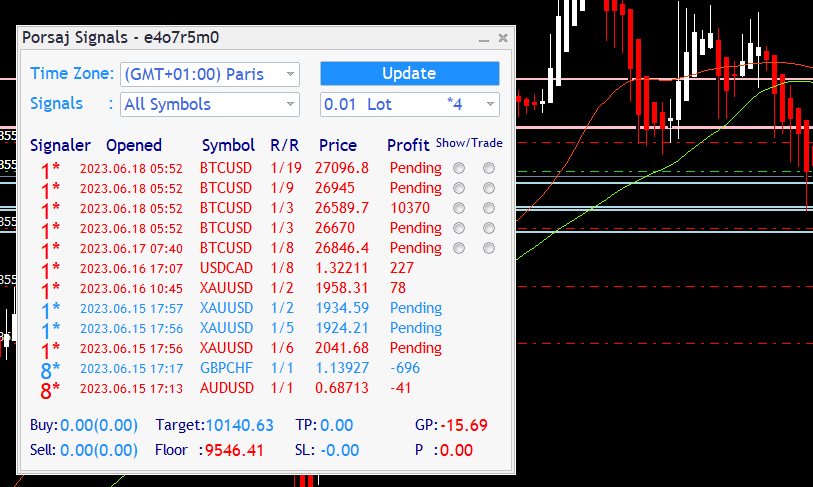

Porsaj Signal

- Utilitários

- Jan Bungeroth

- Versão: 8.7

- Atualizado: 6 fevereiro 2024

- Ativações: 5

We offer:

- Every day signals on EURUSD, XAUUSD (Gold), XAGUSD, GBPUSD, CADJPY, USDJPY, USDCHF, AUDUSD, AUDNZD, NZDUSD, USDCAD, ...

- We offer evaluated signals and you can see the signals with rank of signal providers based on their history

Note:

After installation, please go to Tools>Options>Expert Advisors and add https://porsaj.com to 'Allow WebRequest for listed URL'.

Still Problem?! Please check Internet connection!

More explanation:

Forex and crypto signals are tools used by traders to help them make informed decisions in the financial markets. These signals provide indications or suggestions about the potential direction of price movements for specific currency pairs in the Forex market or cryptocurrencies in the crypto market. Traders can use these signals as a source of information to assist them in making trading decisions.

Here are some key points about forex and crypto signals:

-

Signal Providers: Signal providers are individuals or companies that specialize in analyzing market data, identifying trading opportunities, and generating trading signals. They may use various technical indicators, fundamental analysis, or a combination of both to identify potential entry and exit points in the market.

-

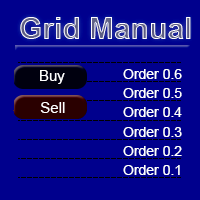

Types of Signals: Signals can be broadly categorized as either buy/sell signals or market analysis signals. Buy/sell signals indicate when to enter or exit a trade, while market analysis signals provide general market insights, trend analysis, or updates on specific assets.

-

Signal Delivery: Signals are typically delivered through various means, including email, SMS, mobile apps, social media channels, or specialized signal platforms. Traders can choose the delivery method that best suits their preferences and trading style.

-

Accuracy and Reliability: The accuracy and reliability of signals can vary depending on the signal provider and their methodology. It's essential to choose reputable signal providers with a track record of delivering consistent and reliable signals. However, it's important to note that no signal can guarantee 100% accuracy, as market conditions can change rapidly.

-

Risk Management: While signals can provide valuable information, it's crucial for traders to incorporate proper risk management strategies. Traders should consider factors like stop-loss orders, position sizing, and risk-reward ratios to manage their risk exposure effectively.

-

Signal Validation: It's advisable to validate signals with your own analysis and research before making trading decisions. This helps ensure that signals align with your trading strategy and risk tolerance.

-

Costs: Signal providers may charge subscription fees or offer different pricing plans for accessing their signals. It's important to evaluate the cost of signals in relation to the potential benefits and your trading budget.

Remember that trading in forex and crypto markets involves inherent risks, and signals should be considered as one tool among many in your trading toolbox. It's essential to develop a comprehensive trading strategy, conduct thorough analysis, and practice proper risk management to improve your chances of success.