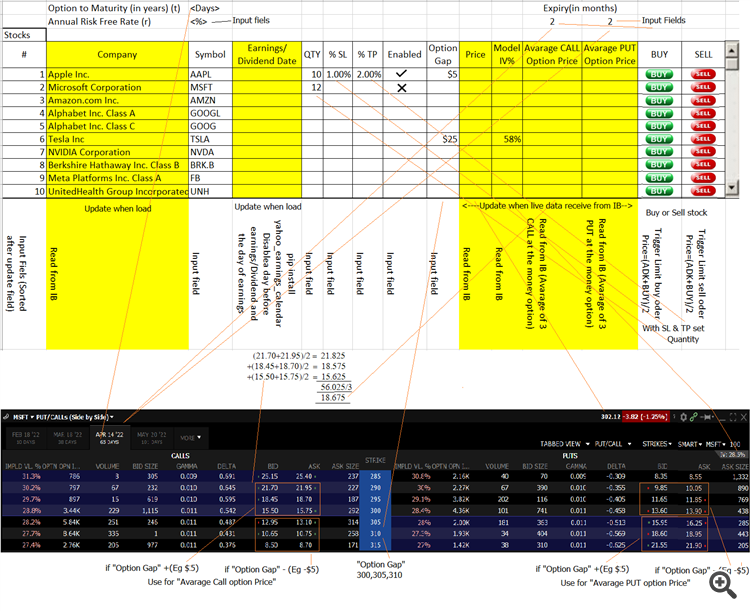

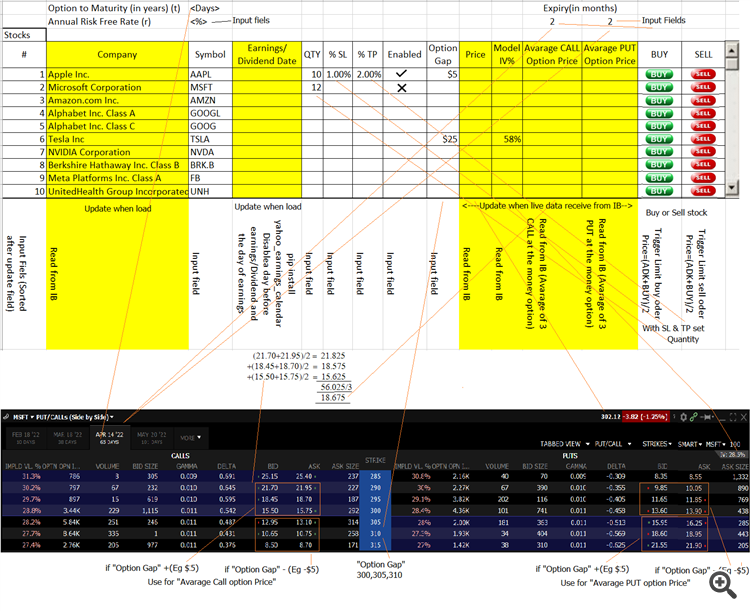

Project have to write in python program using Visual Studio interface with IB API.

1. Read Stock(Company Name)/Option/Model IV% from IB API

2. Display in the chart as shown in below

Column descriptions in vertical text is only to describe function of each column.(Should not display on screen)

3. Earnings have to be retrieved from Yahoo earnings calendar(pip install yahoo_earnings_calendar)/Dividend form "import pandas, requests, datetime, calendar"

4. The during day before, earnings day and next day of earnings "Enable" field have to show X.

5. Purchased stocks have to move up the list and deselect corresponding BUY or SELL button.

6. All the input fields have to store in a ConfigIB.ini file

7. When place BUY or SELL order by clicking BUY/SELL button, have to set TP and SL too. Close order by clicking opposite button.

8. When calculating "Average CALL/PUT Option Price" using "Option gap" value is if + value options from in the money, If - value out of the money.

9. Log, placated orders in a log file with all parameters on hand.

Pedidos semelhantes

I have an equity reporter. This equity reporter displays the maximum and minimum equity reached over a specific interval. So, if the interval is set to 24 hours, the script will generate data in the format: "Profit ATT" (profit AtThatTime) shows max./min. during the specific interval This specific report shows data in pips. It can also be set to display in price or percentages. The interval is also easily adjustable

An EA that executes when the 21 and 55 SMA Cross on certain time frame also the EA will understand supply and demand levels and executes when price reacts on this levels specified and target/stoploss levels will be predetermined...also the robot will also comprise stochastic oscillator

Starting from scratch, I need a solution to develop my own crypto trading and exchange platform. This platform should compare prices across various exchanges like Coinbase, Binance, KuCoin, and Unocoin, as well as different cryptocurrencies. The solution must identify opportunities to buy on one platform and sell on another for a profit, transferring funds to my personal wallet instantly for security. The bot should

Starting from scratch, I need a solution to develop my own crypto trading and exchange platform. This platform should compare prices across various exchanges like Coinbase, Binance, KuCoin, and Unocoin, as well as different cryptocurrencies. The solution must identify opportunities to buy on one platform and sell on another for a profit, transferring funds to my personal wallet instantly for security. The bot should

Starting from scratch, I need a solution to create my own crypto trading and exchange platform. The platform should compare prices across various exchanges like Coinbase, Binance, KuCoin, and Unocoin (as examples) and different cryptocurrencies. The solution must identify opportunities to buy from one platform and sell on another for a profit, transferring the funds to my personal wallet instantly for security. The

Hello i need an expert who can help me modify an open source PineScript indicator code to add additional features. ONLY EXPERT WITH PROVE OF WORK SHOULD CONTACT FOR FURTHER DISCUSSION ON THE PROJECT

hi. I hv a strategy on tradingview need to convert to MT4/MT5 expert advisor for algo trading. would like to add some tradingview strategy setting to the EA(not included in my tradingview code): recalculate after order is filled, order size: xx% of equity

The Bot will use 2 Indicators and should follow these rules: Trade Entry: You must always enter the trade EXACTLY at the close of the current candle, with the expiry time set to the end of the next candle. It will only work if you click BUY or SELL EXACTLY in the last second of the current candle. I don't need to mention that you need a good internet connection and obviously should use the trading platform app. DO

looking for help to get my ibkr automated, i have strategies already built in composer and have JSON for them, i really just need to he setup and explanation on how to maintain it and add new strategies

1. Combination of Market Profiles on daily basis a) this should be combined if the bell curve is similar to the previous day. Rotational day (volume - standard deviation). b) If breakout, new range should be drawn Conclusion: Market profile should be combined on daily after the market is closed 2. Use Vwap indicator, with 0.5 - slow trend, 1.0 - normal trend, 1.5 fast trend. The stop loss should be under the trend