EA 2 Random Patterns

- Experts

- Zafar Iqbal Sheraslam

- Versão: 1.0

- Ativações: 10

Creating a Forex trading strategy based on random patterns is generally not a recommended approach for successful trading. Forex trading is a complex financial market where traders use various strategies, technical and fundamental analysis, risk management, and market knowledge to make informed decisions. Relying on random patterns is more akin to gambling and is unlikely to yield consistent profits in the long term.

Successful Forex trading strategies typically involve careful analysis and planning. Here's a more structured approach to developing a Forex trading strategy:

-

Market Analysis:

- Start by analyzing the Forex market. Understand the major currency pairs, their historical price movements, and the factors that influence them (economic indicators, geopolitical events, central bank policies, etc.).

-

Technical Analysis:

- Utilize technical analysis tools like trendlines, support and resistance levels, moving averages, and candlestick patterns to identify potential entry and exit points.

-

Fundamental Analysis:

- Pay attention to economic news releases, interest rates, inflation rates, and other fundamental factors that can impact currency prices. This information can help you make informed decisions.

-

Risk Management:

- Develop a risk management plan that includes setting stop-loss and take-profit orders to limit potential losses and secure profits.

-

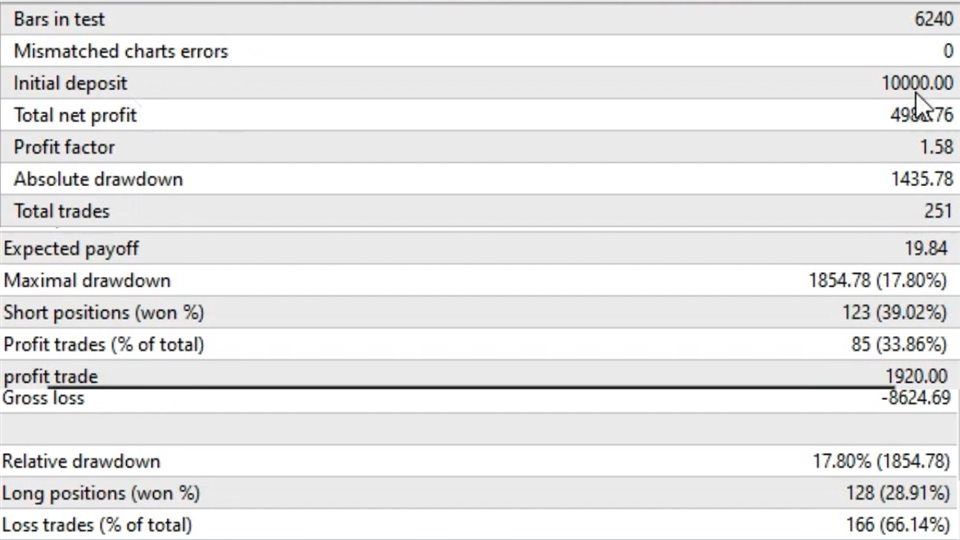

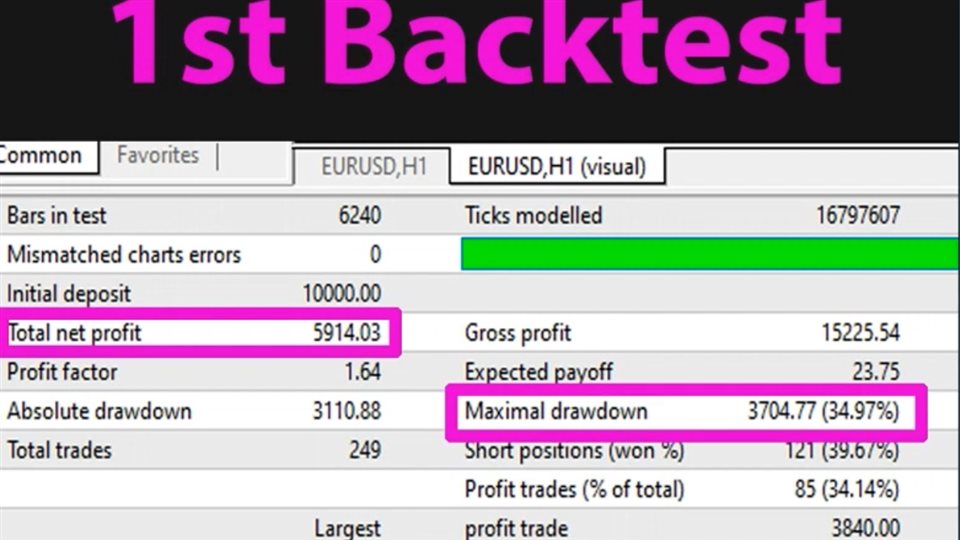

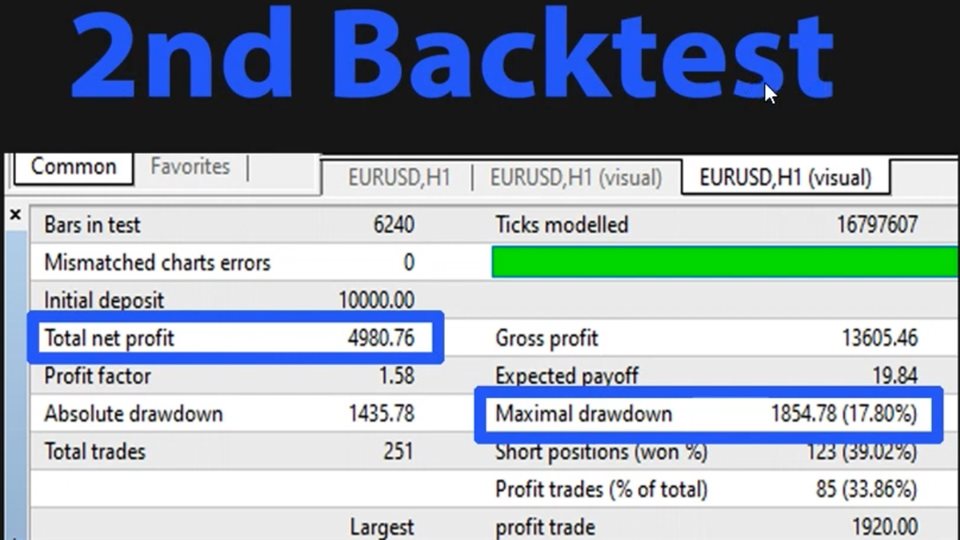

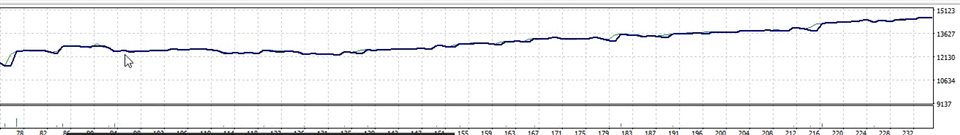

Backtesting:

- Before implementing your strategy with real money, backtest it using historical data to see how it would have performed in the past. This helps you understand the strategy's potential.

-

Demo Trading:

- Practice your strategy in a demo trading environment to gain experience without risking real capital.

-

Continuous Learning:

- Stay updated with market news and trends. Forex markets are dynamic, and strategies need to adapt to changing conditions.

-

Discipline and Patience:

- Emotions can play a significant role in trading. Stick to your strategy and avoid impulsive decisions.

-

Evaluate and Adjust:

- Regularly assess your trading performance and adjust your strategy as needed. Be willing to learn from both successful and unsuccessful trades.

-

Risk Capital:

- Only trade with funds you can afford to lose. Forex trading carries a significant level of risk, and it's important to protect your capital.

In summary, trading based on random patterns is not a sound approach for Forex or any financial market. Instead, focus on developing a well-researched and disciplined trading strategy that incorporates technical and fundamental analysis, risk management, and continuous learning to improve your trading skills over time.