Martin Antimartin on RSI

- Experts

- Roman Shiredchenko

- Versão: 0.1

- Ativações: 5

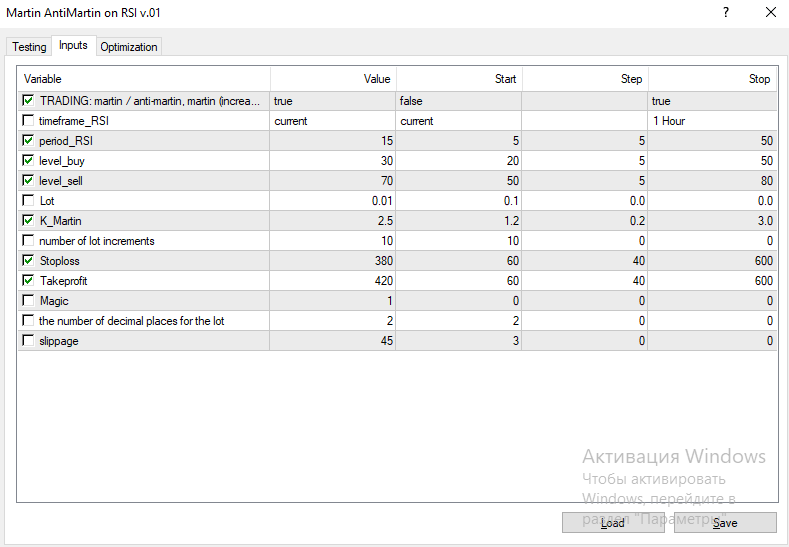

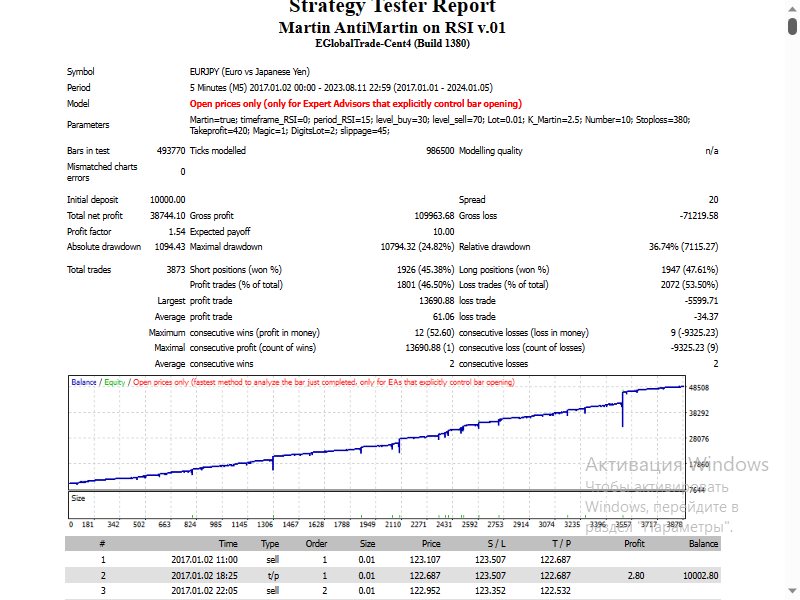

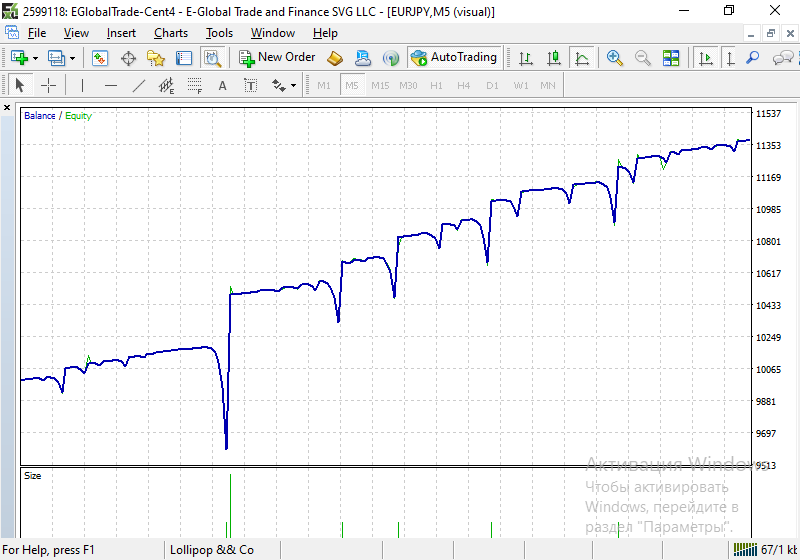

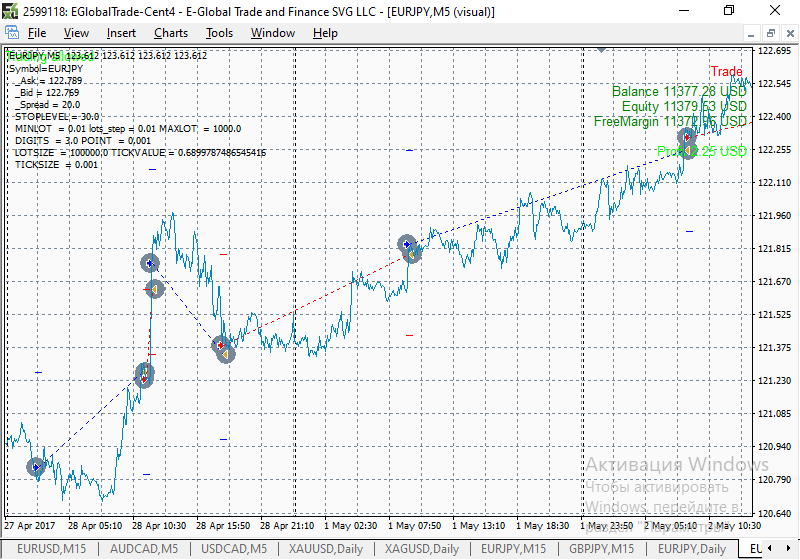

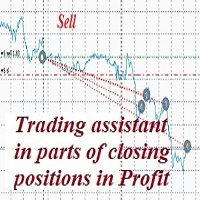

The trading advisor trades with money management elements, both using the martingale system and using the anti-martingale system, at the user's choice. You can choose the type of money management system in external variables. (Usage options with money management according to Martin or AntiMartin) Opens starting positions on the RSI indicator, after exiting the position on the take profit, increases the lot by the AntiMartin coefficient, again we enter the market on the RSI indicator. With Martingale money management, after a stop loss, the lot increases by a factor. When entering a market position, SL, TP, the number of lot increases, the coefficient of lot increases are set. The next position is not opened until the previous one is closed. Trades only at the opening of a new candle on the set timeframe in the direction of the existing market movement. The first entry into a series of profit trades based on the RSI indicator is the intersection of its levels (30) and (70). If the level (30) is crossed upwards from below, this is an entry into the purchase, if the level (70) is crossed downwards, this is an entry into the sale. You can also optimize the period of the RSI indicator and its position entry levels in the trading strategy tester before installing the Expert Advisor for trading. Thus, the starting entry for the martingale is carried out according to the RSI indicator, and then, when the price moves towards the position, it is closed by take profit. When the price moves against the position, it is closed by stop loss and the market is entered in the opposite direction from the direction of the previous position - that is, in the direction of the market movement. This is essentially a trend trading system. If the market reverses again and the position is exited by stop loss, then we re-enter the market position on an increased volume in the direction of the current market movement. This is a revolutionary trading system. As a result, at the next reversal, the market position will be exited by take profit and the entire series of positions will be closed in profit. What will be displayed on your account balance. There is one market position in the market at a time. And a series of losses in pips equal to the value of the stop loss is always closed in profit at the