Kasim Ijelu / 프로필

Practicing self mastery

Kasim Ijelu

diving deep into data and market analysis!

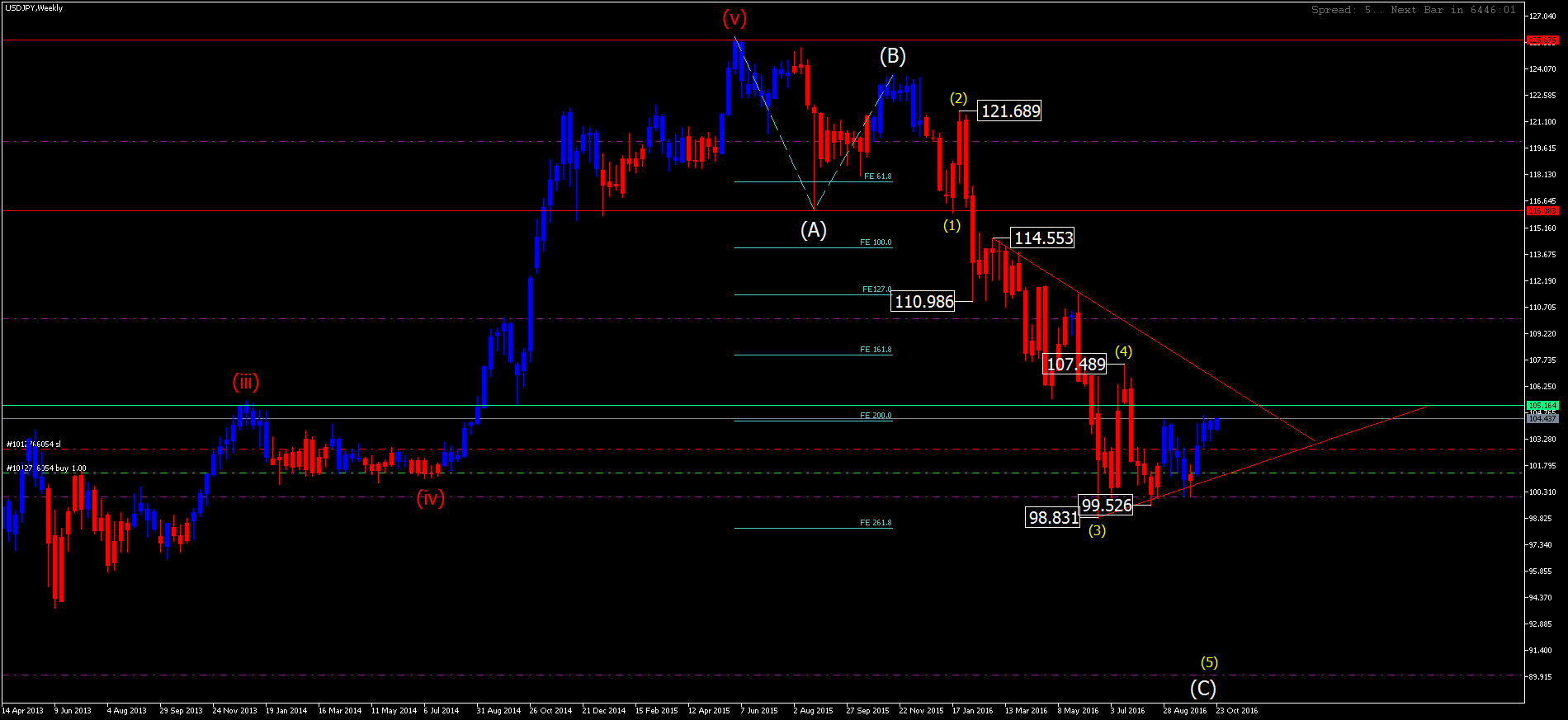

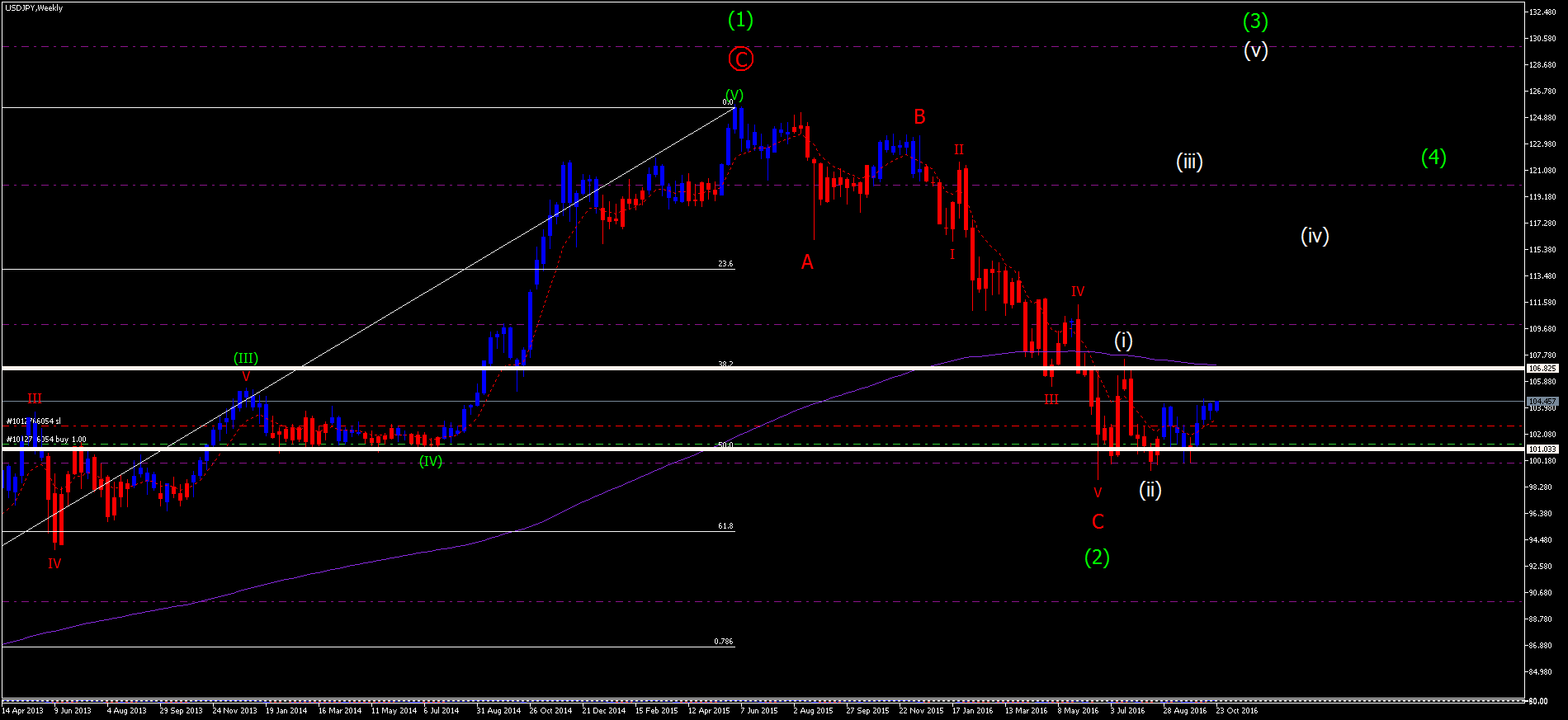

USDJPY

Indeed, while many enjoy the bank holiday, the financial markets continue to operate, reflecting the importance of staying informed and prepared.

