Fat and Slim

- Indicadores

- Pavel Milicka

- Versão: 1.1

- Atualizado: 11 maio 2024

- Ativações: 5

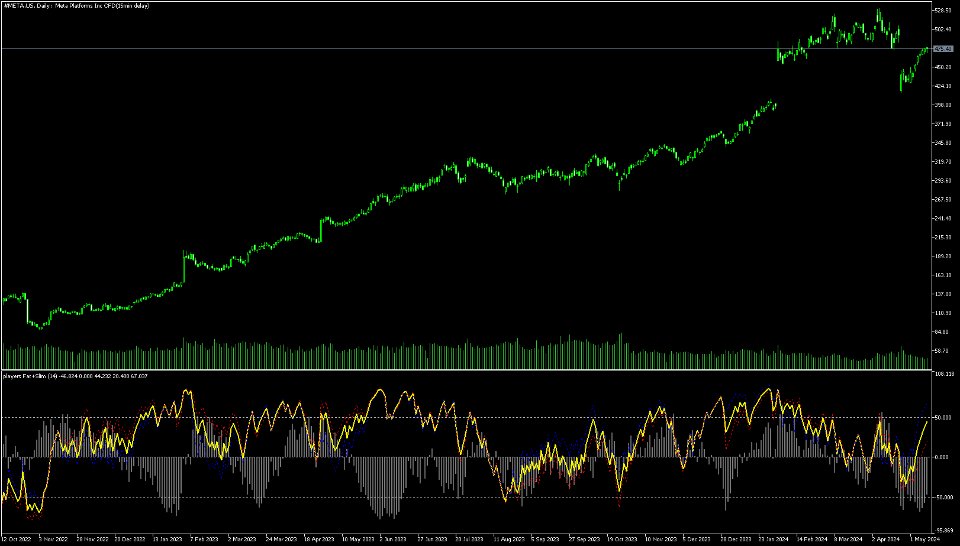

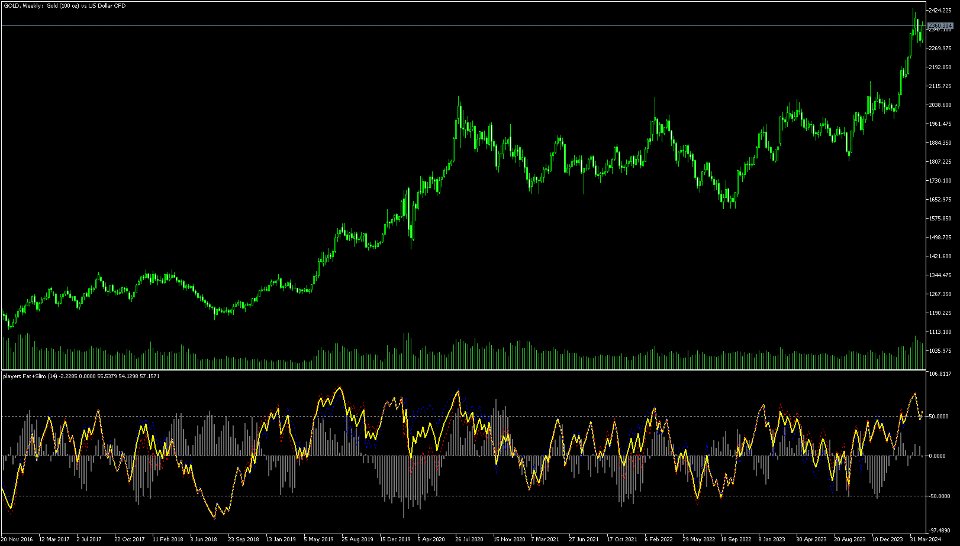

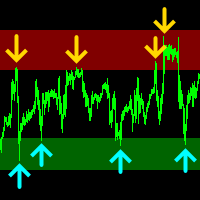

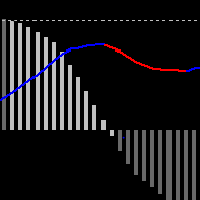

The Fat and Slim indicator tracks strong and weak money in the market.

It is derived from RSI, MFI and many similar indicators. Input values are closing prices and volumes.

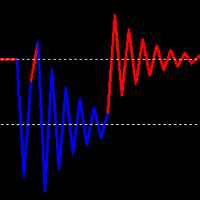

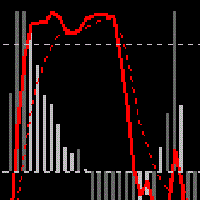

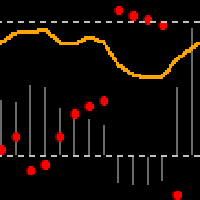

- The RSI (yellow curve) is in the range -100 ... 100. It is additionally multiplied by a coefficient so that the curve is not compressed to the middle values at higher periods (a problem with the classic RSI with different periods).

- Strong/Fat red curve is RSI weighted by higher volumes.

- Weak/Slim blue curve is calculated so that lower volumes have more weight.

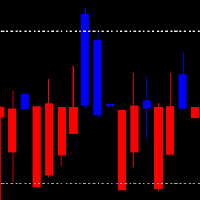

- Finally, a histogram is calculated from the difference (strong-weak).

- the spread between the lines - show whether there is a divergence between strong/weak money.

- which line, i.e. who is driving the price (high volumes or low liquidity?)

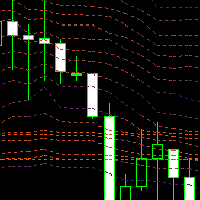

When the movement of the lines becomes clear to you, turn on the histogram - it will simplify the reading of the indicator.

The histogram shows clearly what is driving the price change. If the histogram has the same direction as the price, it is volume/high liquidity; if the histogram goes in the opposite direction than the price, it is low liquidity. Find extremes!

If you are not familiar with how liquidity affects price movement, do a quick study.