Binary Hedger FV

- Experts

- Ayman Magdy

- Versão: 8.23

- Ativações: 5

introduction:

Hello,

I present to you the advanced and final version of the "Binary Hedger FV" Expert Advisor. I won't delve into extensive details about the EA's concept, as I've covered all the information in the initial version or what can be referred to as the EA's trial version, accessible through the following link:

https://www.mql5.com/en/market/product/93688?source=Site+Market+My+Products+Page

In this presented version, you have a comprehensive and complete release that incorporates all the necessary settings. This version operates on both inversely correlated and directly correlated pairs, and it introduces numerous new settings that were absent in the previous version, such as multipliers and more.

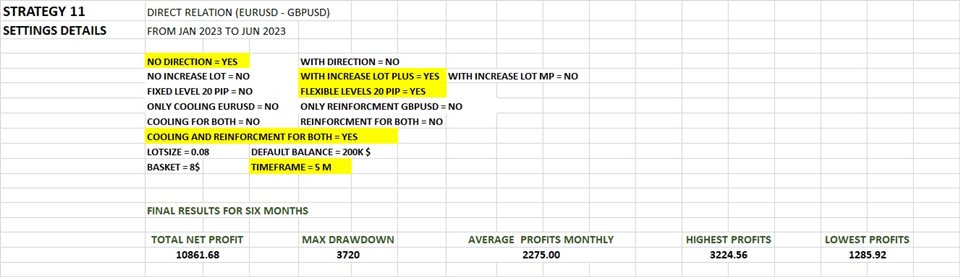

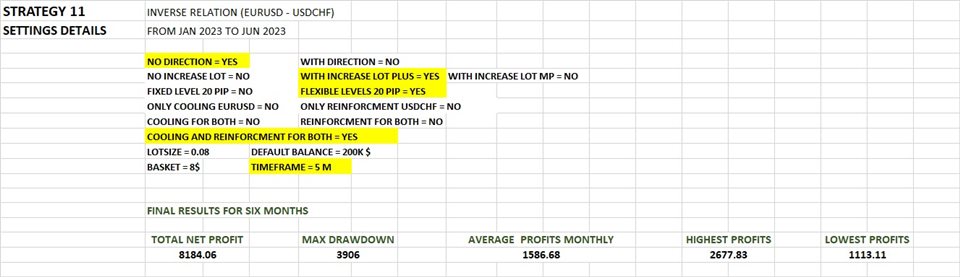

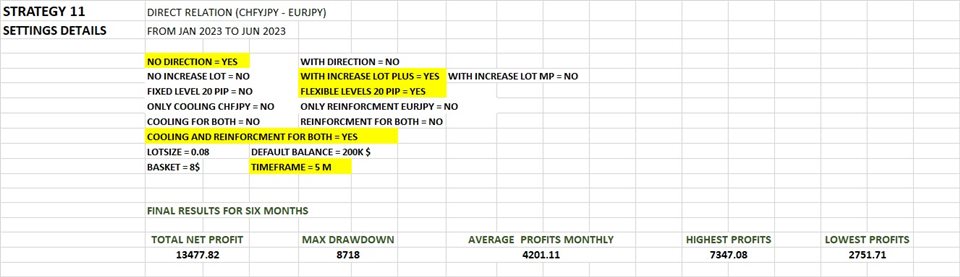

Results and Statistics: Below the EA's images, you'll find a table illustrating the currency correlation percentage on the 4-hour timeframe, covering 2000 candles in the past. All pairs exceeding 70% will be tested, where -0.7 signifies inverse correlation, while +0.7 signifies direct correlation. The higher the percentage, the stronger the correlation between the pairs.

I've selected and tested only one configuration, conducting a backtest over six months. This configuration incorporates all these correlated pairs, and the overall results will be showcased on the EA's homepage through images. As for the remaining configurations and their results in backtests or live trials on demo or real accounts, they will all be displayed in the comments section specific to this EA. Therefore, do keep a consistent watch on the comments section, especially as we're dealing with numerous configurations that require testing.

Small Note: I've set a virtual balance of $200,000 and a basic lot size of 0.08 for all backtests. This provides ample room for trading, especially when employing multipliers. What matters here is drawdown and the achieved profit, and by this, I mean drawdown in dollars and not as a percentage of the capital. Don't focus on the drawdown and profit achieved based on their percentage of the capital. Rather, assess them in terms of their quantity in dollars and evaluate them against your capital.

You can adjust the achieved profit and drawdown by either decreasing or increasing the lot size used in all the backtests, which is 0.08 in our case here.

You can download the currency correlation indicator through Google ..

Attach the indicator to the chart to examine more correlated pairs and add them to the table in case you want to work on other pairs not shown here.

Also, watch the video below as it holds importance.

Another Note: You will find a screenshot of the backtest results below. Occasionally, the net profit might be less than or close to the drawdown in some correlated pairs, and sometimes it might even be negative in other pairs. All of this does not necessarily mean that these specific settings failed on these correlated pairs. What happened is that the Forex Tester platform only allows backtesting for one month in the free version. Consequently, when I conduct a test for each month separately, I deduct the losses from open trades from the profits achieved during the first month. Then I start the second month with the equity balance left after subtracting the losses from open trades. This process continues with each new month.