Regarding the recent market activity, it's intriguing that despite positive home sales data on August 23rd, the dollar index sold off. This could be due to concerns about inflation and potential Federal Reserve rate cuts, which often weigh heavily on market sentiment.

The harmonic Lobster pattern forming at 143.64 in the USDJPY, suggesting a potential reversal point, indicating a possible relief rally for the dollar in the coming week and into the first half of next month. Harmonic patterns like the lobster are used by traders to identify such reversal points based on specific price movements and ratios⁵⁶.

If you have any specific charts or additional data points you'd like to discuss, feel free to share! I'm here to help with any further analysis or insights you might need.

By Kasimu Ijelu

RockSolid Watchtower

USDJPY

Indeed, while many enjoy the bank holiday, the financial markets continue to operate, reflecting the importance of staying informed and prepared.

Regarding the recent market activity, it's intriguing that despite positive home sales data on August 23rd, the dollar index sold off. This could be due to concerns about inflation and potential Federal Reserve rate cuts, which often weigh heavily on market sentiment.

The harmonic Lobster pattern forming at 143.64 in the USDJPY, suggesting a potential reversal point, indicating a possible relief rally for the dollar in the coming week and into the first half of next month. Harmonic patterns like the lobster are used by traders to identify such reversal points based on specific price movements and ratios⁵⁶.

If you have any specific charts or additional data points you'd like to discuss, feel free to share! I'm here to help with any further analysis or insights you might need.

By Kasimu Ijelu

RockSolid Watchtower

Kasim Ijelu

diving deep into data and market analysis!

USDJPY

Indeed, while many enjoy the bank holiday, the financial markets continue to operate, reflecting the importance of staying informed and prepared.

Regarding the recent market activity, it's intriguing that despite positive home sales data on August 23rd, the dollar index sold off. This could be due to concerns about inflation and potential Federal Reserve rate cuts, which often weigh heavily on market sentiment.

The harmonic Lobster pattern forming at 143.64 in the USDJPY, suggesting a potential reversal point, indicating a possible relief rally for the dollar in the coming week and into the first half of next month. Harmonic patterns like the lobster are used by traders to identify such reversal points based on specific price movements and ratios⁵⁶.

If you have any specific charts or additional data points you'd like to discuss, feel free to share! I'm here to help with any further analysis or insights you might need.

Baines cross at 145.06

By Kasimu Ijelu

RockSolid Watchtower

USDJPY

Indeed, while many enjoy the bank holiday, the financial markets continue to operate, reflecting the importance of staying informed and prepared.

Regarding the recent market activity, it's intriguing that despite positive home sales data on August 23rd, the dollar index sold off. This could be due to concerns about inflation and potential Federal Reserve rate cuts, which often weigh heavily on market sentiment.

The harmonic Lobster pattern forming at 143.64 in the USDJPY, suggesting a potential reversal point, indicating a possible relief rally for the dollar in the coming week and into the first half of next month. Harmonic patterns like the lobster are used by traders to identify such reversal points based on specific price movements and ratios⁵⁶.

If you have any specific charts or additional data points you'd like to discuss, feel free to share! I'm here to help with any further analysis or insights you might need.

Baines cross at 145.06

By Kasimu Ijelu

RockSolid Watchtower

Kasim Ijelu

게재된 포스트 How to spot news trades

How to spot trading Opportunities using Economic news events (these can be forecasted ahead of time ) i,e Monday 23...

