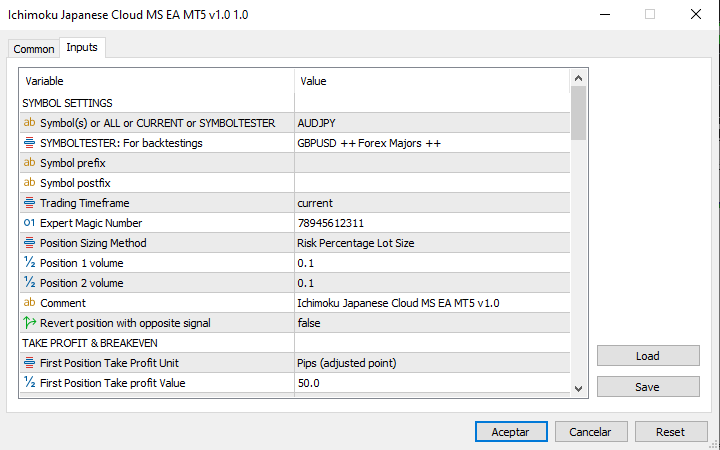

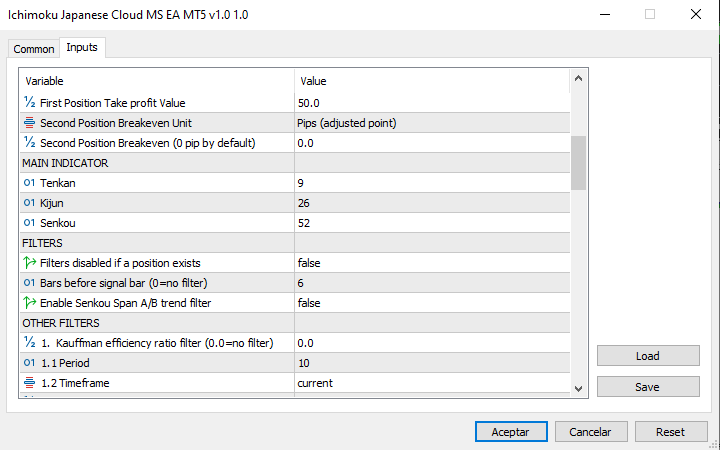

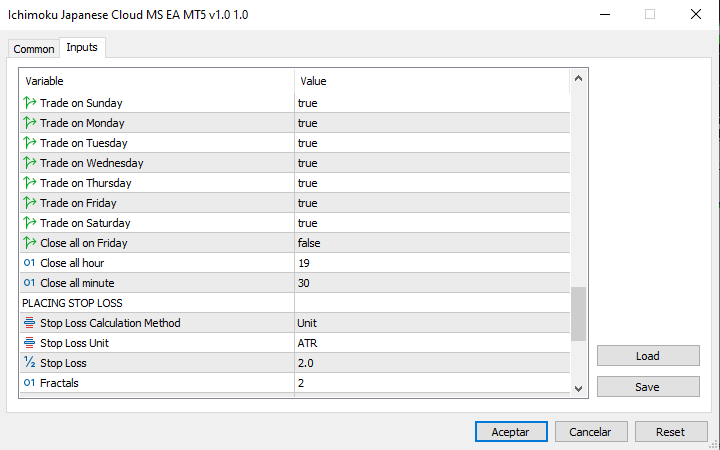

This is a trend strategy that seeks to exploit this characteristic offered by some assets with strong trends. Two positions are placed at market price; one with take profit at a short distance and the other without take profit. Both orders have stop losses, and when the first reaches the take profit on the second position, the stop loss is moved to breakeven.

When it is well configured and on the assets it works well, it generates a flat or slightly falling profit graph most of the time, and occasionally hunts a trend that generates profit spikes.

Before placing the Expert Advisor make sure you know the strategy, unlike many strategies where you don't know what it does. In this strategy you know how it works and you can explore the markets where you can profit. And since it is a trend strategy, you can place the expert advisor according to the current market trend and stop it as appropriate.

Therefore it is an Expert Advisor for people who want to do their own backtesting and use their own configurations.

