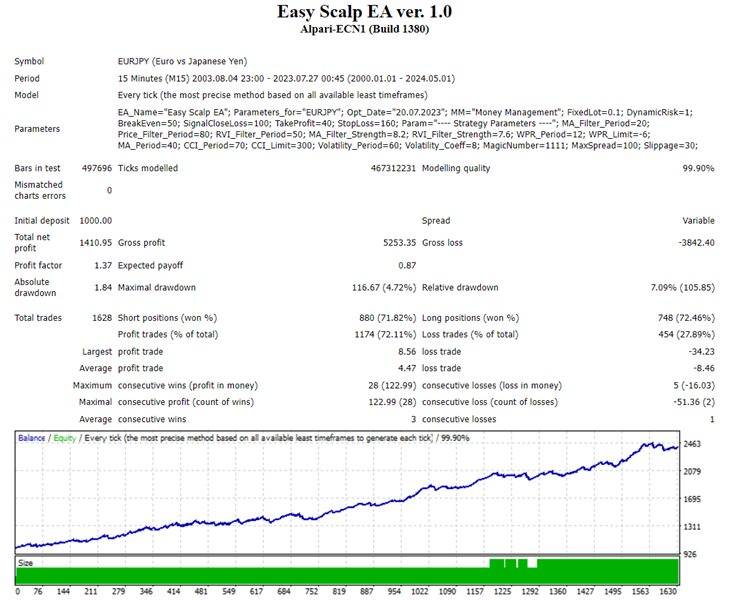

Easy Scalp EA

- Experts

- Mikhail Kornilov

- Versão: 1.0

- Ativações: 10

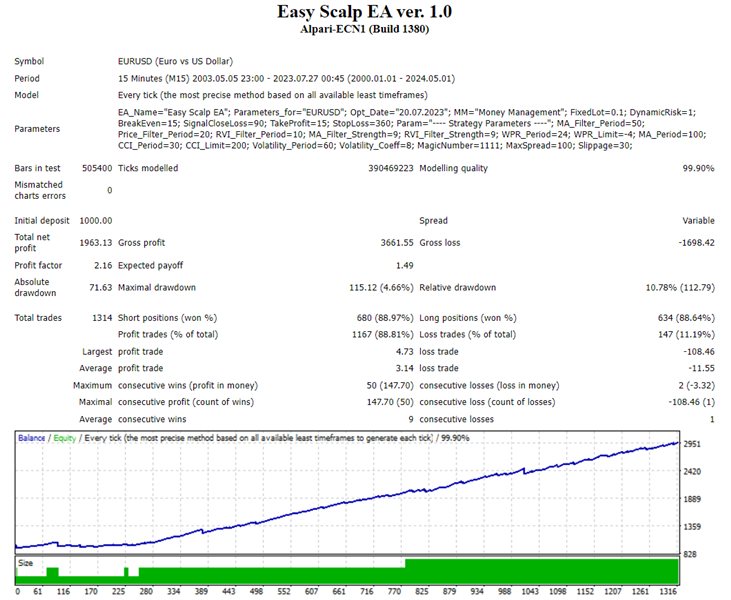

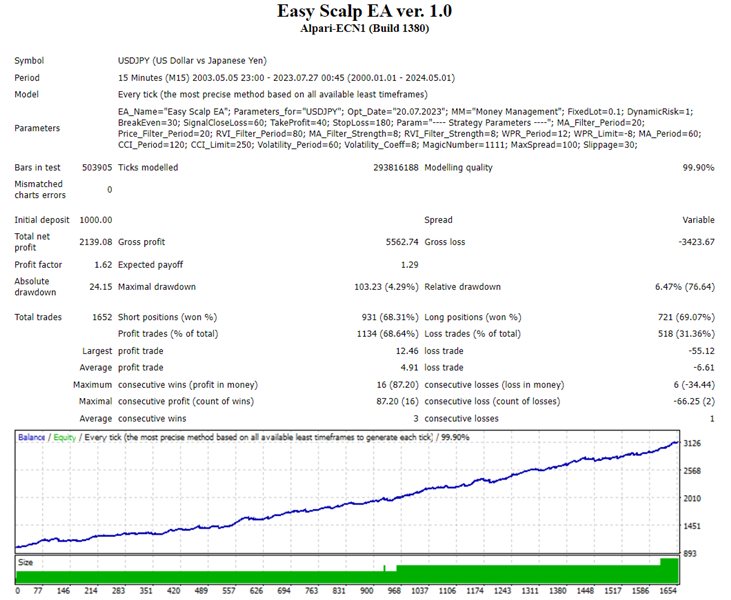

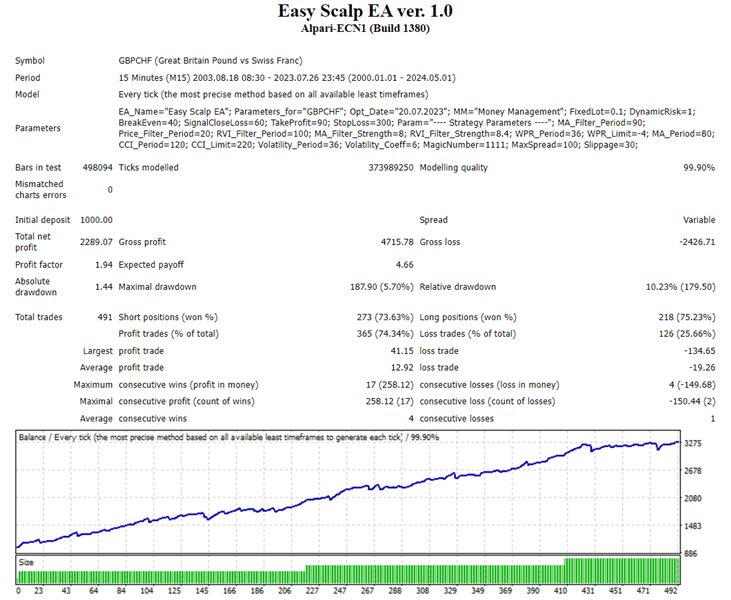

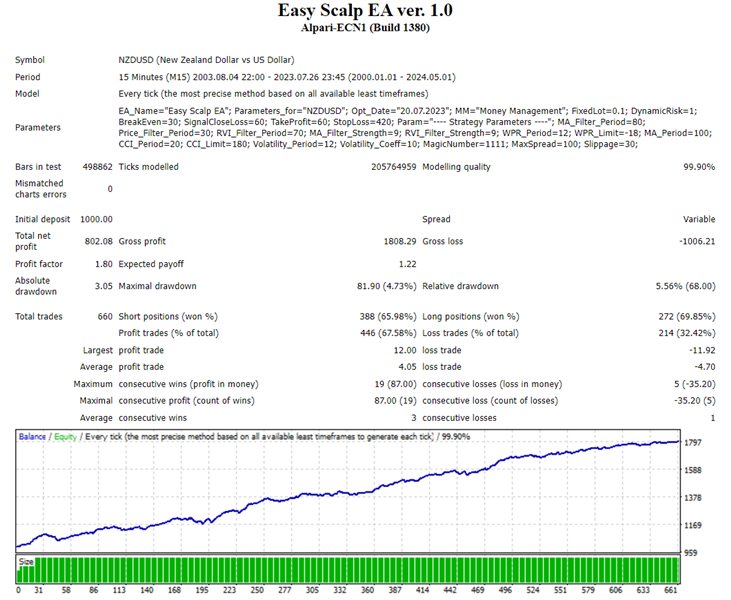

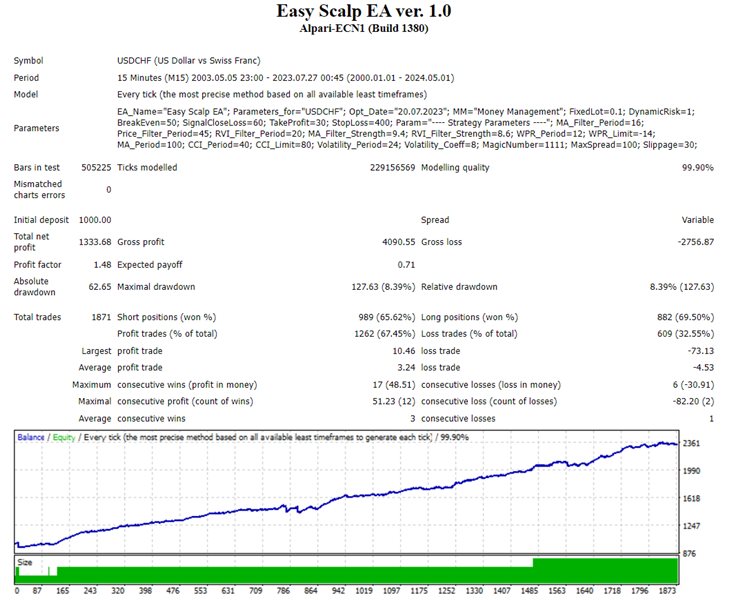

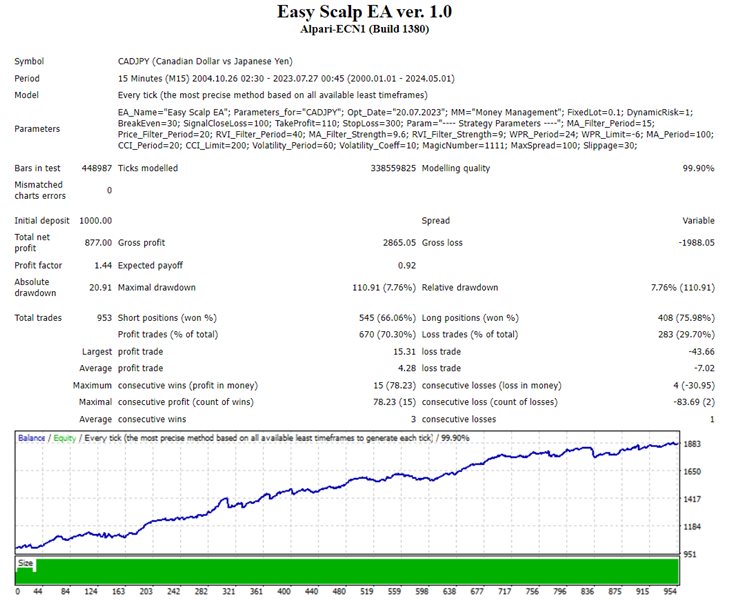

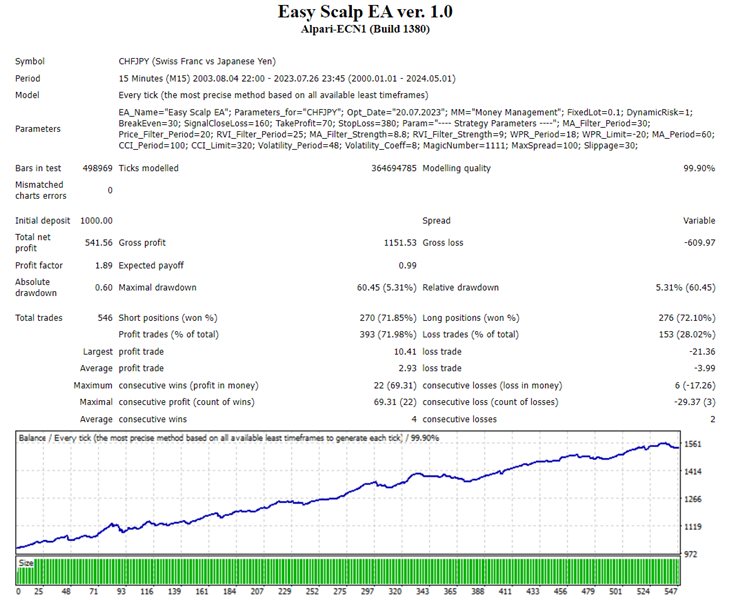

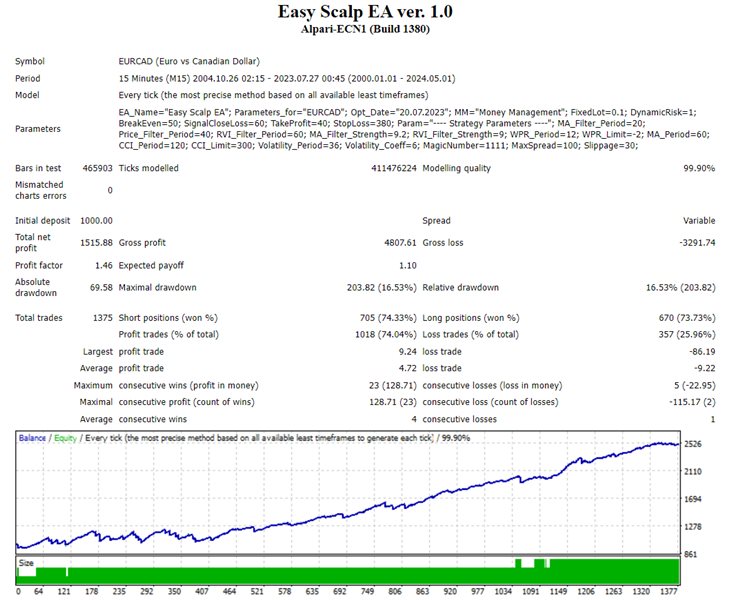

Easy Scalp is a classical indicator-based scalping EA, which can be easily optimized for every currency pair. The EA always places fixed stop loss and take profit and doesn’t use averaging.

2 copies are left for $69. The next price is $89.

Monitoring: https://www.mql5.com/en/signals/2026299

Advantages

- Doesn’t use dangerous strategies

- Can work with small deposit

- Doesn’t sensitive to spread

- Fast optimization

