Ultra AI Pro

- Experts

- Smart Trading Robots Ltd

- Versão: 7.5

- Ativações: 5

***Limited Launch Offer! Ultra AI Pro will be free to download for the first 50 users! After that we are going full price. All we ask in return is that you give us some feedback, review Ultra AI Pro and leave a comment.***

Ultra A.I Pro is a sophisticated trading bot tailored for assets with strong long-term holding potential and robust market growth fundamentals, typically associated with indices like NAS100, S&P 500, and others.

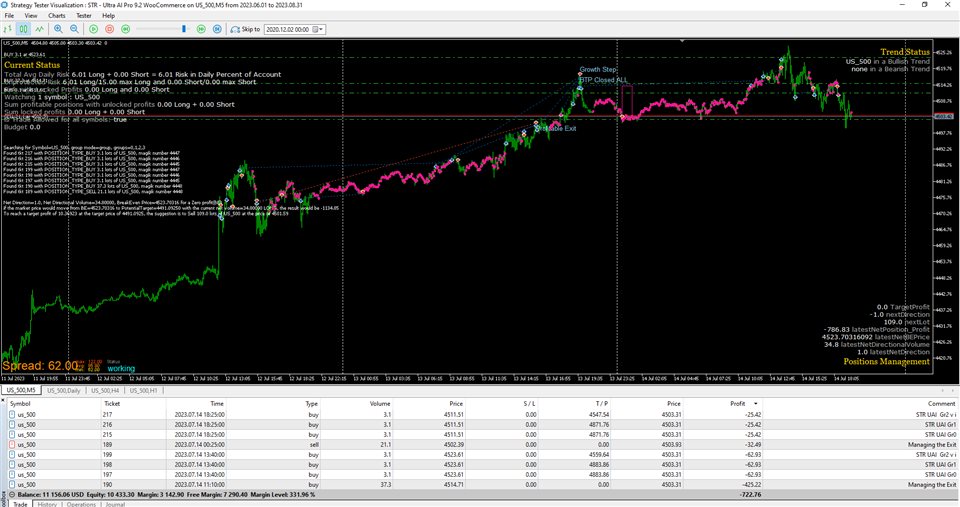

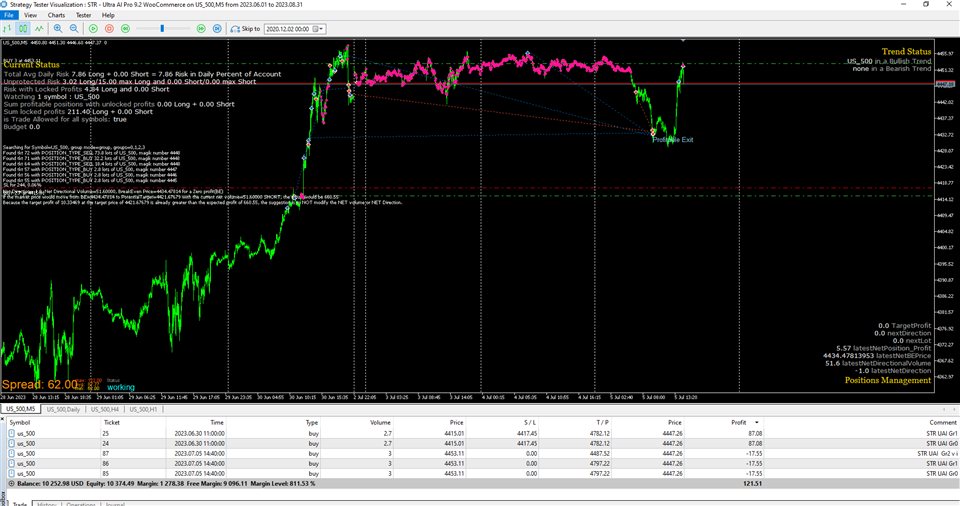

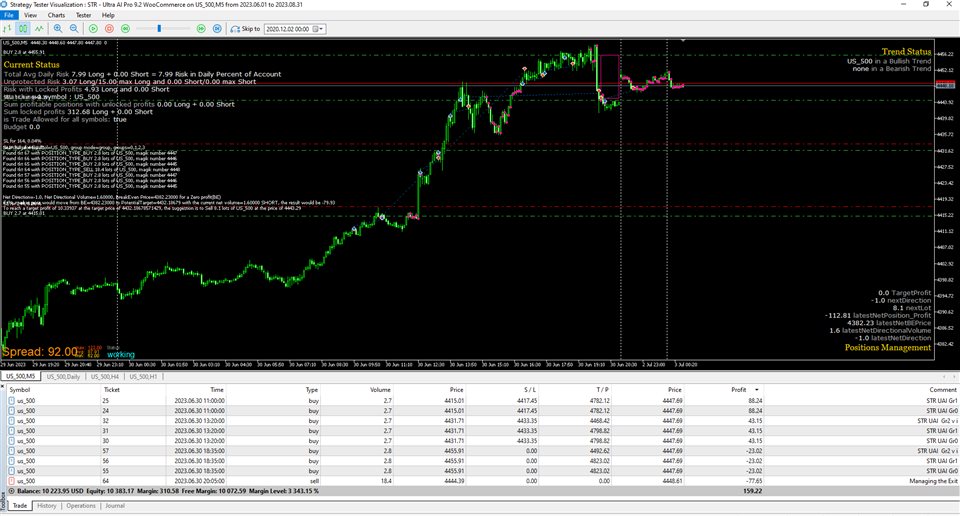

Designed to operate daily, Ultra A.I Pro meticulously capitalizes on market movements and trends across multiple time frames. It employs a time-weighted entry strategy, gradually building a position around the asset's current market price range. This approach ensures that the robot enters multiple small positions at varied prices over time. As the asset grows, these open positions appreciate in value, while Ultra A.I. Pro continues to strategically position within the range.

One of Ultra A.I Pro's defining features is its "Directional Switch" mechanism. If a position fails to hit its take profit mark and the market trends unfavorably, the bot astutely identifies a specific level to launch a new trade in the opposite direction. This counter-trade is not just a reactive measure to the initial position's potential loss; it's a proactive strategy to profit from the emerging market direction. If this feature is activated, the EA will continually adapt, switching directions until the trade turns profitable.

Risk management is at the core of Ultra A.I Pro's design. Users can leverage the daily ATR movement to define their risk thresholds. The bot's position gap feature offers flexibility in managing the range between positions both above and below the market price. This dual approach ensures that users can capitalize on favorable market shifts while minimizing exposure during adverse movements. Additionally, the integration of high Fibonacci levels offers another layer of risk management, allowing traders to harness market momentum while maintaining a safety net.

Ultra A.I Pro also recognizes the importance of equity growth. As your equity expands, brokers can enhance your margin, enabling the opening of new positions at elevated prices and amplifying your leverage. The bot's optional break-even variable acts as a protective shield for trades once activated, preserving profits and fostering account growth before even finalizing the position. This dynamic makes Ultra A.I Pro exceptionally compatible with broker accounts, regardless of their leverage spectrum, from smaller to larger values.

The bot's versatility shines when it comes to exit strategies. Ultra A.I Pro provides a plethora of user-defined parameters for taking profit levels, stop loss levels, trailing stops, break-evens, and basket take profits. Users can deploy these tools individually or in tandem, tailoring their trading approach to their unique preferences and objectives. With Ultra A.I Pro, you're not just investing; you're strategizing for success.

