Lotsize calculator for deriv and synthetic indices

- Utilitários

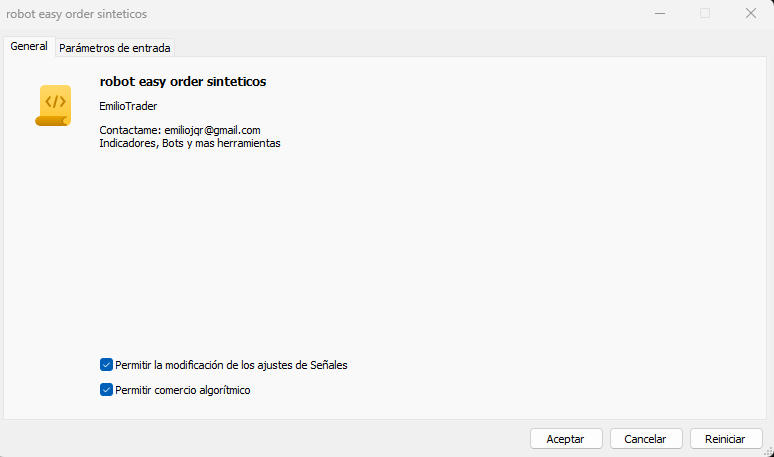

- Emilio Jose Quintero Ramos

- Versão: 1.0

- Ativações: 5

It has never been so easy to manage the risk of your account until now, this tool will allow you to have full control of your capital and manage your entries in the synthetic index derivative markets, in an easy, practical and safe way.

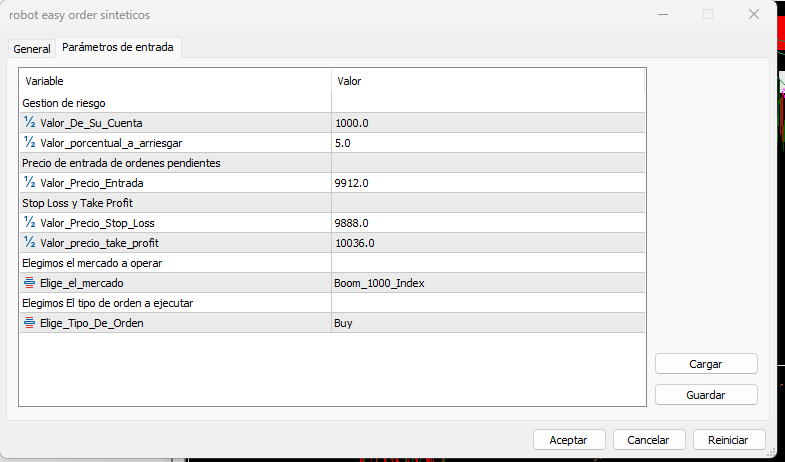

The available input and configuration parameters are as follows :

RISK MANAGEMENT

1. Value of your account: Here as its name says you will place the value corresponding to the size of your account, for example if your account is 150 dollars the corresponding value will be 150.

2. Percentage Value To Risk: If we want to risk for example 3% of our account in an operation we fill this item with the number 3, since the percentage values go from 1 to 100% of the account.

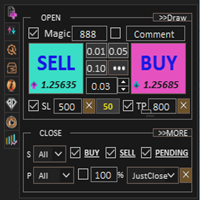

ENTRY PRICE PENDING ORDERS

* If our order is not a market execution order we must assign the entry price of our position as we would normally do.

STOP LOSS AND TAKE PROFIT

STOP LOSS : It is mandatory to set a stop loss in the orders since this tool calculates the value of the volume based on the distance to which the stop loss of the established order is located.

TAKE PROFIT : If we want our order to have take profit we can set it, in case we do not want a take profit value the parameter will be 0.

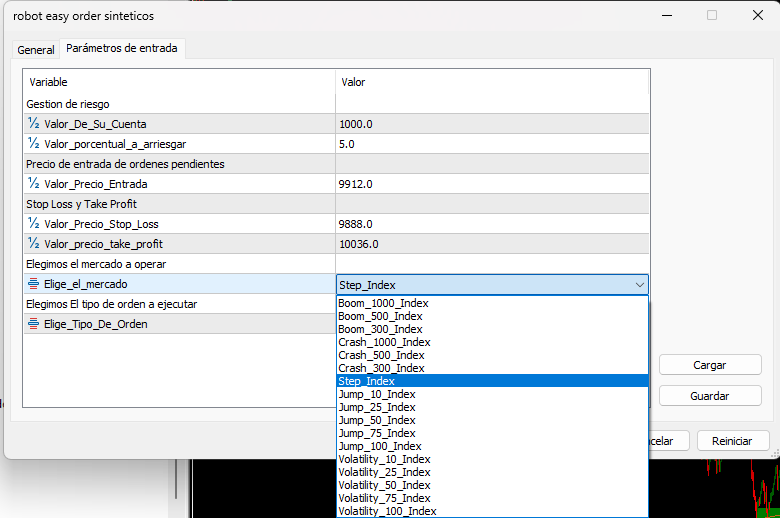

CHOOSE MARKET: We choose the market in which we want to place our order to make the corresponding calculations.

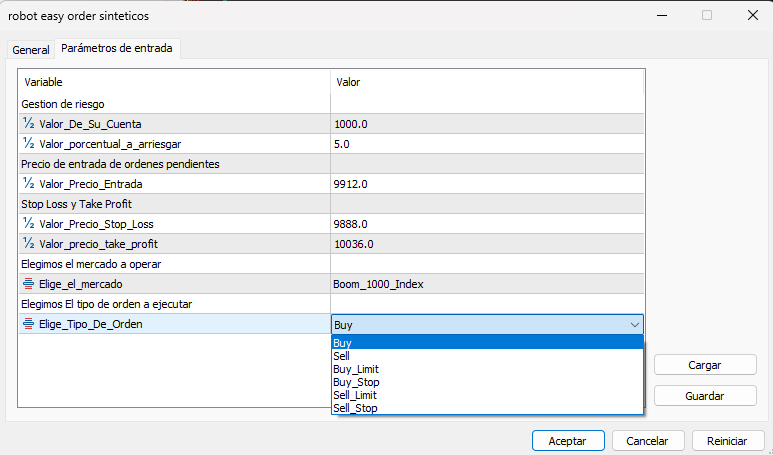

CHOOSE ORDER TYPE: We select the type of order we want to execute in the market.