High Frequency Algo

- Experts

- Augustine Kamatu

- Versão: 2.3

- Atualizado: 19 setembro 2024

- Ativações: 5

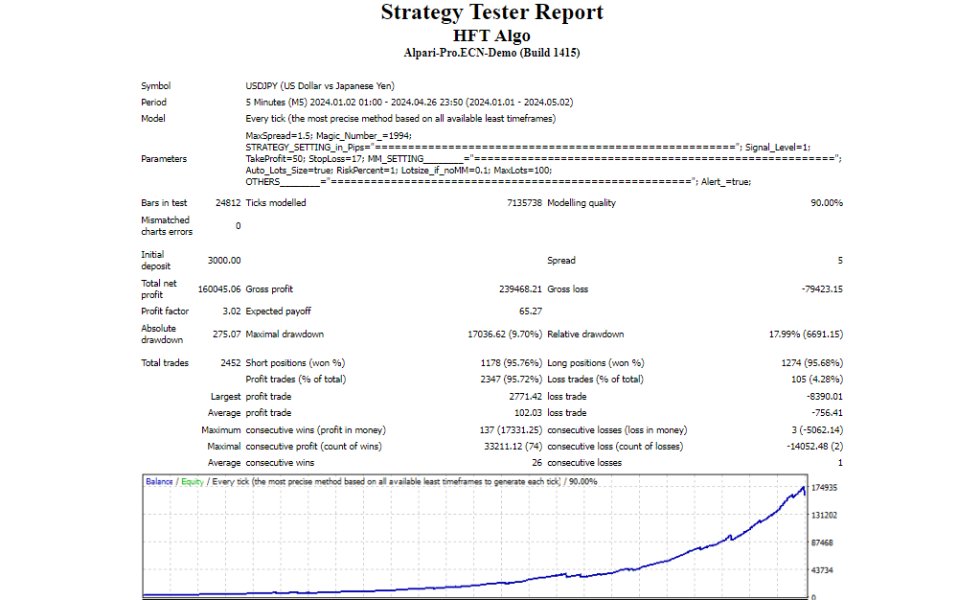

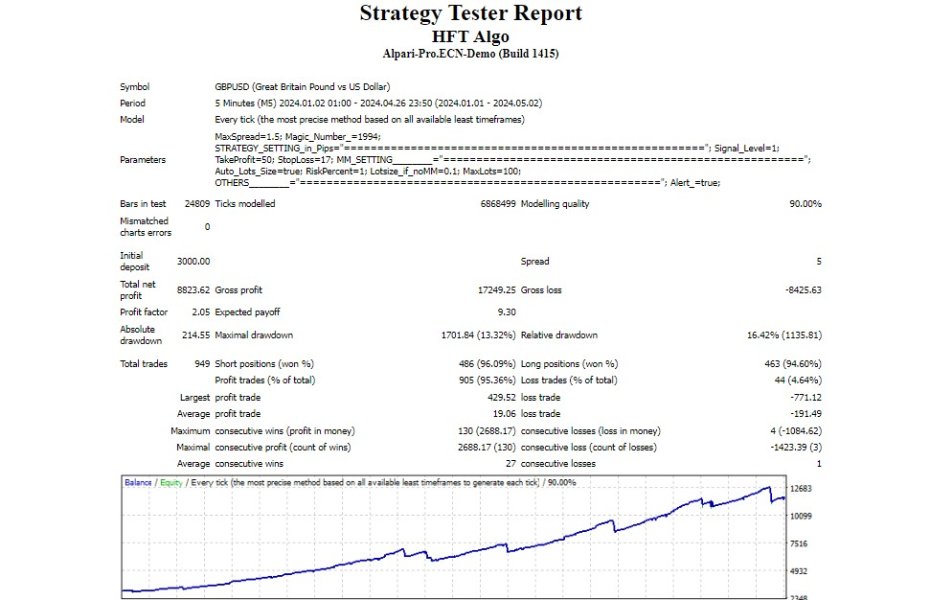

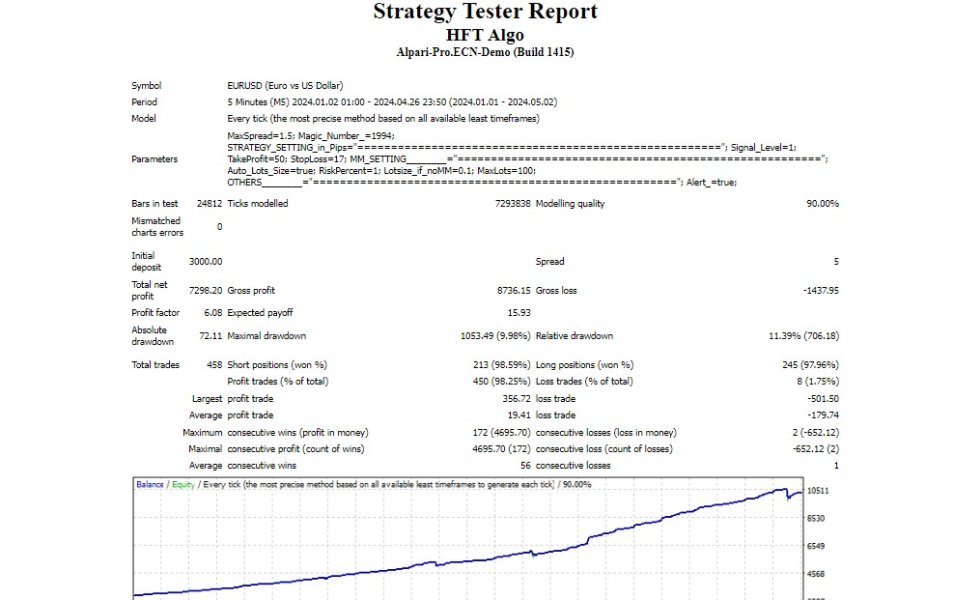

This is a High Frequency Algo system based on this version https://www.mql5.com/en/market/product/116720 that targets pull-backs and breakouts and scalps just a few pips then exits. Positions do not stay in the market for long. The algorithm is a comprehensive and sophisticated trading system designed to optimize performance in volatile market conditions. Here are the key highlights of how the algorithm works:

Adaptive Risk Management

The algorithm dynamically adjusts stop-loss, take-profit, and trailing stop levels based on the current market spread and volatility. This allows it to maintain tight risk control while maximizing profit potential.

Trend and Momentum Analysis

The algorithm analyzes the current price action and market trend to determine the optimal entry and exit points. It uses a combination of technical indicators, such as moving averages and Bollinger Bands, to identify strong trends and momentum.

Multi-Timeframe Approach

The algorithm considers price data from multiple timeframes, including the current and previous candles, to make more informed trading decisions. This helps it identify and capitalize on short-term opportunities while staying aligned with the broader market direction.

Position Sizing and Exposure Management

The algorithm adjusts the lot size based on the minimum and maximum lot sizes allowed for the symbol. It also implements a Martingale-like lot size adjustment to manage the overall exposure and risk.

Profit Trailing and Loss Mitigation

The algorithm employs a sophisticated profit trailing and loss mitigation strategy. It continuously monitors the profitability of open positions and automatically closes them when predefined profit or loss thresholds are reached. This helps to lock in gains and limit potential losses.

Spread and Volatility Monitoring