end. What you can observe on the balance of your account. You can set a maximum limit on the number of coups on increased entry volumes for capital control. Further, trading will go to the starting volume. You can also select this value using the trading strategy optimizer. When trading on the anti-martingale money management option, the market is also entered at the intersection of the RSI indicator levels, then, when exiting the market by take profit, the subsequent trading volume increases. This is a trend trading system, it is clear that the trend does not continue indefinitely, that is why the value of the number of lot restrictions exists in the settings of the external variables of the expert. After it is exceeded, the market is entered on an initial small volume. This variant of money management, anti-martingale, is often used by traders to overclock a trading account. When several times in a row on increased volumes the trading account was dispersed several times and again started trading on the initial small starting lot. After exiting a series of positions by take profit, the next series of profitable positions begins when the RSI indicator triggers. It is recommended to start trading with small values of the starting lot. Also, to control risks - there is a limit on the number of coups on increased volumes. This is clearly written in the name of the variables, which all speak for themselves. For a more complete understanding of the trading approach, screenshots from the strategy tester are attached. There is also an option to select the range of values of the parameters of external variables for optimization from the values on the history of the price movement of the symbol. For anti-martingale - I suggest that you independently choose the valid values of external variables for profitable trading. The trading approach itself is working - I use it on my trading accounts with different parameter values. So, external variables look like: extern bool Martin = true; //TRADING: martin / anti-martin, martin (increase by K_Martin with loss) / by anti-martin (increase by K_Martin with profit) extern ENUM_TIMEFRAMES timeframe_RSI = 5; extern int period_RSI = 15; extern int level_buy = 30; extern int level_sell = 70; extern double Lot = 0.01; // initial volume extern double K_Martin = 2.0; //lot increase factor extern int Number = 10; // number of lot increments extern int Stoploss = 380, take profit = 420; extern int Magic = 1; // magic number expert extern intDigitsLot = 2; // the number of decimal places for the lot extern int slippage = 45; // slippage in pips