소셜 네트워크에 공유

109

Kasim Ijelu

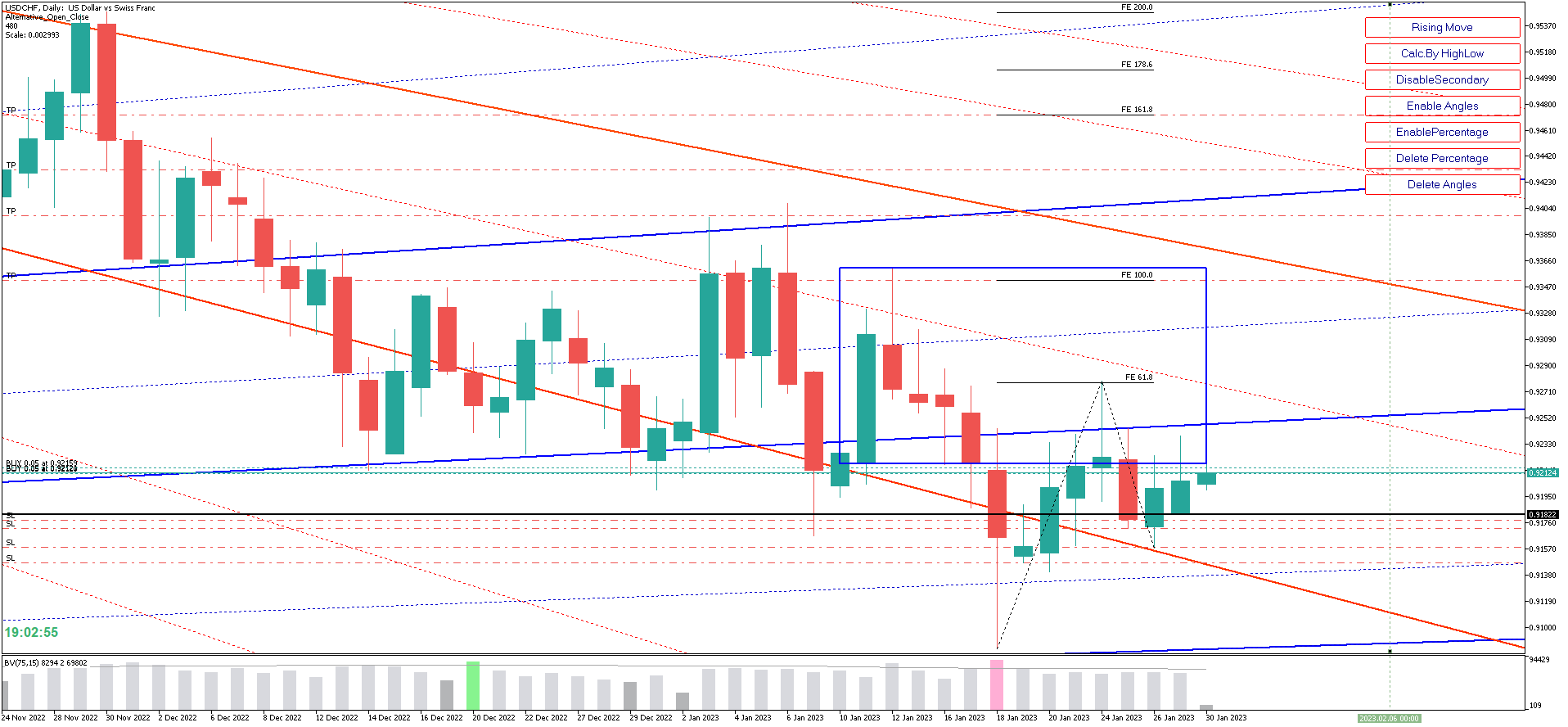

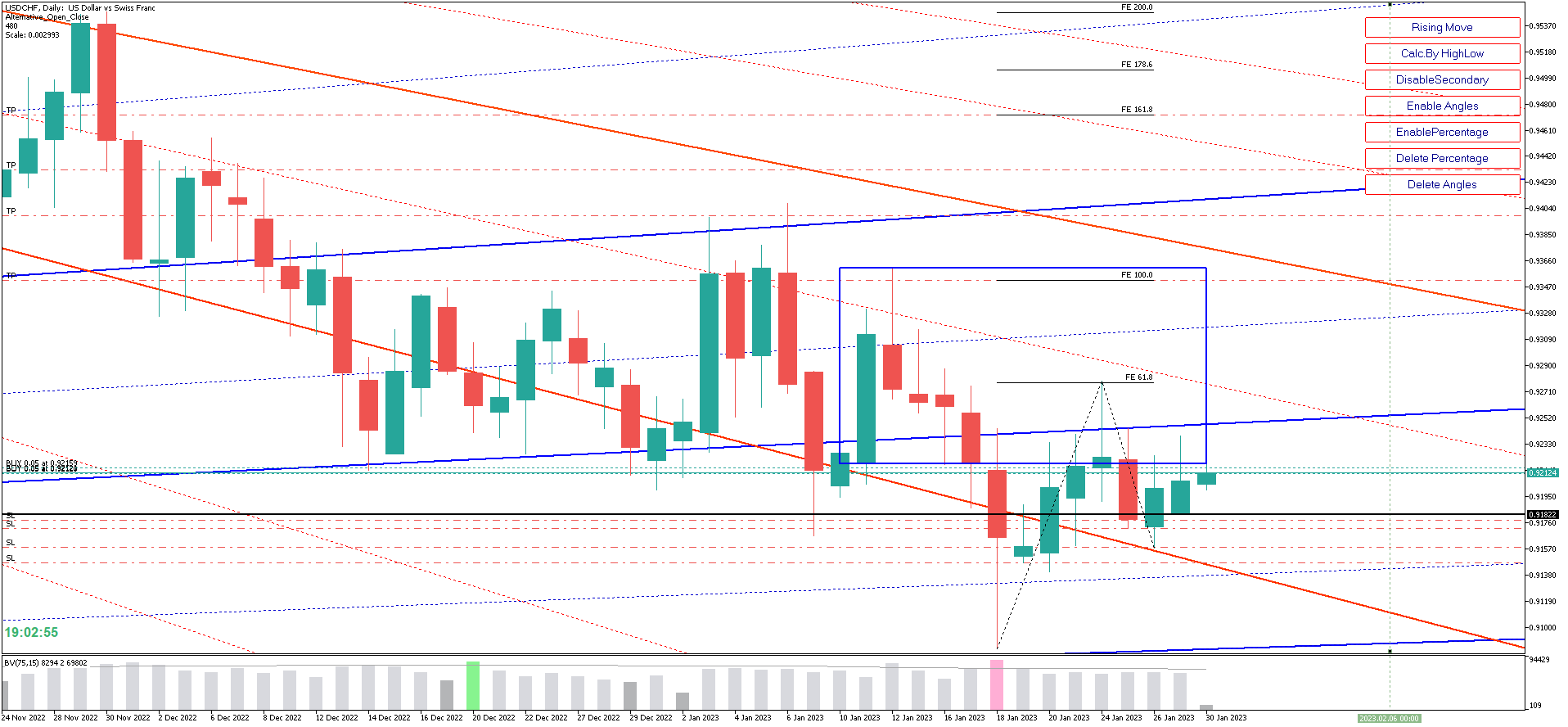

Daily ruling planet Mars

Transiting Mars in Gemini (10° Gem 44')

Transiting Mars in the Seventh House

This can be a good time to focus forging new business alliances. in the corporate arena , I'm interpreting this time as establishing a new trend as Mar is a war God with red fury something the bulls are customer to when the sails are blowing in their favor in the up and coming days from theses levels of support up to attest to 0.93000 level. Bulls may also draw extra confidence that Jupiter is all involved in this transit saying we can move way beyond 0.9300 as Jupiter represents expansion this week as

Transiting Jupiter in Aries (6° Ari 27')

Transiting Jupiter in the Fifth House This transit is strongest (within 1 degree) from 26/1/2023 to 12/5/2023, exact 1/2/2023.

USDCHF Long projection Confirmed Above 0.9271 61.8 Target 1: 0.9300 T2: 0.9404

Transiting Mars in Gemini (10° Gem 44')

Transiting Mars in the Seventh House

This can be a good time to focus forging new business alliances. in the corporate arena , I'm interpreting this time as establishing a new trend as Mar is a war God with red fury something the bulls are customer to when the sails are blowing in their favor in the up and coming days from theses levels of support up to attest to 0.93000 level. Bulls may also draw extra confidence that Jupiter is all involved in this transit saying we can move way beyond 0.9300 as Jupiter represents expansion this week as

Transiting Jupiter in Aries (6° Ari 27')

Transiting Jupiter in the Fifth House This transit is strongest (within 1 degree) from 26/1/2023 to 12/5/2023, exact 1/2/2023.

USDCHF Long projection Confirmed Above 0.9271 61.8 Target 1: 0.9300 T2: 0.9404

Kasim Ijelu

Self Mastery: This is what they don’t tell you as traders. The greatest achievement of a trader’s journey is not his or her works of art on a chart or the amazing overpriced robot software or computer technology, but the recognition of his/her own dysfunction, his own trading madness...

소셜 네트워크에 공유

247

Kasim Ijelu

technical trading is OK: not tough and choppy but neither fully respecting lines of support and resistance.

