Termos de Referência

I need a program that can do what I do, which is demonstrated below:

I monitor 22 currency pairs at the same time. Each currency pair has charts set up as follows:

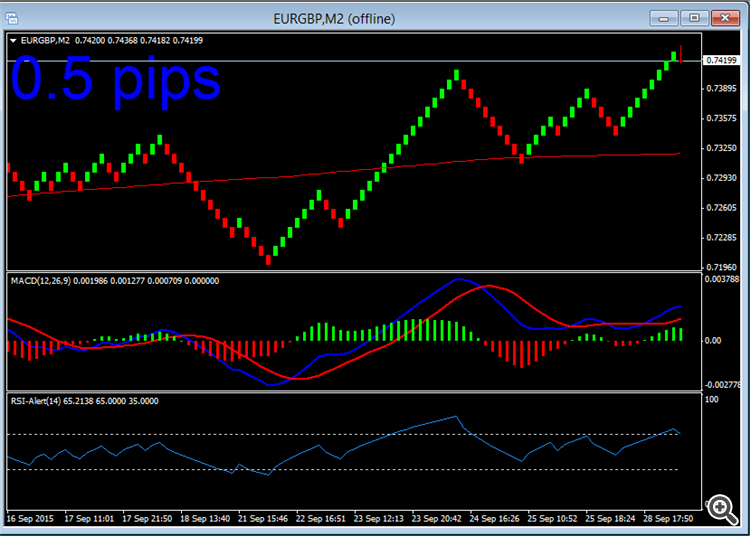

10PIPS Renko with 300 period MA, 12,26,9 MACD, and 14 period RSI with 35 and 65 levels.

I wait until RSI touches the 35 or 65 level in any of the pairs.Then I check if all the conditions below are available in that currency pair:

1) If RSI has touched the 65 level, MACD and signal lines should both

be above zero line and the last Renko bar should still be green and MA

should have an upward angle

or 2) If RSI has touched the 35 level, MACD and signal lines should both be below zero line and the last Renko bar should still be red and MA should have a downward angle

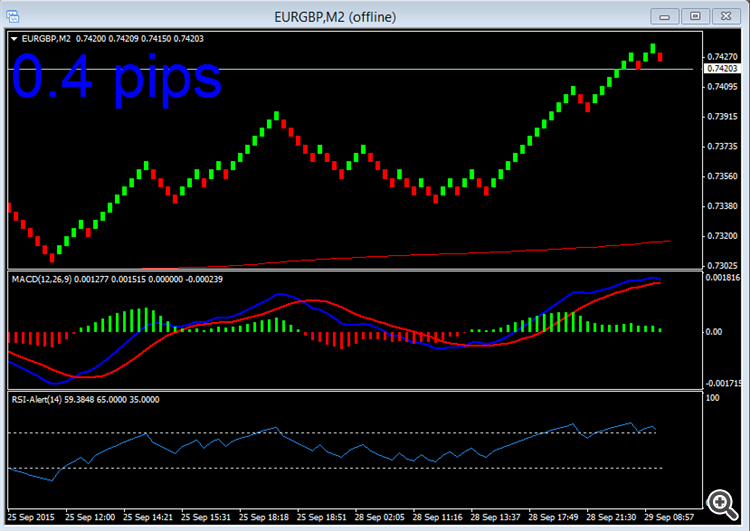

If any of the conditions 1 or 2 are available, I switch to 5PIPS Renko in the same currency pair window as shown below:

As soon as I switch to 5pips Renko chart I check the following conditions:

3) If condition 1 made me switch to 5pips Renko chart, both MACD and signal lines should be above zero line and MACD should still be above signal line in 5pips renko chart. Then I place a short trade with trailing stop as soon as MACD crosses the signal line from above.

or 4) If condition 2 made me switch to 5pips Renko chart, both MACD and signal lines should be below zero and MACD should still be below signal line in 5pips renko chart. Then I place long trade with trailing stop as soon as MACD crosses the signal line from below.

I only place one trade at a time.

Also since I normally trade the whole day, I make sure I trade pairs with AUD, NZD, JPY during asian session and pairs with EUR, GBP and CHF during London session and etc.