B4S ICT Killzones

- Indicadores

- Henry Waribu Macharia

- Versão: 2.0

- Atualizado: 4 junho 2024

- Ativações: 5

Brief Description

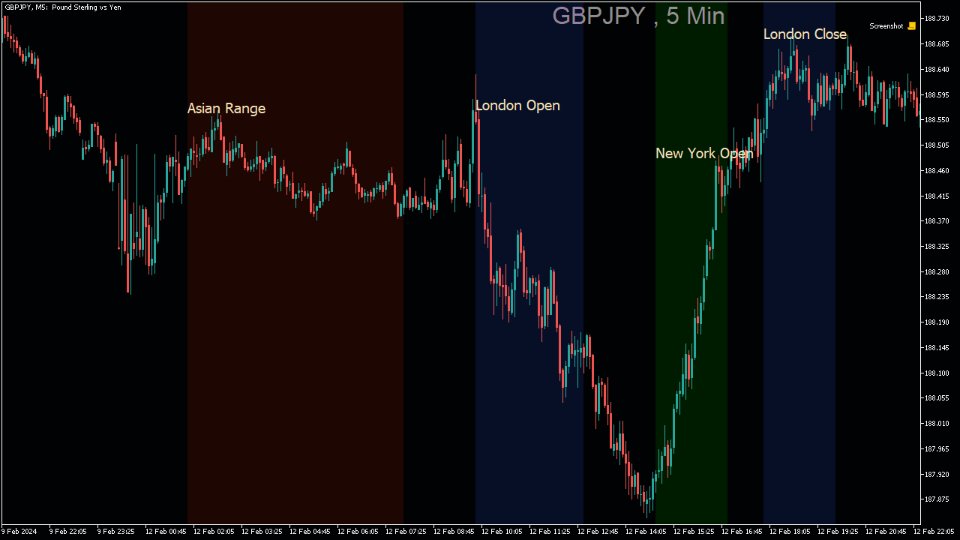

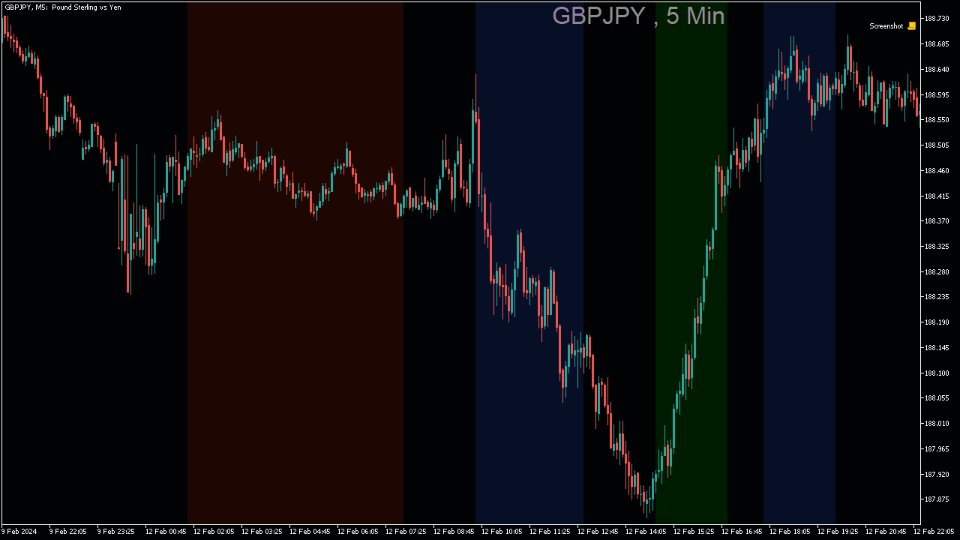

The B4S_ICT_Killzones indicator is designed to enhance your trading strategy by highlighting key market times based on the Inner Circle Trader's (ICT) proven trading model. This indicator intelligently plots colored boxes around critical "killzone" periods, providing valuable insights into market behavior influenced by different geographical and time zone locations and time variations.

Features / Indicator Settings

1. Killzone Identification

- Asian Range: Target the Asian trading session with precision using the specified time range.