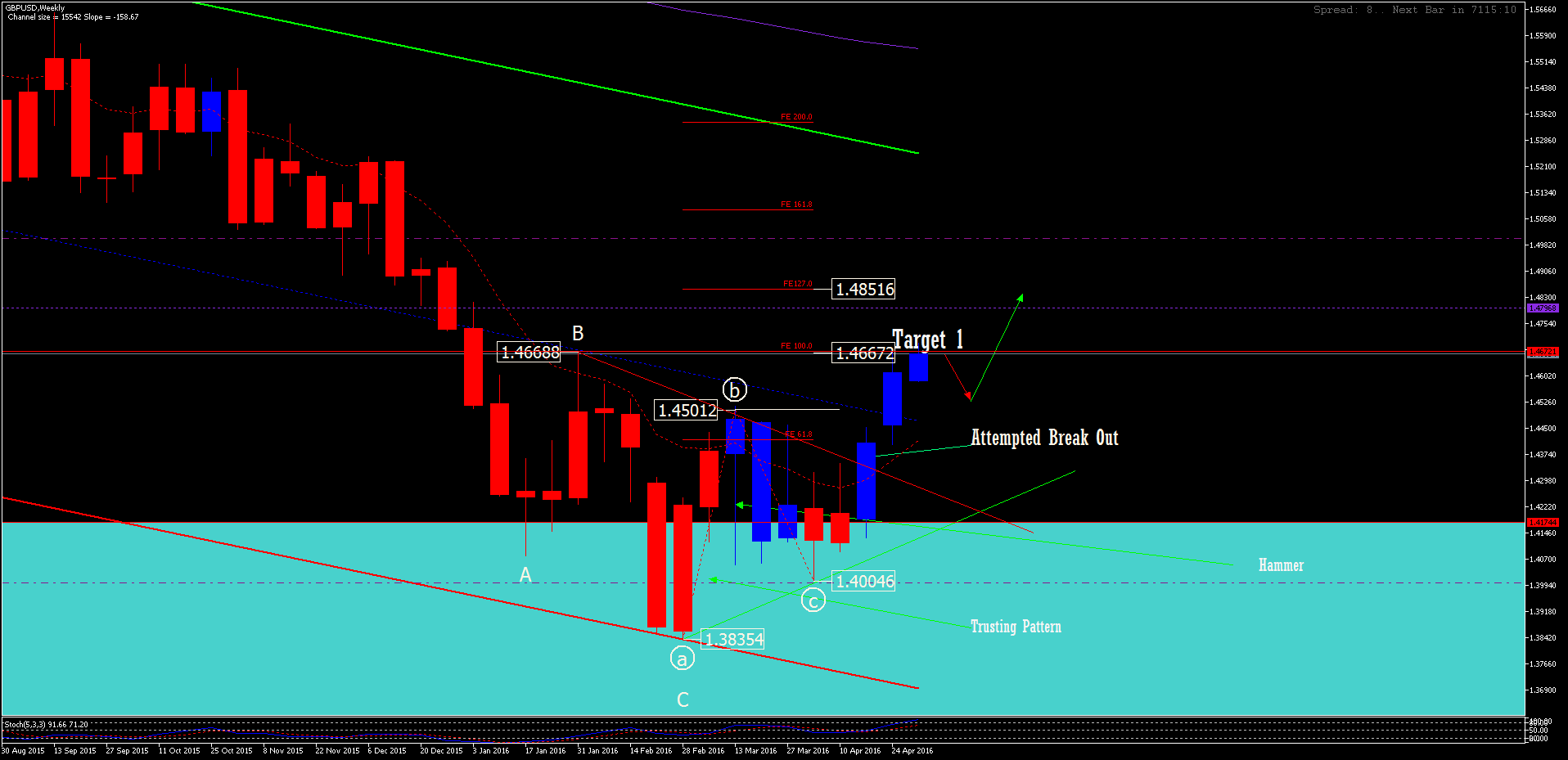

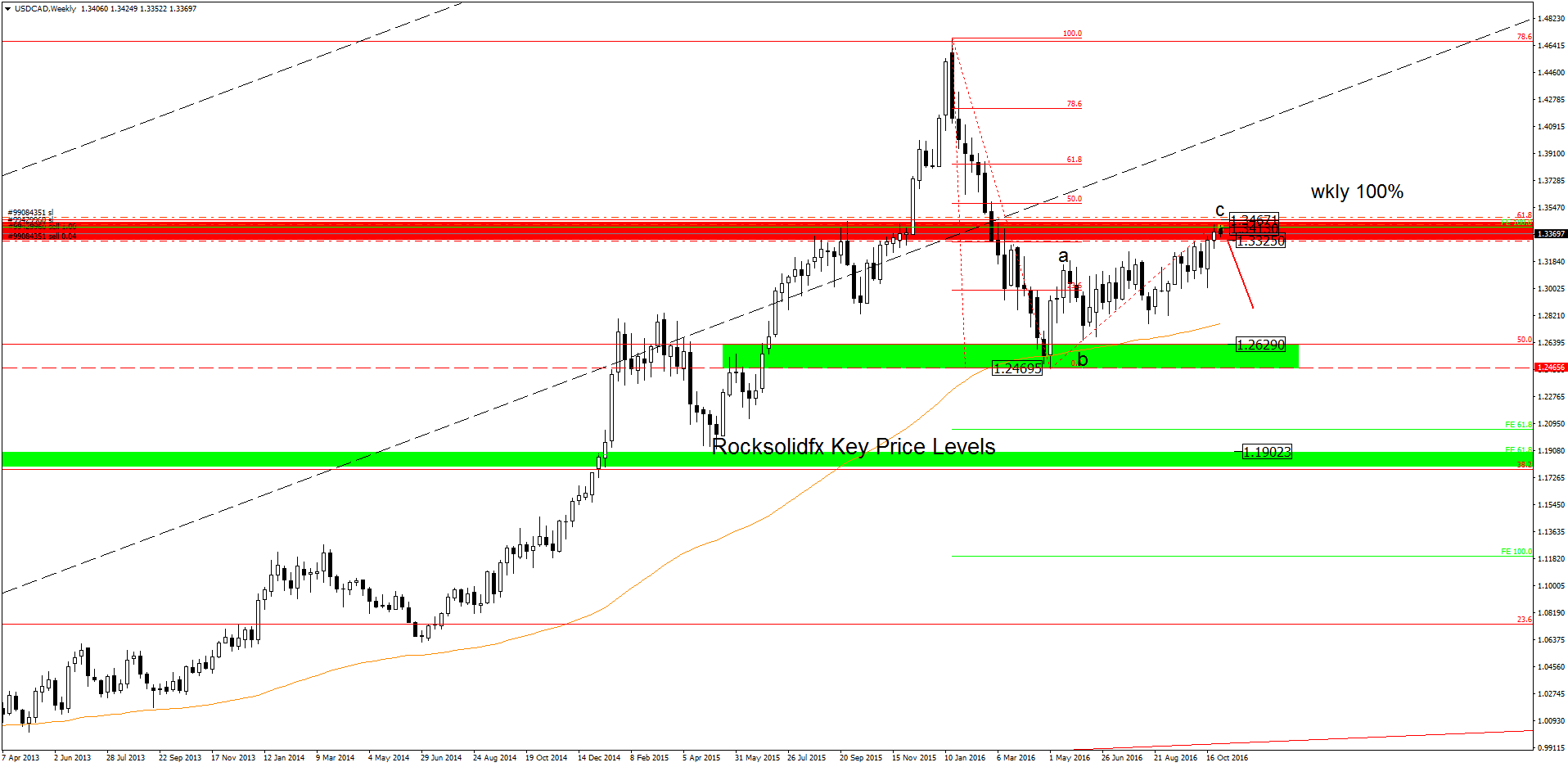

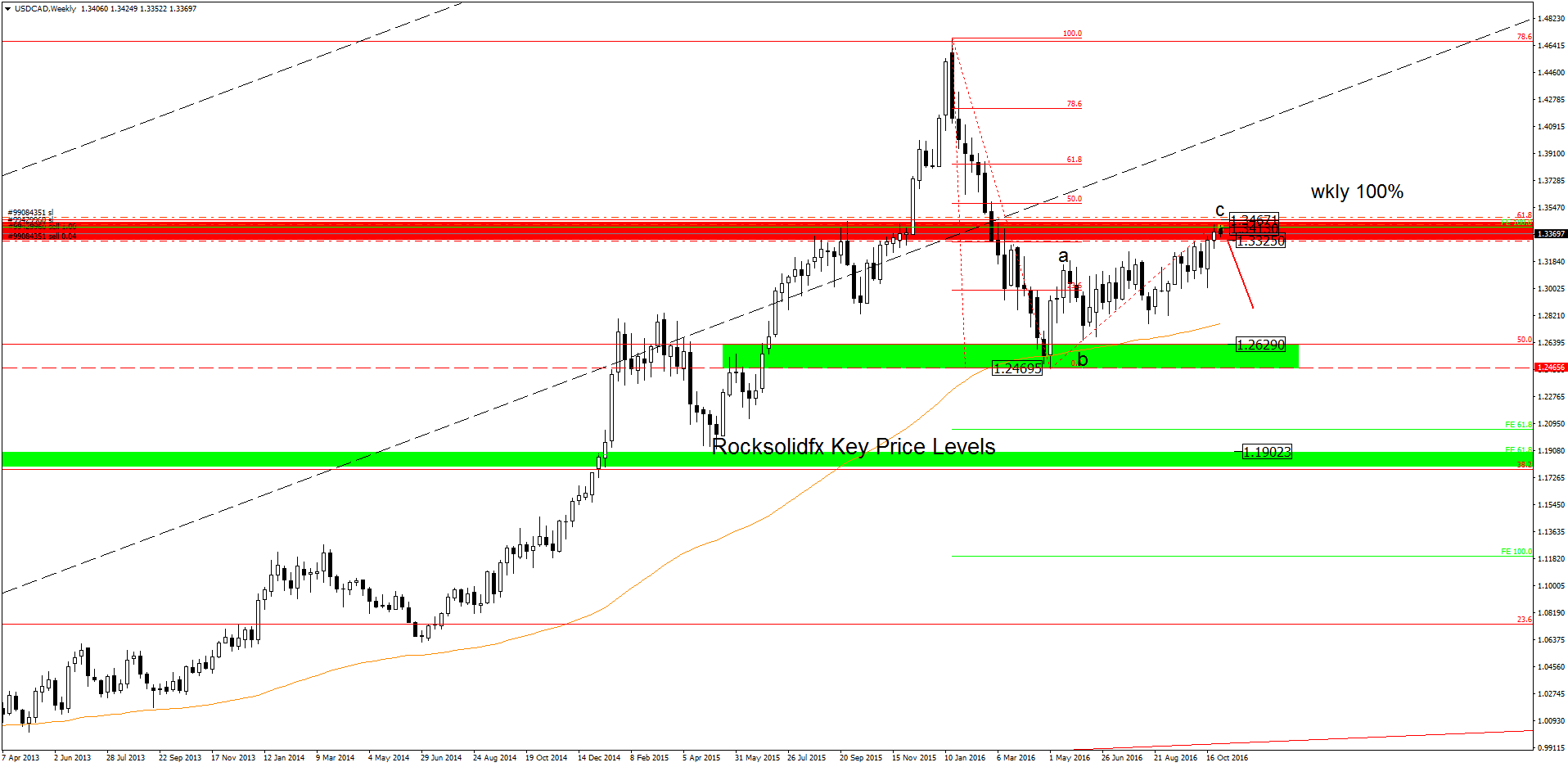

Dollar/CAD Recent Moves

Since the big fall in oil prices in late 2014, Dollar/CAD is trading at higher levels, and the Bank of Canada cut interest rates twice. The new government led by Justin Trudeau enacted fiscal stimulus, a rarity in the Western world. This takes some of the burdens off the shoulders of Stephen Poloz, the BOC governor.

The next move by the Federal Reserve, BOC actions, oil prices and the impact of government spending will all move the currency. Also, watch out for the worries about elevated housing prices in Vancouver and also in Toronto.

Dollar/CAD Recent Moves

Since the big fall in oil prices in late 2014, Dollar/CAD is trading at higher levels, and the Bank of Canada cut interest rates twice. The new government led by Justin Trudeau enacted fiscal stimulus, a rarity in the Western world. This takes some of the burdens off the shoulders of Stephen Poloz, the BOC governor.

The next move by the Federal Reserve, BOC actions, oil prices and the impact of government spending will all move the currency. Also, watch out for the worries about elevated housing prices in Vancouver and also in Toronto.

