timeframe, if set inputs accordingly.

No grid.

All trades have TP and SL.

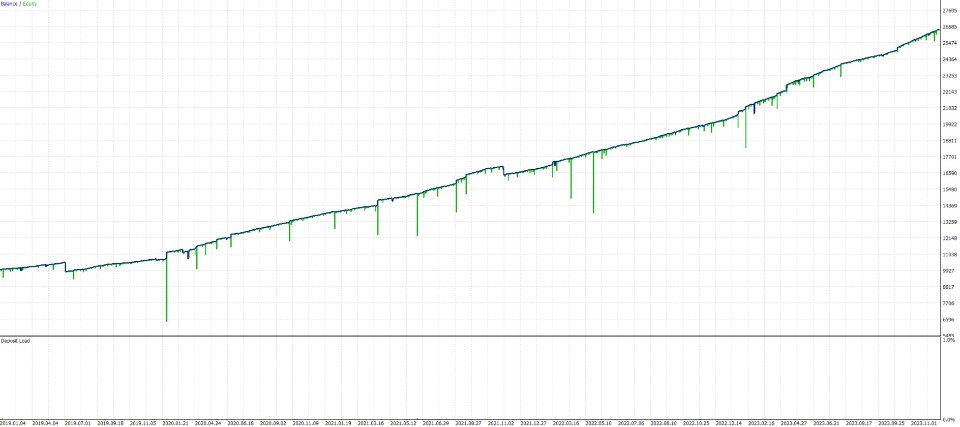

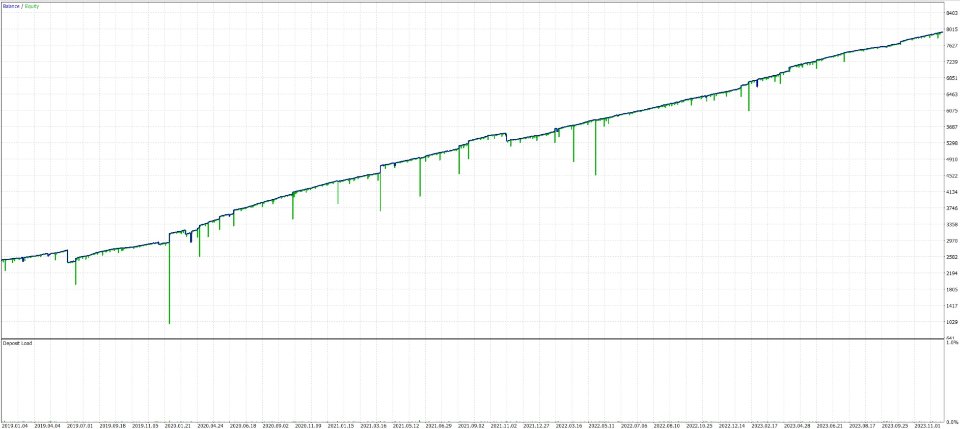

The strategy base its entries on a Bollinger Band based strategy, then trades are managed by a drawdown management system which increases drastically the amount of winning set of trades, almost all of them, note that a winning set of trades may contain both winning and losing trades. The DD Mgmt system also slightly increases the lot size in every trade, but in a controlled and calculated manner, and a limited amount of times, making the system totally trustworthy and avoiding falling into hazardous trading behaviour.

This system provides a steady % return amount over the years, with consistent performance, making it a solid and trustworthy strategy to have in a portfolio.

The drawdown system increases drastically the amount of winning set of trades, and it requires some balance to let it breath. Min amount. $2500 for a full mode risk manage, still risk tolerance can be modified in inputs.

System:

The strategy will look for entries based on the Bollinger Band, if price goes above upper band it will set a short trade, and if price is below lower band it will set a long trade, target at middle line of BB.

Then if price goes into DD, when activated the Drawdown Management System it will set more trades to hedge out of the position, meanwhile slightly increasing lot size of new positions.

The system will perform at it best in trending markets, or markets with volatility.

Inputs:

1.Magic Number

2.Manual Lot Size: lot size for first trade of set of trades (if Autolot false).

3.Autolot: if true it calculates automatically best lot size for the current balance.

4.period for BB: Bollinger Band period input setting.

5.deviation for BB: Bollinger Band deviation input setting.

6.Drawdown Management: turn drawdown management on.

7.DD Management lot increase: type of lot increase in DD Management.

8.Coeficcient for Exponential: amount lot increase type in DD Mgmt (if exponential).

9.Coeficcient for Exponential: amount lot increase type in DD Mgmt (if incremental).

10.Risk Level for DD Mgmt: from 1 to 3.5, step 0.5 increases risk in the DD Mgmt, more risk means more trades allowed to be opened if necessary, which will determine more winning set of trades, but it needs more margin and more balance to let the set of trades breath.

11.ATR period: ATR Filter period, ATR filter takes the max and min ATR of the selected amount of bars, and then execute only the trades which have the ATR bigger than the selected ATR Threshold, ensuring some volatility in the market which helps this system to improve performance.

12. ATR Bars Range period: how many bars to look bar for max and min ATR.

13.ATR % Threshold: between 0 and 100, is the % of ATR band determines min ATR to have our starting trade.

14. Trading Start Hour: start of trading hour for the first trade of set of trades.

15. Trading Start Min. Idem

16. Trading End Hour.

16. Trading End Min.