IT IS NOT A EXPERT ADVISOR TO BUY AND PLACE ON THE MARKET. YOU CAN DOWNLOAD THE DEMO VERSION AND DO YOUR OWN BACKTESTING.

BUY SIGNAL JAPANESE CLOUD STRATEGY

1. The price must be above the cloud.

2. The Tenkan Sen must be above the cloud.

3. The price must cross the Tenkam Sen upwards, but before 6 candles.

4. The entry candle will be the one that opens below the Tenkam Sen and closes above the Tekam Sen and we enter its close.

5. We will place the stop loss protected by a previous swing or on the other side of the cloud.

6. The entry candle should never be touching the cloud

7. If the signal candle is touching the cloud, the next candle that closes above the Tenkam Sen and without touching the cloud will be the signal candle, and this is often on the next candle.

8. Target 1 is located at 60 pips, where we close half of the position and move the stop to breakeven. The amount of pips varies depending on the time.

9. The rest is managed as "trailing", and the first candle that opens and closes below the Tenkam Sen will mark the closing of the position.

10. If half of the operation has already been closed, as there is no open risk, a new signal can be entered if it is generated.

SELL SIGNAL JAPANESE CLOUD STRATEGY

1. The price must be below the cloud.

2. The Tenkan Sen must be below the cloud.

3. The price must cross the Tenkam Sen downwards, but before 6 candles.

4. The entry candle will be the one that opens above the Tenkam Sen and closes below the Tekam Sen and we enter its close.

5. We will place the stop loss protected by a previous swing or on the other side of the cloud.

6. The entry sail should never be touching the cloud.

7. If the signal candle is touching the cloud, the next candle that closes below the Tenkam Sen and without touching the cloud will be the signal candle, and this is often on the next candle.

8. Target 1 is located at 60 pips, where we close half of the position and move the stop to breakeven. The amount of pips varies depending on the time.

9. The rest is managed as "trailing", and the first candle that opens and closes above the Tenkam Sen will mark the closing of the position.

10. If half of the operation has already been closed, as there is no open risk, a new signal can be entered if it is generated.

