AwesomeFlip

- Experts

- Lucilla Tomasini

- Versão: 1.0

- Ativações: 5

Suitable for Beginners and Satisfying for Experienced Traders

Are you an experienced trader?

I don't have to explain anything to you. You know what a reliable backtest and a long time in the market are worth. I hope you have fun with all the information at your disposal.

Are you a beginner?

You don't have to worry about setting any operational parameters or doing a lot of backtesting to find the ideal setting. Just look at the statistics and assess the risk you want to take.

Do a backtest to ensure the risk is calculated correctly and that there are no problems with your broker's specifications, or run it on a demo account for a while.

The backtest data are there to give you an idea of what you can expect from this EA.

If everything goes wrong, what is the maximum loss I'm looking at?

Look at the DRAWDOWN in dollars. Is that too high a figure? Instead of $100, choose a lower amount (see the recommended minimum) and do the ratio.

How much can I expect to earn each month?

Look at MONTHLY AVERAGE PROFIT, but remember that there are months at a loss! It's a time goal of at least one year.

How many trades does the strategy make in a month?

Look at the total number of trades and divide it by the backtest months.

And so on. Number of consecutive loss, average trade, average Win/Loss.

Before using any EA, make sure you fully understand the risks involved. This EA is provided "as is," with no guarantees of specific performance or results. Past results do not guarantee future results.

The EA detects a change in Awesome Oscillator and place stop order on a level define by another indicator.

Order type Stop

Entry Level indicator-based

Entry signal Awesome oscillator-based

Stop Loss ATR-based. Min 30 pip, max 200 pip

Take profit fixed pip

Move SL to BreakEven fixed pip

Exit Friday 10 pm broker time

Trading rules are checked only on bar open.

Backtest performed with StrategyQuant X

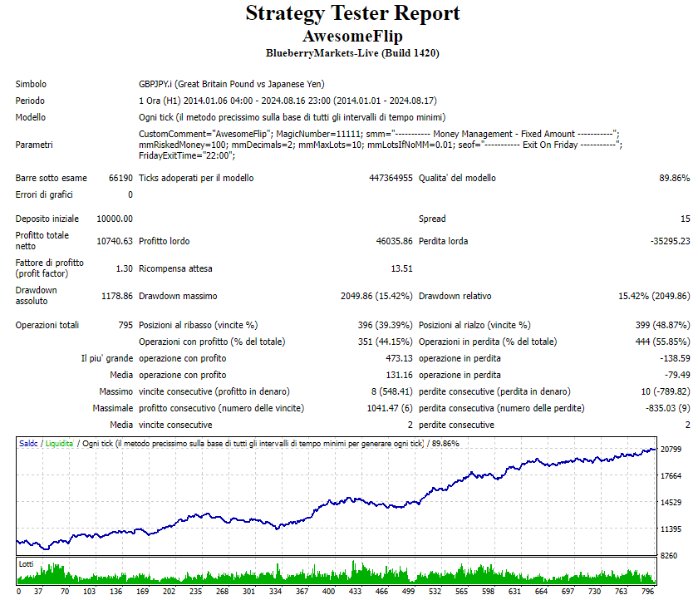

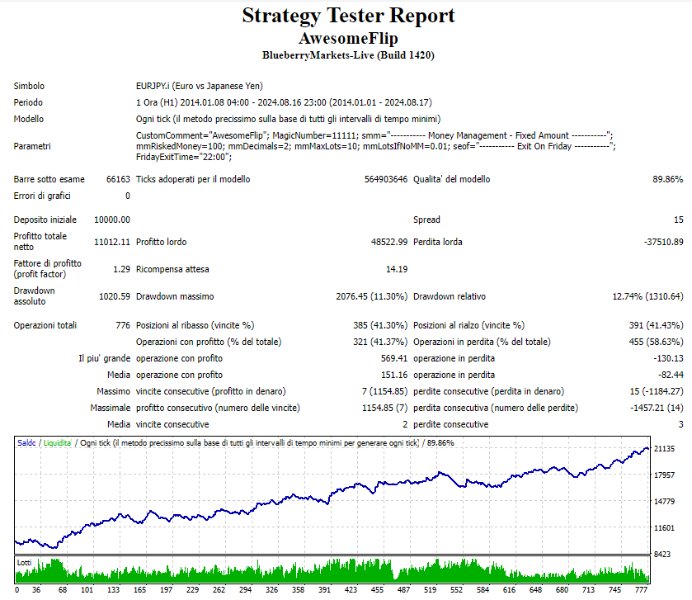

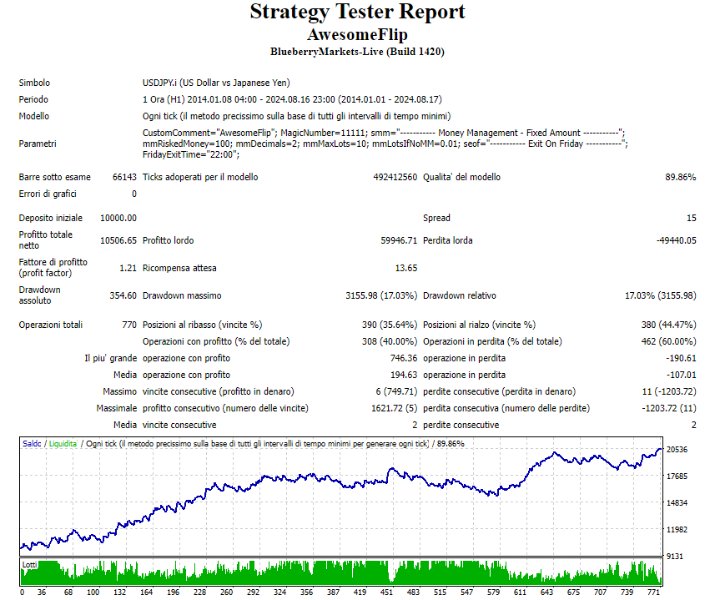

GBPJPY - EURJPY - USDJPY

Data Source Dukascopy from 2010 to 2024 February 02

Timezone UTC+02 (European DST)

Precision 1 minute tick simulated

Timeframe H1

Spread 1.5 pip

Commission 6 $ per full lot

Risk per trade 100 $ fixed amount --> see screenshot statistics reflect realistic behavior without any compound effect

Initial capital 10000 $

Parameters setup

Custom comment

By default, EA's name

MagicNumber

Choose a unique number for each market on which you use EA so that you can track performance separately.

Risk per trade

Please take a look at the strategy metrics to manage the risk you want to take.

Keep in mind that depending on the width of the SL, the minimum size could result in a loss greater than the value you set. Recommended minimum value 20$ (15 $ only for USDJPY)

Size decimals

Order size will be rounded to the selected number. Use 2 for microlots 0.01

Size if no MM

How many lots should be traded if something goes wrong in the size calculation. Default value 0,01

Maximum lots

The biggest size allowed

Exit Friday

By Default 22 for time zone UTC+02 (Mon-Fri)

Enter the equivalent based on your broker's time zone. Ex. UTC+01 = 21

Easy peasy! No need to set up other parameters.

This EA is provided to trade GBPJPY - EURJPY - USDJPY timeframe H1

Check your broker's specifications to set properly Exit on Friday

This EA was created with StrategyQuant X a powerful platform to generate, develop and research algo strategies