Variables Overview:

-

SL, TSL, and TP Settings:

- These settings revolve around defining take profit (TP) and stop loss (SL) levels based on the average daily ATR movement. The trailing stop loss (TSL) is determined by the number of bars for the EMA, and there's a provision to activate a break-even function.

-

Risk Settings:

- These settings allow users to manage the risk associated with their trades. They can set the maximum unprotected risk, decide the direction of trades (long or short), and specify risk percentages for different groups of trades. There's also a feature for a directional switch based on daily ATR movement and account growth.

-

Portfolio Strategies:

- These settings are designed to manage the overall portfolio. They include features like setting growth targets, managing stop losses, and determining when to close trades. The Garbage Collect (GC) feature targets losing positions and determines when to offset losses.

-

Prop Trading Settings:

- These settings are specific to proprietary trading. They allow users to set conditions for equity protection, specify withdrawal days, and determine when to close all trades, either daily or on specific days like Fridays.

-

Trade Entry Settings:

- These settings dictate how and when the bot enters trades. They include time intervals for checking indicators, defining position gaps based on daily ATR, and setting conditions for trend strength. There are also settings related to Fibonacci levels, moving averages, and oscillators like RSI to refine trade entries.

-

Multi Symbol Settings:

- These settings allow users to trade multiple symbols simultaneously. Users can specify which symbols to trade long or short, set correlation limits between instruments, and manage entries on the same symbol. There's also a provision to trade the VIX symbol and set conditions based on its levels.

In essence, Ultra AI Pro offers a comprehensive set of parameters that allow users to customize their trading strategy extensively, from risk management to trade entries and portfolio strategies. The bot is designed for both individual asset trading and multi-symbol trading, with a strong emphasis on risk management and strategic trade entries.

Detailed Input Variables:

1. SL, TSL, and TP Settings:

- TP as Daily ATR Multiplier Gr1 & Gr0: Determines the take profit level for group 0 and group 1 positions based on the average daily ATR movement.

- TP as Daily ATR Multiplier ATR Gr2: Determines the take profit level for group 2 positions based on the average daily ATR movement.

- SL as Daily ATR Multiplier: Sets the stop loss level based on 1 Daily ATR. A value of 0 means no stop loss.

- Trailing Period GR1 on Medium TF & GR0 on Daily TF (0 = no trailing): Specifies the number of bars for the EMA that tracks the trailing stop for group 1 and group 0.