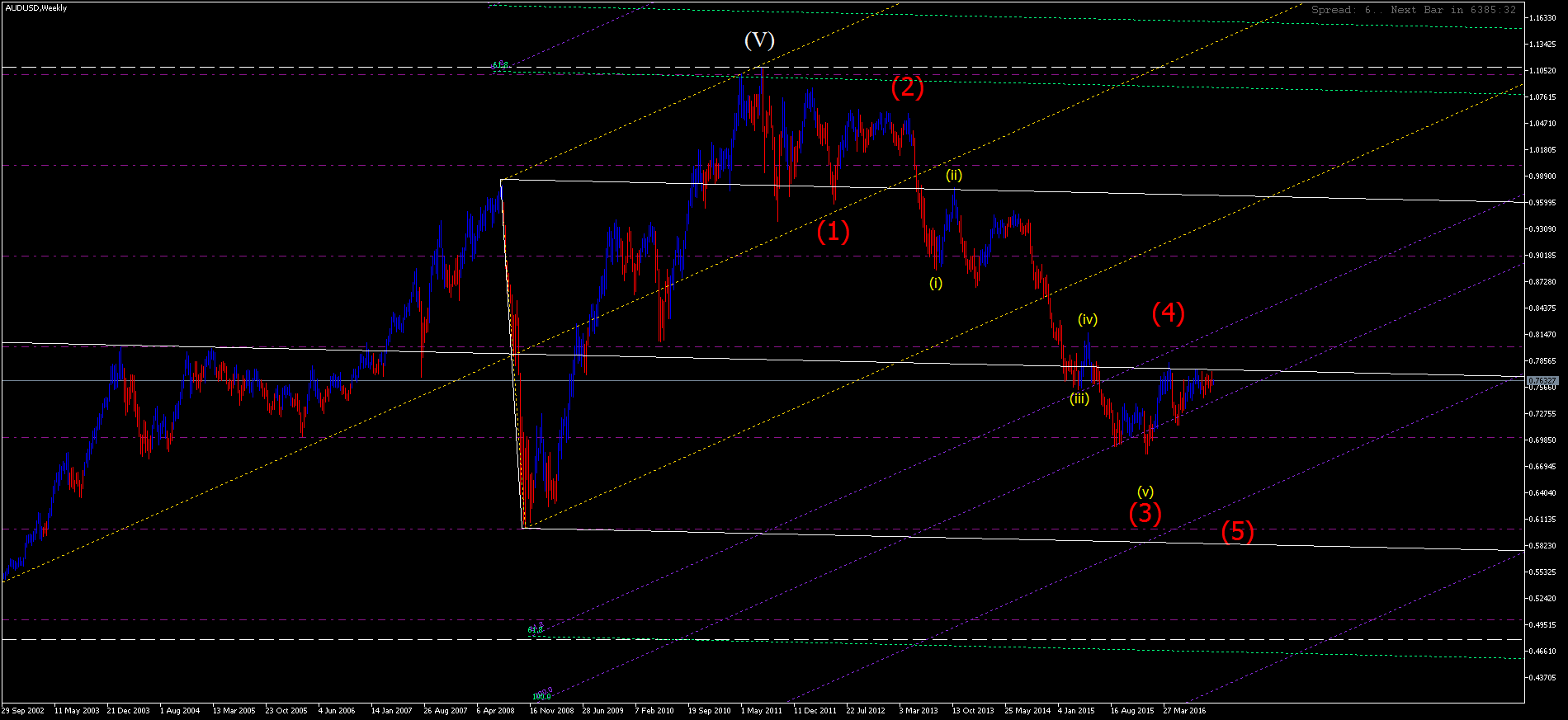

Kasim Ijelu

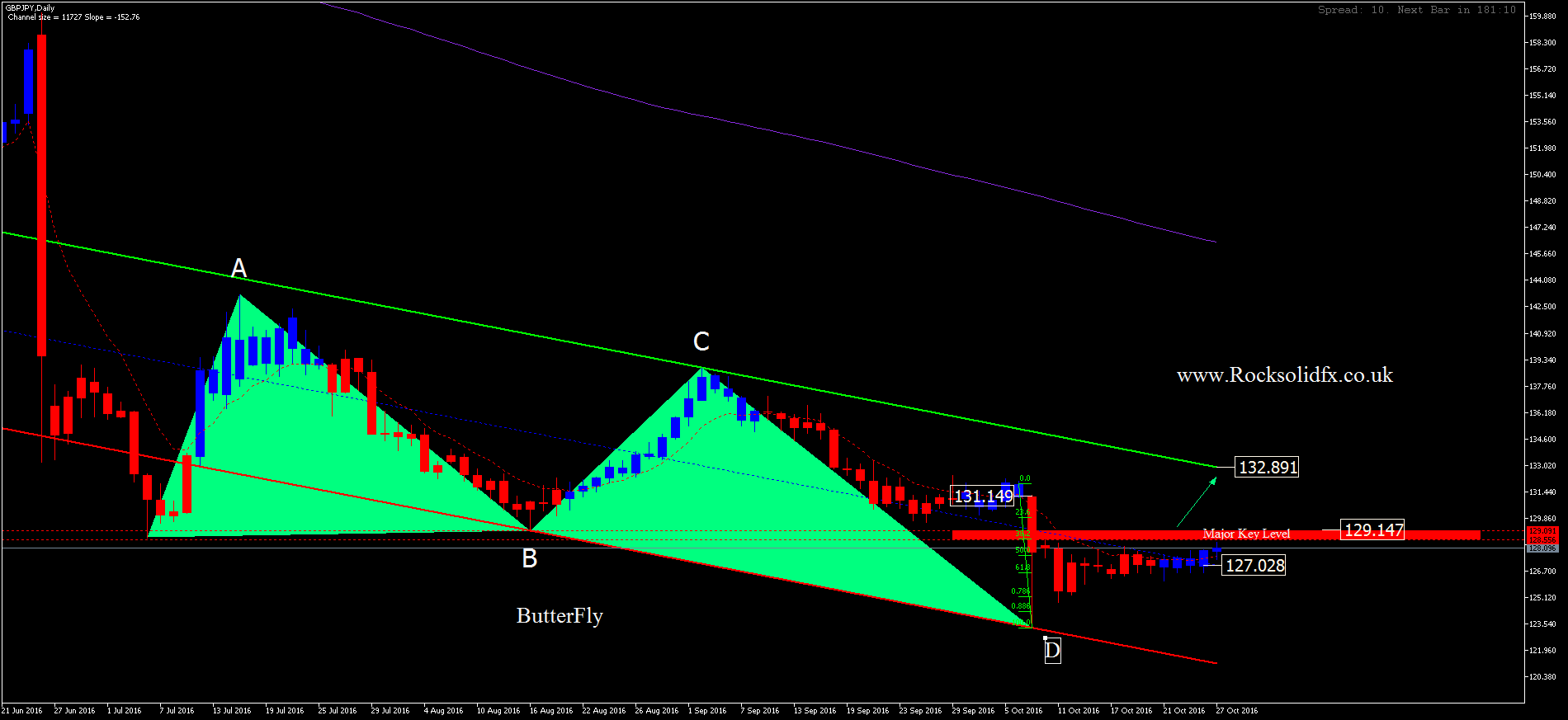

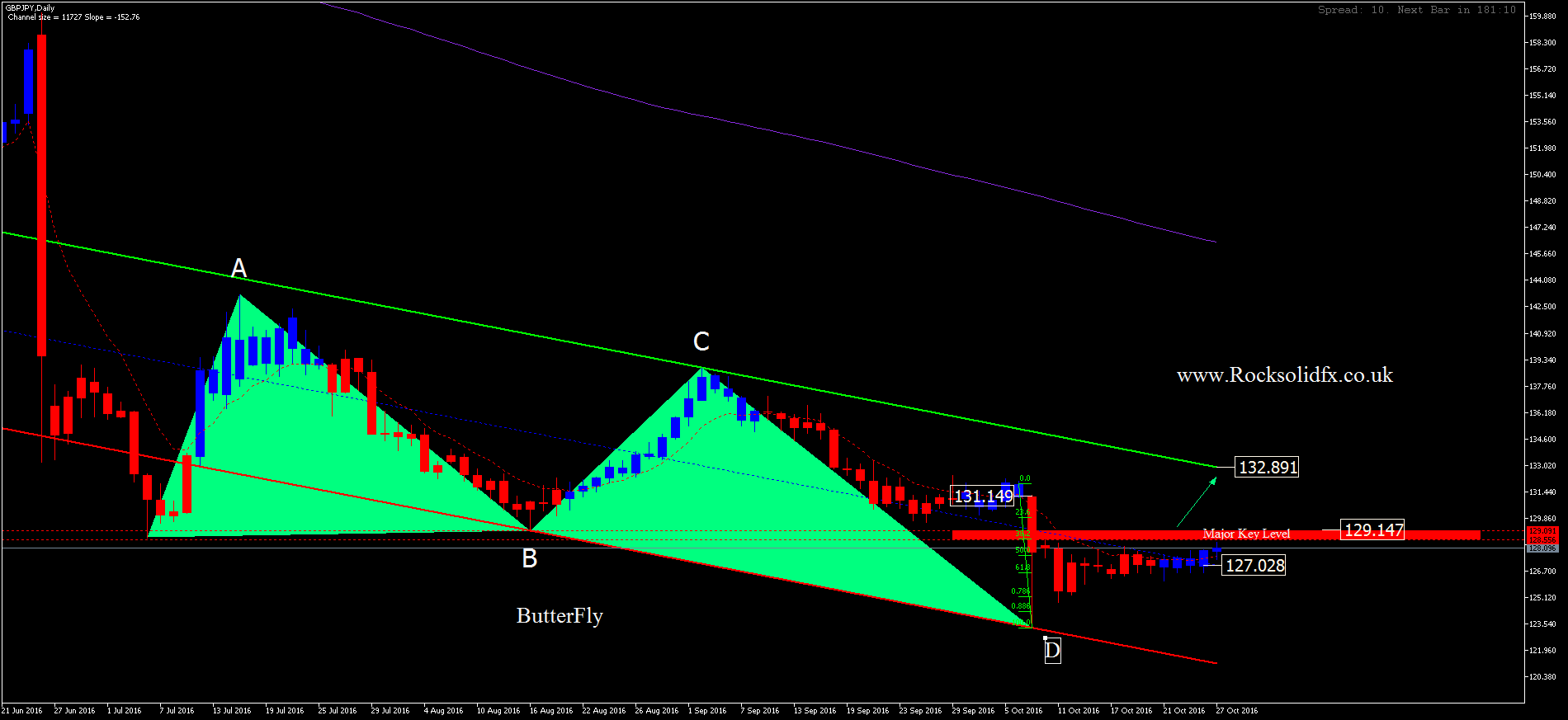

Will be interesting to watch price action at these levels see write up

http://rocksolidfx.co.uk/rocksolidfx-elliot-wave-analysis/gbpjpyelliotwaveanalysis/

http://rocksolidfx.co.uk/rocksolidfx-elliot-wave-analysis/gbpjpyelliotwaveanalysis/