- London Open Killzone: Gain insights during the opening of the London market for strategic decision-making.

- New York Open Killzone: Navigate the New York market opening with confidence by identifying key time periods.

- London Close Killzone: Capture opportunities during the closing hours of the London market for optimized trading.

- Custom Killzone: Custom user-defined killzone.

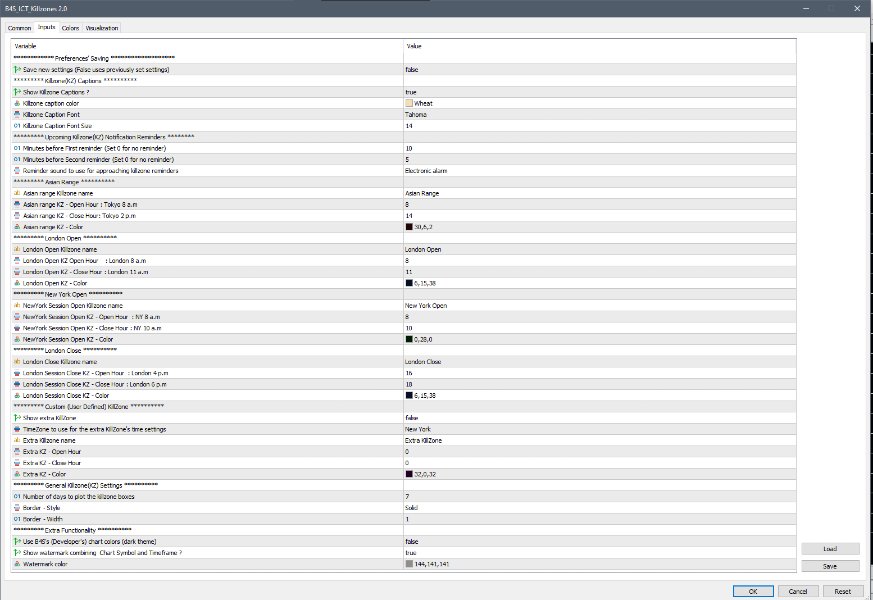

2. Persistent User Settings

- One-time Configuration: Set your preferred indicator settings just once, and they will persist across future restarts, saving you time and effort.

- Adaptable Settings: Easily modify saved settings by toggling a simple Boolean switch in the input section.

3. Chart Customization

- Number of Days: Customize the number of days for which the killzone boxes are plotted on your chart.

- Watermark Display: Choose to display a watermark combining the chart symbol and timeframe for added convenience.

4. Killzone Captions and Notifications reminders

- Captions: Display informative captions within the killzone boxes for quick reference.

- Notification Reminders: Receive timely reminders before approaching killzone periods, enhancing your preparedness for potential market movements. Set reminders with customizable time intervals and notification sounds.

5. Geographic Settings

- Time-zone Flexibility: Adjust killzone times based on your geographical location for accurate market analysis.

- Color Customization: Personalize the appearance of killzone boxes with a range of color options for easy visual identification.

Importance of Killzones in Relation to Liquidity and Market Participation

1. Enhanced Liquidity during Killzones:

- Asia Range Killzone:

- Asia & Australia related price movements: Asian Range Killzone often coincides with the release of economic data from countries like Japan and Australia. This convergence of economic events can amplify liquidity, impacting financial instruments pairs such as JPY, the Nikkei 225 Index, Australia's S&P/ASX 200 index, and AUD.

- London Open Killzone:

- Market Wake-Up: The opening of the London market marks a crucial period where liquidity surges as European traders join the market. This increased participation often leads to pronounced price movements, offering traders the chance to capitalize on early trends.

- European Economic Reports: The London Open Killzone aligns with the release of significant economic reports from Europe. Traders focusing on EUR and GBP pairs can benefit from heightened liquidity during this period.

- New York Open Killzone:

- U.S. Market Influence: The New York Open Killzone sees a surge in liquidity as U.S. traders enter the market. This influx of participants can drive decisive price action, providing traders with potential entry and exit points.