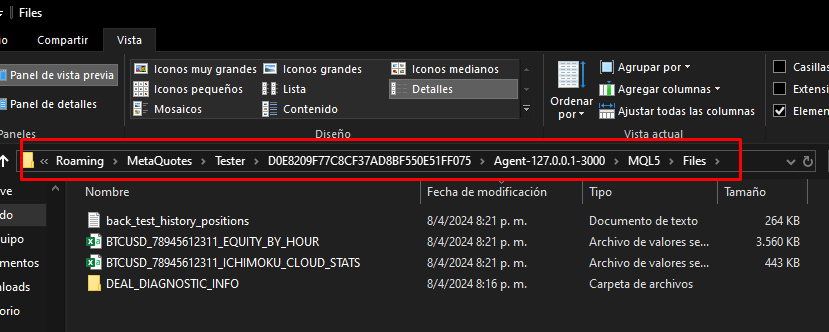

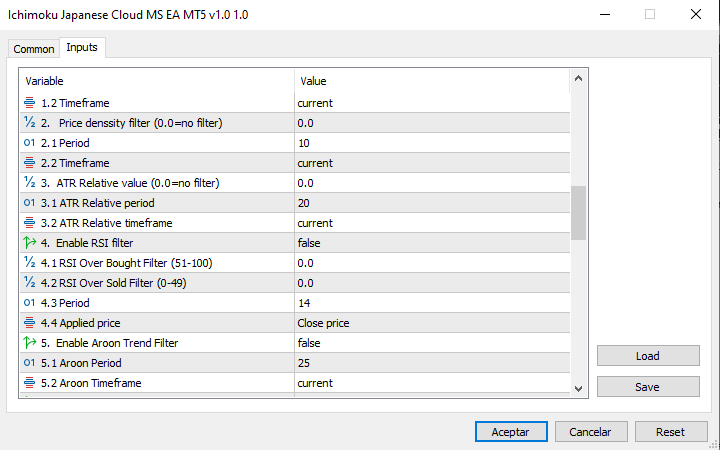

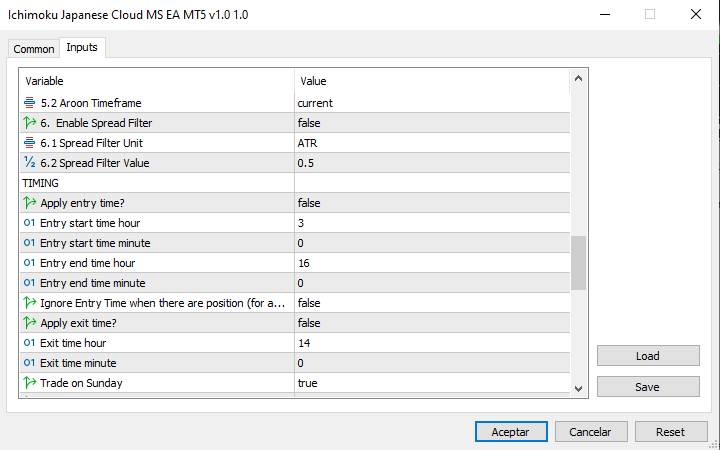

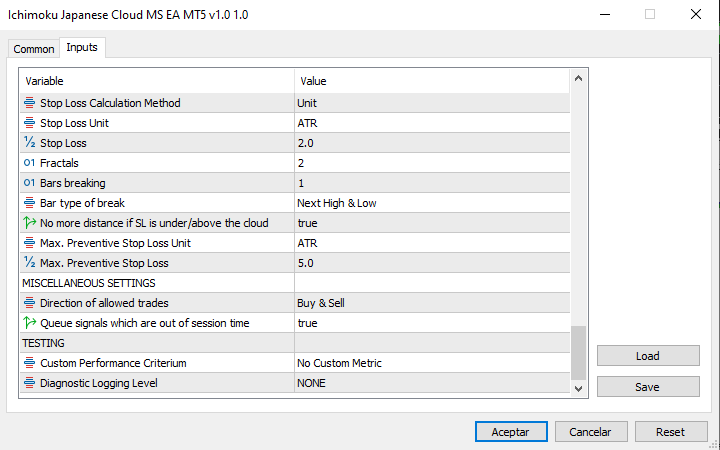

A set of filters have been added that can be tested, and if you select during backtesting the “Diagnostic Logging Level” option as “HIGH” you will get a .csv file with information that you can analyze from a spreadsheet. The path it is placed on looks like this path

C:\Users\Administrator\AppData\Roaming\MetaQuotes\Tester\D0E8209F77C8CF37AD8BF550E51FF075\Agent-127.0.0.1-3000\MQL5\Files

PROS

- It is a strategy resistant to losses. You have the opportunity to rectify if it is misconfigured, if you take the precaution of healthy risk management for example 0.5%/0.5%.

RESTRICTIONS:

- Changes to parameters are not allowed. You must stop the EA and restart with the new changes you want to make. You will lose track if there are open positions, so you will have to close them manually.

- Do not remove the stop loss, the results may be unexpected. For example the philosophy is if there is no Stop Loss then ignore the Breakeven.

- Only for Hedge accounts.

- Does not support the FIFO rule.

- Using multiple symbols requires more memory.

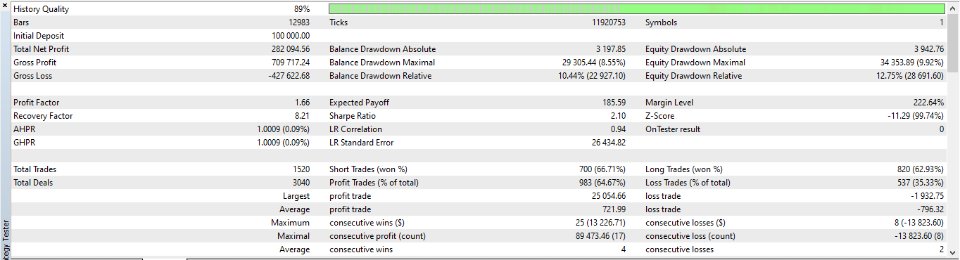

The backtesting shown in the screenshot was performed with data from Dukascopy.