Quickstrike Gold Peak

- Experts

- Lucilla Tomasini

- Versão: 1.0

- Ativações: 5

Suitable for Beginners and Satisfying for Experienced Traders

Are you an experienced trader?

I don't have to explain anything to you. Test it out!

Are you a beginner?

You don't have to worry about setting any operational parameters or doing a lot of backtesting to find the ideal setting. Just look at the statistics and assess the risk you want to take.

Do a backtest to ensure the risk is calculated correctly and that there are no problems with your broker's specifications, or run it on a demo account for a while.

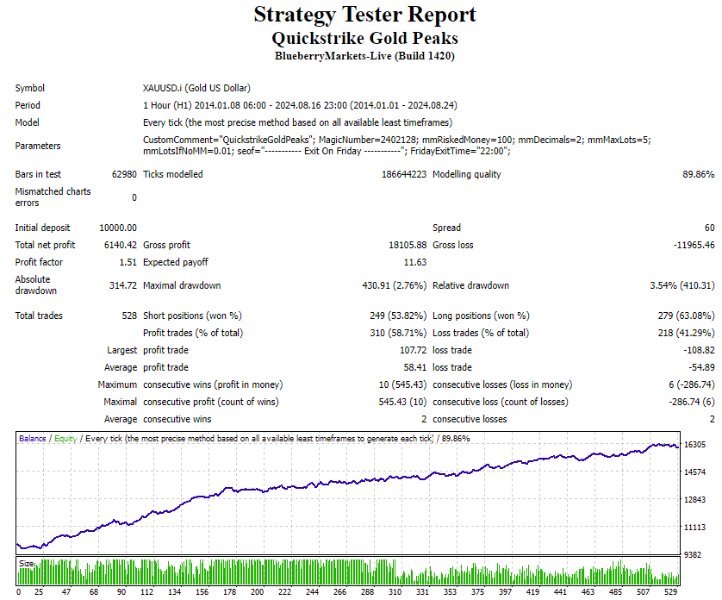

The backtest data are there to give you an idea of what you can expect from this EA.

If everything goes wrong, what is the maximum loss I'm looking at?

Look at the DRAWDOWN in dollars. Is that too high a figure? Instead of $100, choose a lower amount (see the recommended minimum) and do the ratio.

How much can I expect to earn each month?

Look at the net profit and divide it by the months of testing, but remember that there are months at a loss! It's a time goal of at least one year.

How many trades does the strategy make in a month?

Look at the total number of trades and divide it by the backtest months.

And so on. Number of consecutive loss, average trade.

Before using any EA, make sure you fully understand the risks involved. This EA is provided "as is," with no guarantees of specific performance or results. Past results do not guarantee future results.

Parameters setup

Custom comment

By default, EA's name.

MagicNumber

Choose a unique number for each market on which you use EA so that you can track performance separately.

Risk per trade

Please look at the strategy metrics to manage the risk you want to take.

Depending on the width of the SL, the minimum size could result in a loss more significant than the value you set. Recommended minimum value 20 $

Size decimals

Order size will be rounded to the selected number. Use 2 for microlots 0.01

Size if no MM

How many lots should be traded if something goes wrong in the size calculation. Default value 0,01

Maximum lots

The biggest size allowed.

Exit Friday

By Default 22 for time zone UTC+02 (Mon-Fri)

Enter the equivalent based on your broker's time zone. Ex. UTC+01 = 21

Easy peasy! You don't need to set up other parameters.

This EA is provided to trade XAUUSD timeframe H1

Check your broker's specifications to set properly Exit on Friday

The EA verifies the entry signal and places pending orders on the medium-term high or low.

SL and TP are based on ATR. TP is usually smaller than SL, but the average profit remains higher than the average loss, and the win rate exceeds 58%

This EA can catch price explosions by taking profit even within minutes.

Order type Stop

Entry Level Highest/Lowest midterm period

Entry signal EMA-based

Stop Loss ATR-based. Min 600 pip, max 3000 pip

Take profit ATR-based

Trailing stop none

Exit signal-based

Exit Friday 10 pm broker time

Trading rules are checked only on bar open.

XAUUSD

Data Source Dukascopy from 2014 to 2024

Timezone UTC+02 (European DST) Trading hours Monday - Friday

Timeframe H1

Spread 60 pips

Risk per trade 100 $ fixed amount --> see screenshot statistics reflect realistic behavior without any compound effect

Initial capital 10000 $

This EA was created with StrategyQuant X, a powerful platform to generate, develop, and research algo strategies.