The algorithm closely tracks the current market spread and volatility, and takes appropriate actions to mitigate the impact of extreme market conditions. It can cancel pending orders and close positions if the spread exceeds a certain threshold.

Multi-currency Trading

The algorithm is built to trade all currency pairs from one instance/chart. Once you attach the EA to a chart, you need to specify the maximum spread. Only pairs whose spread is below the maximum spread will be traded.

Parameters

| Parameter | Description |

|---|---|

| MaxSpread | Currency pairs with spread below this maximum spread will be traded. If spread is above this value, currency pair will not be traded and if there is a pending order, it will be deleted. A value of 1 means 1 pip or 10 points |

| Magic_Number | This is a unique identifier to track orders opened by the EA |

| Signal_Level | This parameter is used as the threshold that will trigger a trade because price is expected to reverse if the candle stick extends beyond this threshold. You can set any value from 0.5 to 10. Higher values give fewer trades but higher accuracy. |

| TakeProfit | Take profit in pips. A value of 10 means 10 pips or 100 points |

| StopLoss | Stop Loss in pips. A value of 10 means 10 pips or 100 points |

| Auto_Lots_Size | Parameter to enable the EA trade using calculated lot size based on the RiskPercent input. If it is set to false, lot sizes that will traded are Lotsize_if_noMM |

| RiskPercent | This parameter is used to increase or decrease the calculated lot size. A value of 1 means 100% of the calculated lot size will be used. |

| Lotsize_if_noMM | This parameter is only active if Auto_Lots_Size=false. A value of 0.1 means that any trade opened will be of lot size 0.1 |

| MaxLots | This parameter is only active if Auto_Lots_Size=true. This parameter limits the maximum lot size traded. A value of 100 means that the maximum lot size for any trade opened will be 100. |

| Alert | When set to true, it will give an alert when a trade is triggered. |

Note that results will vary depending on leverage.

Overall, this algorithm demonstrates a comprehensive and adaptive approach to automated trading, leveraging advanced techniques to navigate the complexities of high-frequency markets.