- BE Offset as percent of winning gap mtp: Determines when the break-even function is triggered.

- Start Trailing in % of TSL (GR0,GR1): Specifies the distance from the current market price to the entry price relative to the potential stop loss distance.

2. Risk Settings:

- Max unprotected risk in Daily Percent of account movement: Specifies the maximum unprotected risk for trades that might result in losses.

- Target Fraction Long / Short for Unprotected risk (1=Long, 0=Short): Determines the fraction for shorts and longs.

- Gr0 - Risk % of eqt mov p.Daily ATR, trailing on Daily (0=no): Specifies the maximum percentage unprotected risk for Gr0.

- Gr1 - Risk % of eqt mov p.Daily ATR, trailing on Medium - TF (0=no): Specifies the maximum percentage unprotected risk for Gr1.

- Gr2 - Risk % of eqt mov p.Daily ATR, no trailing (0=no): Specifies the maximum percentage unprotected risk for Gr2.

- Directional Switch Daily ATR MTP (0=off): Determines the directional switch trade entry based on the average daily ATR movement.

- Directional Switch Target Equity Growth: Sets the account growth percentage for the directional switch trade position.

3. Portfolio Strategies:

- Growth target in percent of equity for Basket TP: Determines when portfolio procedures are executed based on open and close trades.

- On GT, Shrink SL in % of itself (100=no shrinking): Specifies the percentage to shrink the SL of all trades after reaching the Basket TP target.

- Close all on each Basket TP: A boolean value to determine if all trades should be closed upon reaching the Basket TP.

- GC (Garbage Collect) - MTP of Daily Risk to target each loosing position: Determine the multiplier of daily risk to start targeting loosing positions.

- GC (Garbage Collect) - MTP of Daily Risk to Trigger feature: Determines the trigger based on the necessary additional profits to offset the losses.

- Enforce closing only the oldest loosing trade: A boolean value to determine if only the oldest losing trade should be closed.

- Minimum days for GC to target losers against unprotected winners: Specifies the time in Daily ATR before the garbage collect starts targeting losing positions against winning positions.

4. Prop Trading Settings:

- Prop Suspension on daily drawdown (100=No): Specifies the percentage of balance drop to trigger equity protection.

- % of initial equity reached to terminate the EA: Determines the percentage of initial balance drop to trigger equity protection.

- Withdrawal on fixed day of the month: Specifies the day of the month for withdrawals.

- Prior to withdrawal, Close all?: A boolean value to determine if all trades should be closed before withdrawal.

- Close all on Friday at (Empty=Do not close all on Friday): Specifies the time on Friday to close all positions.

- Time to close all everyday (Empty=NA): Specifies the daily time to close all positions.

5. Trade Entry Settings:

- Time interval for time-weighted entries(TWE-TF): Determines the interval for checking technical indicators for opening new trades.

- Winning Side Position Gap in fraction of Daily ATR: Determines the distance between new winning trades.

- Loosing Side Position Gap in fraction of Daily ATR: Determines the distance between new loosing trades.

- Period for Triple TF trend filter (0=off): Checks the strength of the trend based on this EMA value in three time frames.

- Require Fast MA beyond Slow MA: A boolean value to determine if the fast moving average should be beyond the slow moving average.

- Type of EMA for DAILY: Choice between EMA or Triple EMA for Daily.

- Medium TimeFrame: Specifies the 3rd timeframe for the triple trend.

- Days for Fibo Filter (0=off): Determines the Fibonacci filter value in days.

- Highest Fibo Level to allow Buy (0 to 1): Specifies the highest Fibonacci level for buying.

- Highest Fibo Level to allow Sell (0 to 1): Specifies the highest Fibonacci level for selling.

- Oscillator Entry - Medium TF Periods: Uses the RSI level as an additional entry: The RSI period to determine oscillator entry.

- Oscillator Entry - Recovery Level on Medium TF (0=no Type 2 Entry): The RSI level for oscillator entry.

- Max Price Stretch in ATR to allow Entry: Specifies the ATR multiplier to avoid opening new trades during extended market movements.

6. Multi Symbol Settings:

- List of Symbols to allow long: Specifies symbols for trading long positions.

- List of Symbols to allow short: Specifies symbols for trading short positions.

- Max ABS Correlation allowed on multi symbols (0=lowest, 1=max): Determines the maximum allowed correlation between instruments.

- Avoid Same symbols entries: A boolean value to determine if new entries on the same symbol should be avoided if a position already exists.

- Vix symbol with current broker: Enter VIX Symbol if available and you want to trade this.

- Max Vix level to allow accumulating VIX Product: Specifies the maximum VIX level for trade accumulation.

- Vix Level to prevent new long positions on other assets: Specifies the VIX level to prevent new long trades on other assets.

This list provides a comprehensive overview of the parameters available for Ultra AI Pro, allowing users to customize their trading strategy extensively.