- Fixed stop loss

Requirements

- Minimal deposit: 10$

- Account type: any, ECN is preferred

- Currency pair: any

- Time frame: М15

Settings

- FixedLot – fixed lot size (at DynamicRisk = 0)

- DynamicRisk – dynamic risk dependent on deposit

- BreakEven – break even value in points

- SignalCloseLoss – close level at opposite signal

- TakeProfit – take profit value in points

- StopLoss – stop loss value in points

- MA_Filter_Period – period of filtering MA

- Price_Filter_Period – period of filtering by price deviation

- RVI_Filter_Period – period of filtering RVI

- MA_Filter_Strength – intensity of filtering by MA (от 0 до 10)

- RVI_Filter_Strength - intensity of filtering by RVI (от 0 до 10)

- WPR_Period – period of WPR to close trades

- WPR_Limit - value of WPR to close trades

- MA_Period – period of MA in the main entry strategy

- CCI_Period - period of CCI in the main entry strategy

- CCI_Limit – maximal value of CCI to open trades

- Volatility_Period – period of ATR (used to estimate current volatility)

- Volatility_Coeff – value of ATR

- MagicNumber – magic number of EA’s orders

- OpenOrderComment – comment to orders

- MaxSpread – maximal spread value to open trades

- Slippage – admissible slippage for non-ECN accounts

Actual presets for all pairs:

https://c.mql5.com/31/930/Easy_Scalp_Ver_1.0__Presets.zip

4-digits points are used in settings. The EA recalculates all parameters automatically for 5-digits if necessary.

Optimization recommendations

Easy Scalp EA can be optimized very good and fast. One can test and optimize the EA using open prices that significantly speed up the process. At that it is important to follow some rules in order to avoid over-optimization which emerges in extra outstanding results.

Rule 1. Overvalue the spread at optimization. But not too much. If fixed spread is used the recommended values are following:

30 points for EURUSD, USDCHF, USDJPY, USDCAD, AUDUSD, EURCHF, NZDUSD

50 points for EURAUD, EURCAD, EURJPY, GBPUSD, AUDJPY, AUDCHF, AUDJPY, EURGBP, CADJPY, CADCHF, CHFJPY

60 points for AUDNZD, NZDCAD, NZDCHF, NZDJPY

70 points for GBPCHF, GBPJPY, GBPCAD, GBPAUD, GBPNZD, EURNZD

If real spread is used add 10 points to it in your TDS settings.

Rule 2. Use forward and backward periods for testing. Optimize on about 60% of all available history leaving 20% on both sides.

Rule 3. Optimize all parameters of the trading strategy but use big step and range (3 – 5 steps for every parameter). Then optimize in the vicinity of obtained results and increase the precision by narrowing the range. Usually, 3-4 cycles are needed.