You will see this process in the video below. Ideally, backtesting should be conducted on consecutive months without interruption.

In the future, I will purchase the paid version of the Forex Tester platform if this expert advisor achieves good sales. However, the current backtesting method using the free version is not bad. In fact, it has yielded very good results on some correlated pairs. Perhaps you need to look at the screenshots below, focusing more on the "Average Monthly Profit" section than the net profit, and comparing it to the drawdown for pairs with unfavorable results.

Moreover, these poor or weak results are not the end of the world for these pairs. There are many, many more settings that will be tested and presented in the comments section here. Stay tuned...

Expert Inputs: I will explain some of the essential inputs briefly and ignore the rest, as they are likely evident to everyone and don't require further explanation.

1- ToStopEA_ByBalance=1000000 :

This option means that the EA will temporarily stop after achieving a certain number of baskets, whether it's after one basket or multiple baskets. To clarify with an example: Let's assume your capital is $1000, and the basket size is $10. If you want the EA to stop opening new trades after the first basket, you will enter $1010 in this field before starting the EA. If you want it to stop after two baskets, you'll enter $1020, and for three baskets, you'll enter $1030, and so on. If you want to run the EA again and have it open new trades, you'll only need to add the new basket size or the number of baskets you want plus your current balance. If you wish to disable these restrictions and let the EA run continuously and open trades, leave the default settings as they are.

The primary symbol chosen for inversely correlated pairs.

The secondary symbol chosen for inversely correlated pairs. If you intend to work with two inversely correlated pairs, enter them here. "Master" refers to the first pair, and "Slave" to the second. Alternatively, you can write points instead of the pair name if you're working with the other type of correlation, which is direct correlation.

3- VarB="________Symbols with directly correlated";

The secondary symbol chosen for directly correlated pairs. If you intend to work with two directly correlated pairs, enter them here. "Master" refers to the first pair, and "Slave" to the second. Alternatively, you can write points instead of the pair name if you're working with the other type of correlation, which is inverse correlation.

4- PairMaster_FollowedBySlave: The symbol chosen as the master pair, followed by the slave pair. If a master pair is selected (e.g., EURUSD), the corresponding slave pair (e.g., USDCHF) will follow its direction.

-

Master: This boolean value activates when attaching the EA to the master pair only. It indicates whether the selected symbol is the master. When activated, the master symbol's direction influences trading. If enabled, it implies that the overall direction is governed by the moving average, and the "No_Direction" option must be disabled (set to false).

-

SlaveDirectRelation: This boolean value indicates a direct relationship between symbols. If enabled from the beginning, the expert advisor will work with directly correlated pairs. For example, if the master pair is EURJPY, this option can be enabled for the slave pair CHFJPY and disabled for EURJPY.

-

SlaveInverseRelation: This boolean value indicates an inverse relationship between symbols. If enabled from the beginning, the expert advisor will work with inversely correlated pairs. For example, if the master pair is EURUSD, this option can be enabled for the slave pair USDCHF and disabled for EURUSD.

6- MainProfit:

The main profit target, which represents the average profit between trades.

ToActiveMainProfit:

The number of orders required to activate the main profit.

6- Var1_4="_____Without general direction restrictions

No_Direction=true

This set of options:

Set all of them to false if you want to work without general direction restrictions.

7- These options are interrelated ...

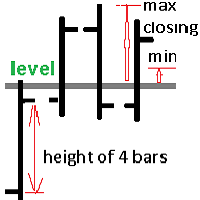

Cooling_FixedLevels=false,Reinforcment_FixedLevels=false

Fixed_Level=20

And also these options are interrelated ...

Cooling_FlexibleLevels=true,Reinforcment_FlexibleLevels=true

Start_Distance=20

Distance_Factor=1.5

8- plus=true,mp=false,Fixed_Lots=false

- plus: This means increasing the lot size for each trade using the addition system, which involves using the "Lots + LotsPlus" option, such as 1, 2, 3, 4, etc.

- mp: This means increasing the lot size for each trade using the multiplication system, which involves using the "Lots * LotsMP" option, such as 1, 2, 4, 8, etc.

- Fixed_Lots: This means having a fixed lot size for all trades.

9- For Baskets:

Firstly inversly correlated pairs:

- TotalProfitsInverseBuy:

Total profits from buying the master symbol + buying the slave symbol.

- TotalProfitsInverseSell:

Total profits from selling the master symbol + selling the slave symbol.

Secondly directly correlated pairs:

- TotalProfitsDirectBS:

Total profits from buying the master + selling slave symbols.

- TotalProfitsDirectSB:

Total profits from selling the master + buying slave symbols.

Conclusion: The expert advisor has achieved very good results in backtesting with various settings and some interrelated pairs. Some of these settings have been placed here on the main page of the expert, while others will be posted in the comments section here. Additionally, there are many other settings that have not been tested yet.

They will be tested and posted in the comments. Therefore, I will be offering this expert advisor at a higher price in the future. For now, I will be offering it at a modest price for a limited time, so take advantage of the opportunity and try it before the price increases.

Finally, I advise you not to risk or blindly trust any expert advisor or technical analysis. Be cautious at all times when trading, whether manually or using a robot. Feel free to reach out to me if you have any questions.

Best of luck to everyone!