MACD on FATL AM

- Indicadores

- Andriy Matviyevs'kyy

- Versão: 27.0

- Atualizado: 11 setembro 2024

- Ativações: 10

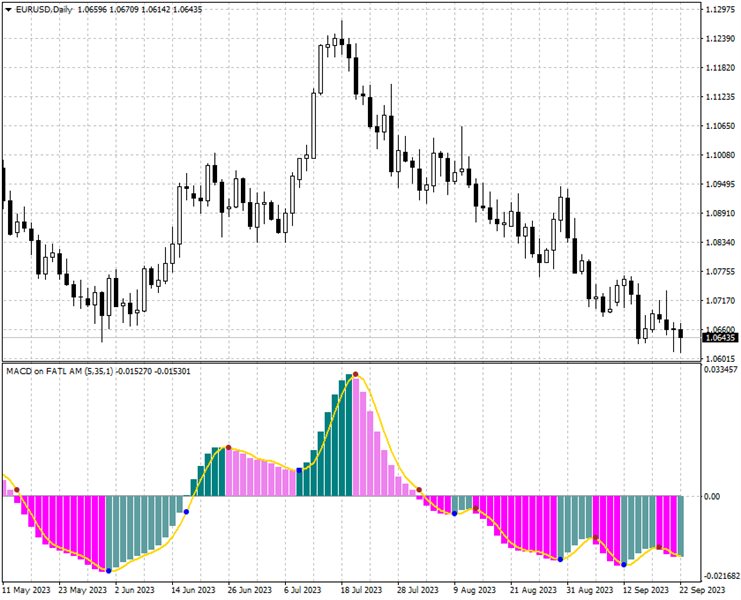

This indicator is one of the variants of the MACD technical indicator.

The indicator is the difference between two moving averages with different smoothing periods.

Each moving average is additionally smoothed by an adaptive digital filter.

In a simplified sense, an adaptive digital filter is a moving average with effective smoothing.

Using a digital filter allows you to smooth out sharp fluctuations with minimal signal delay.

Using the indicator:

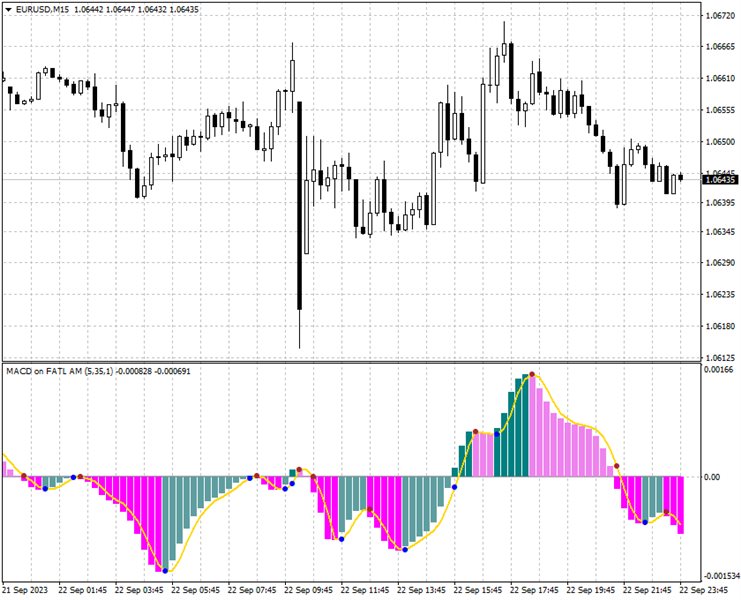

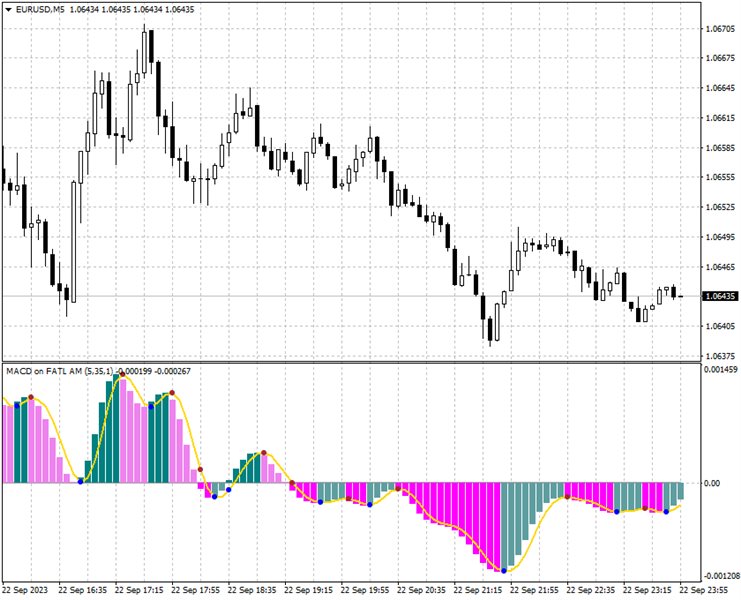

It should be taken into account that the values of the indicator on the zero bar (which has not finished forming yet) may change, so decisions should be made after the end of the bar formation, at the moment of opening a new zero bar.

Confirmation of the indicator signals is usually the price breaking the high (for buying) or low (for selling) of the bar on which the signal was given.

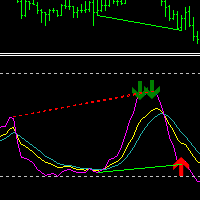

As a signal, the indicator crosses the zero line. When the zero line is crossed by the indicator from top to bottom, a sell signal is given, when from the bottom up, a buy signal is given.

The second type of signal is a fall or rise in the indicator values. If the indicator values begin to decline after growth, this is a sell signal. If the indicator values begin to grow after falling, this is a signal to buy.

The indicator also uses divergence analysis. If prices make a new high on the chart, which is higher than the previous one, and the indicator at this time makes a new high on its chart, but lower than the previous one, this means that an upward downward movement may soon begin to reverse. And vice versa, if prices make a new low on the chart, which is lower than the previous one, and the indicator at this time makes a new low on its chart, but higher than the previous one, this means that a downward trend reversal may soon begin.