BreakOut and Zone Recovery by MQLSquare

- Experts

- Maziar Safaeinajafabadi

- Versão: 2.2

- Atualizado: 1 novembro 2023

- Ativações: 10

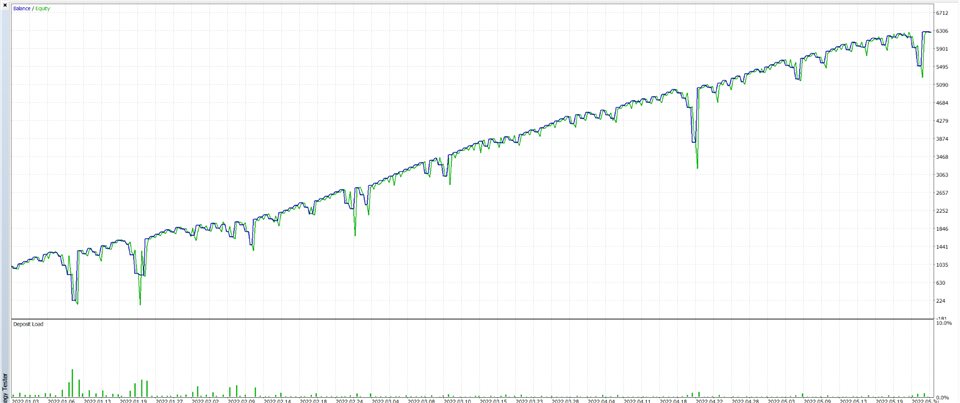

Introducing a sophisticated BreakOut and RecoveryZone tool designed to empower traders in any market scenario, facilitating the optimization of trade opportunities.

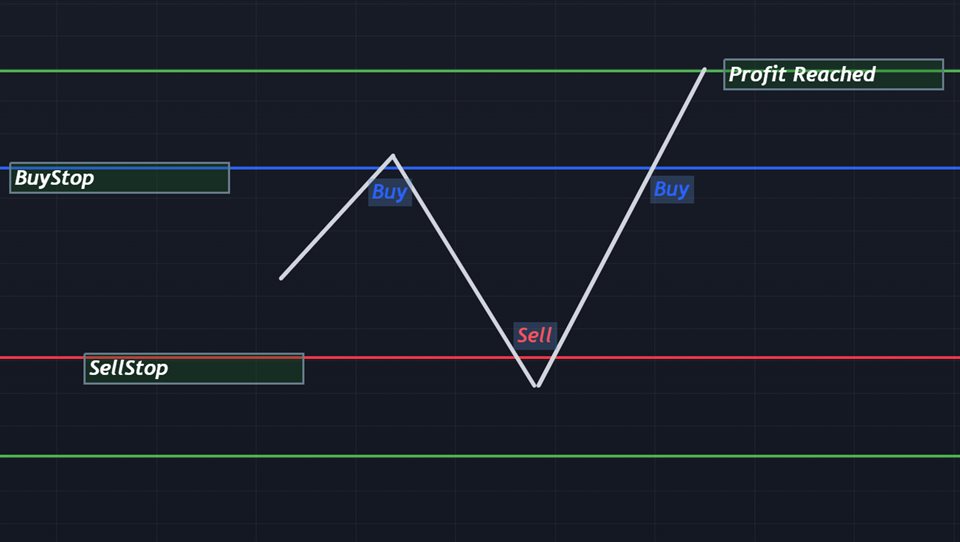

The core strategy revolves around executing price breakouts using BuyStop and SellStop orders to achieve specific profit targets in dollars. Notably, traders can manually set the BuyStop and SellStop levels by simply clicking and dragging lines on the chart (FixedZone=true is required).

For swift market entry, you can drag the BuyStop line below the current price to initiate a buy position, and similarly, drag the SellStop line above the price for an instant sell position.

Crafted for serious traders seeking a top-tier tool for trade execution, it's imperative to utilize the Identifier input as your EA magic number, which can be any number or character of your choice.

Here's a breakdown of the input parameters:

1. Starting Lot Size: This represents your initial lot size at the commencement of a trading cycle.

2. Multiplier: This factor adjusts your lot size following losing trades or market reversals (for a fixed lot size, set the multiplier to 1). It's advisable not to use a multiplier exceeding 1.5.

3. Increasing Period: This parameter determines the rate at which your lot size increases. It's a powerful tool for managing trading volume, especially when employing martingale strategies.

4. Profit in Dollars: This signifies the target profit amount in dollars, indicating the conclusion of a trading cycle.

5. TimeFrame: Choose the timeframe you wish to monitor for the highest and lowest prices in the market to apply your trading zone.

6. Number of Candles to Look Back: Specify the number of candles to consider when identifying the highest and lowest prices in the selected timeframe.

7. Tolerance: This value, measured in pips, is added to the BuyStop and subtracted from the SellStop levels.

8. Fixed Zone: When set to true, the recovery zone remains static, which is essential for manual zone adjustments on the chart.

9. Fixed Zone Size in Pips: This parameter sets the fixed distance between the BuyStop and SellStop levels when employing a fixed zone.