Kasim Ijelu

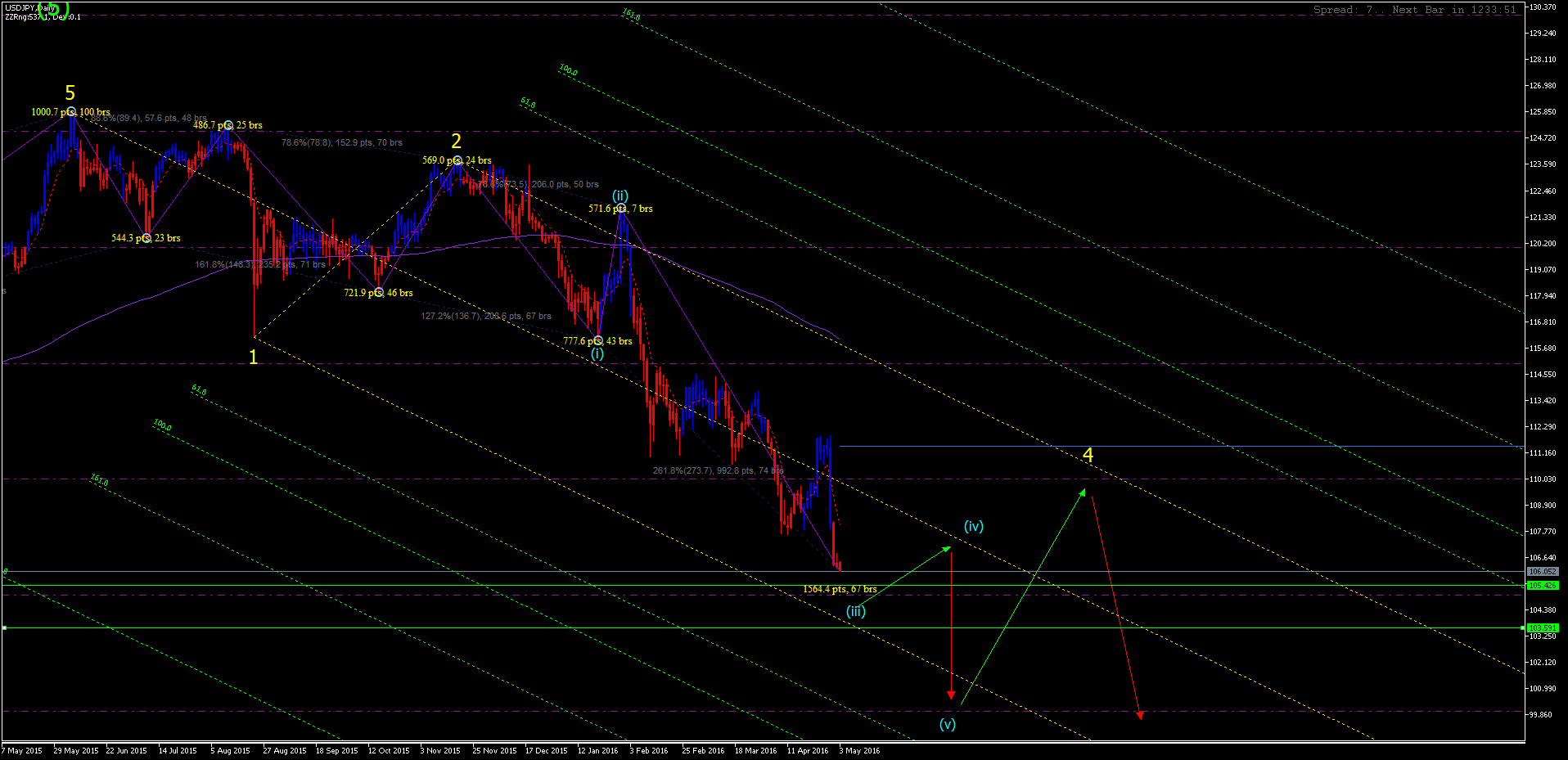

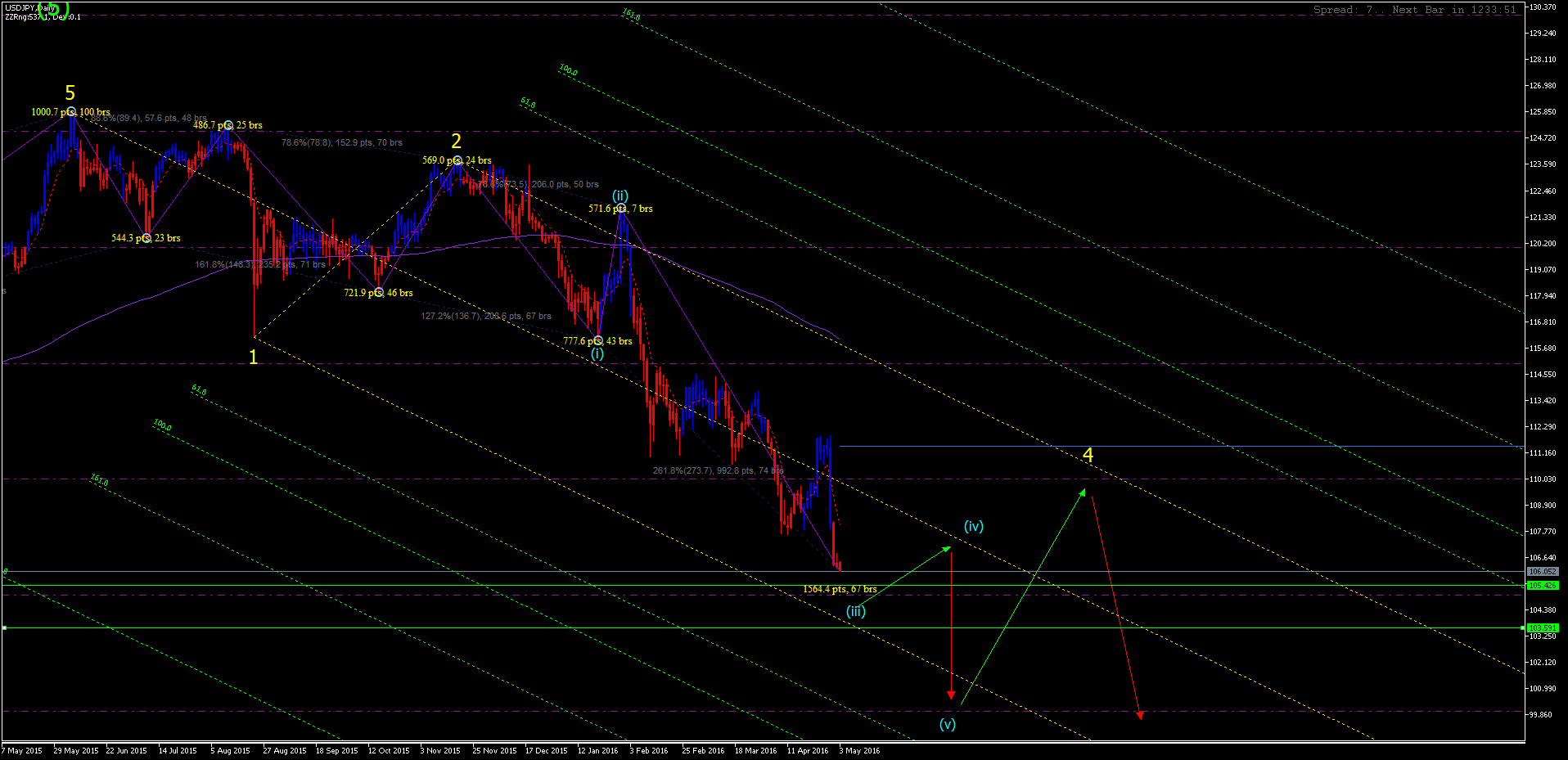

BoJ staying on the sidelines and not implementing any easing, the yen has room to move even higher.

USD/JPY posted huge losses, surging some 520 points. The pair closed at 106.23, its