- Market’s Overlap: The New York Open session sees an overlap with both the European and U.S. sessions. This results in increased liquidity as traders from different regions actively participate, contributing to more robust market conditions.

- U.S. Economic Releases: The New York Open Killzone coincides with the release of key economic indicators and news from the U.S. market. Traders can capitalize on the increased liquidity and volatility associated with market reactions to significant news.

- London Close Killzone:

- Unwinding Positions: The London Close Killzone is characterized by the unwinding of positions as European traders conclude their activities. This can result in heightened volatility and increased liquidity, creating opportunities for traders to capitalize on price reversals or continuations.

- Late European News Flow: The London Close Killzone sees the impact of late-breaking news from Europe, contributing to liquidity spikes. Traders engaged in EUR and GBP pairs may find opportunities as markets react to these developments.

2. Key Insights into Market Participation:

- Asian Range Killzone:

- Early Asian Traders: Traders looking to engage early in the Asian trading day often focus on the Asian Range Killzone. Understanding the liquidity dynamics during this period can help traders gauge market sentiment and make informed decisions.

- News-Driven Sentiment: Traders in the Asian Range Killzone closely monitor news from Asia and Europe to gauge market sentiment. Understanding how news events impact liquidity allows for more informed decision-making.

- London Open Killzone:

- European Trader Influence: Traders wishing to align their strategies with European market sentiment closely monitor the London Open Killzone. The influx of European participants can set the tone for the trading day.

- New York Open Killzone:

- U.S. Trading Impact: The New York Open Killzone is crucial for those wanting to capture opportunities influenced by U.S. market sentiment. Understanding the liquidity and participation dynamics during this period is key to successful trading.

- London Close Killzone:

- Position Adjustment: Traders often use the London Close Killzone to adjust their positions ahead of the market close. Recognizing the liquidity patterns during this time assists in anticipating potential market movements.

3. Maximizing Opportunities through Strategic Analysis:

- Timing Execution: Understanding when liquidity peaks occur allows traders to time their executions more effectively, potentially reducing slippage and optimizing trade outcomes.

- Event-Driven Trading: Combining knowledge of economic releases with killzone analysis allows traders to engage in event-driven trading, aligning their strategies with both scheduled and unscheduled news.

- Country-Specific Analysis: Understanding the news flow related to specific financial instruments during killzones enables traders to tailor their approaches based on the unique characteristics of each instrument.

- Holistic Approach: By combining the analysis of killzones, liquidity patterns, and news events, traders can adopt a holistic approach to decision-making.

- Risk Management: Awareness of news-driven liquidity spikes allows traders to implement effective risk management strategies during volatile periods, safeguarding their positions.

Why B4S ICT Killzones?

- Strategic Insights: Gain a competitive edge by aligning your trades with key market movements during killzone periods.

- Time-Saving: Set your preferences once, and let the indicator persistently apply them, saving you time and effort.

- Versatility: Adapt to different market conditions with the flexibility of customizable settings and color schemes.

Holistic Trading Approach

B4S ICT Killzones provides a comprehensive approach by integrating time-zone aspects into the analysis of liquidity and market participation during key killzone periods. Traders can leverage this holistic perspective to navigate financial instruments’ markets more effectively, aligning their strategies with both scheduled economic releases and unscheduled news events for optimized trading outcomes.

Related Topics

- B4S

- #ICT (Inner Circle Trader)

- #SMC (Smart Money Concepts)

- #ICT Killzone Theory

- #Killzones

- #ICT Trading Education

- #ICT Trading Insights

- #ICT Market Structure Analysis

- #ICT Order Flow Analysis

- #ICT Price Action Trading

- #ICT Market Maker Concepts

- #ICT Market Manipulation Analysis

- #ICT Trade Setups and Opportunities

- #Market Analysis Tools

- #Price Action Analysis

- #Market Volatility Analysis

- #Market Timing Tools

- #Market Participation Analysis

- #LiquidityAnalysis

- #Asian Trading Sessions

- #London Market Open

- #New York Market Open

- #TradingToolbox

- #Market Sentiment Analysis

- #Forex Market Timing

- #Technical and Fundamental Analysis Integration

- #Forex Market Dynamics