10. Maximum Lot Size: If you're using a multiplier greater than 1, the lot size won't increase beyond this maximum limit throughout a cycle.

11. Allowable Drawdown (% of Equity): Determine the allowable drawdown as a percentage of your account equity. If this threshold is reached, the EA can close all positions. The "Remove expert after first cycle" setting specifies whether the EA should self-remove from the chart after a cycle.

12. Use Virtual Stop Loss: Enabling this feature allows the EA to apply stop loss to each position without affecting performance.

13. Hedge Mode: When activated, positions will not close during market reversals. The recovery zone will be fixed and will hedge between BuyStop and SellStop levels until the profit target is met. Using a higher multiplier (between 1.5 and 2.0) is recommended for hedging, but it involves higher risk.

14. Remove Expert After First Cycle: This option, when enabled, automatically removes the EA from the chart after it completes its first profit cycle, offering convenience.

15. EA Identifier: This serves as the EA's comment and identifier. It is crucial to use unique identifiers when employing the EA on multiple charts within the same account.

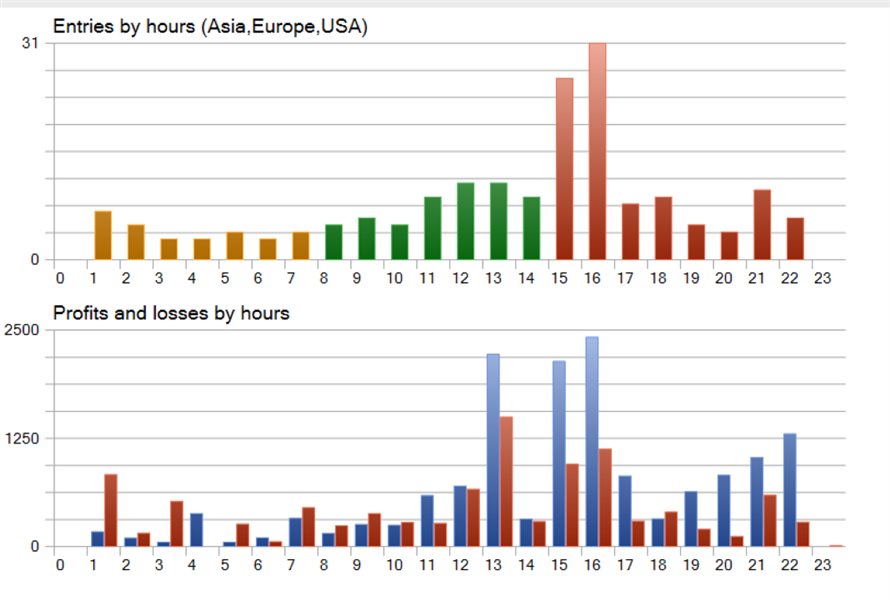

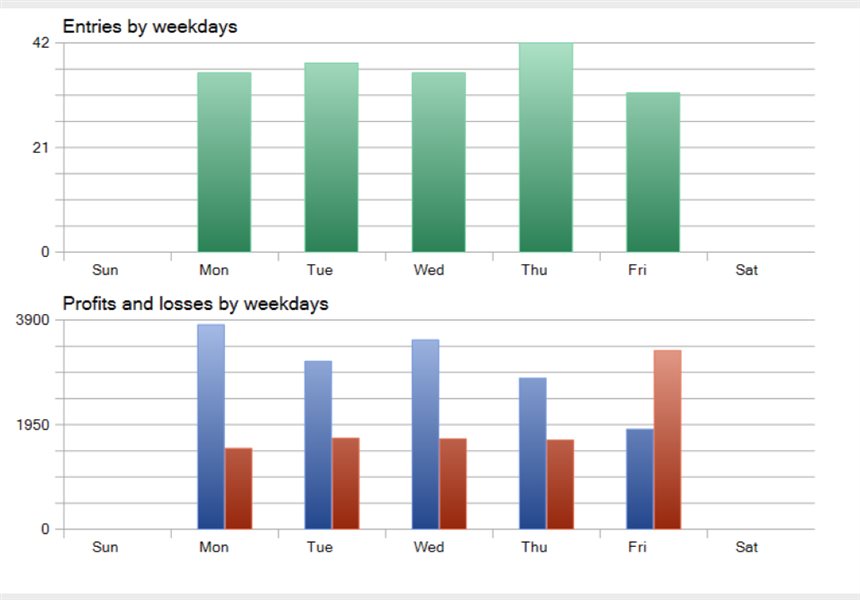

16. Times to Apply EA: Define specific hours and days during which the EA should operate based on broker time. Consider aligning this with high trade volume and market activity.

17. Telegram Messaging: If enabled, the EA can send messages to your Telegram chat, notifying you when a cycle begins, new trades are opened, and when profit targets are achieved. It requires activation by messaging the Telegram bot once.

Please note that this EA performs optimally in high-volume and trending markets. For a solution tailored to ranging markets, consider an alternative option.

O usuário não deixou nenhum comentário para sua avaliação