lowest level since October 2014. The upcoming week is very quiet,

USD/JPY posted huge losses, surging some 520 points. The pair closed at 106.23, its lowest level since October 2014. The upcoming week is very quiet,

Kasim Ijelu

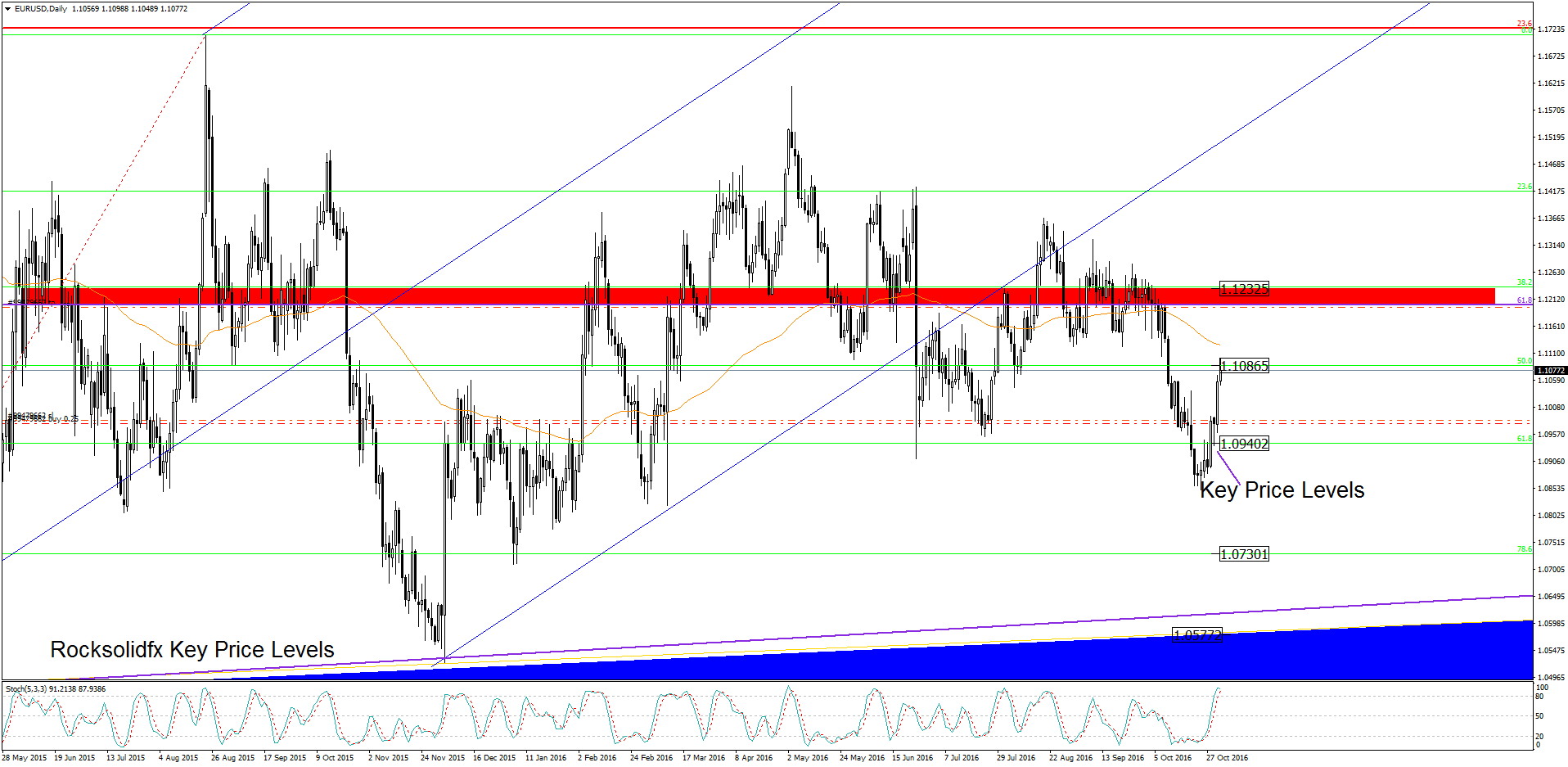

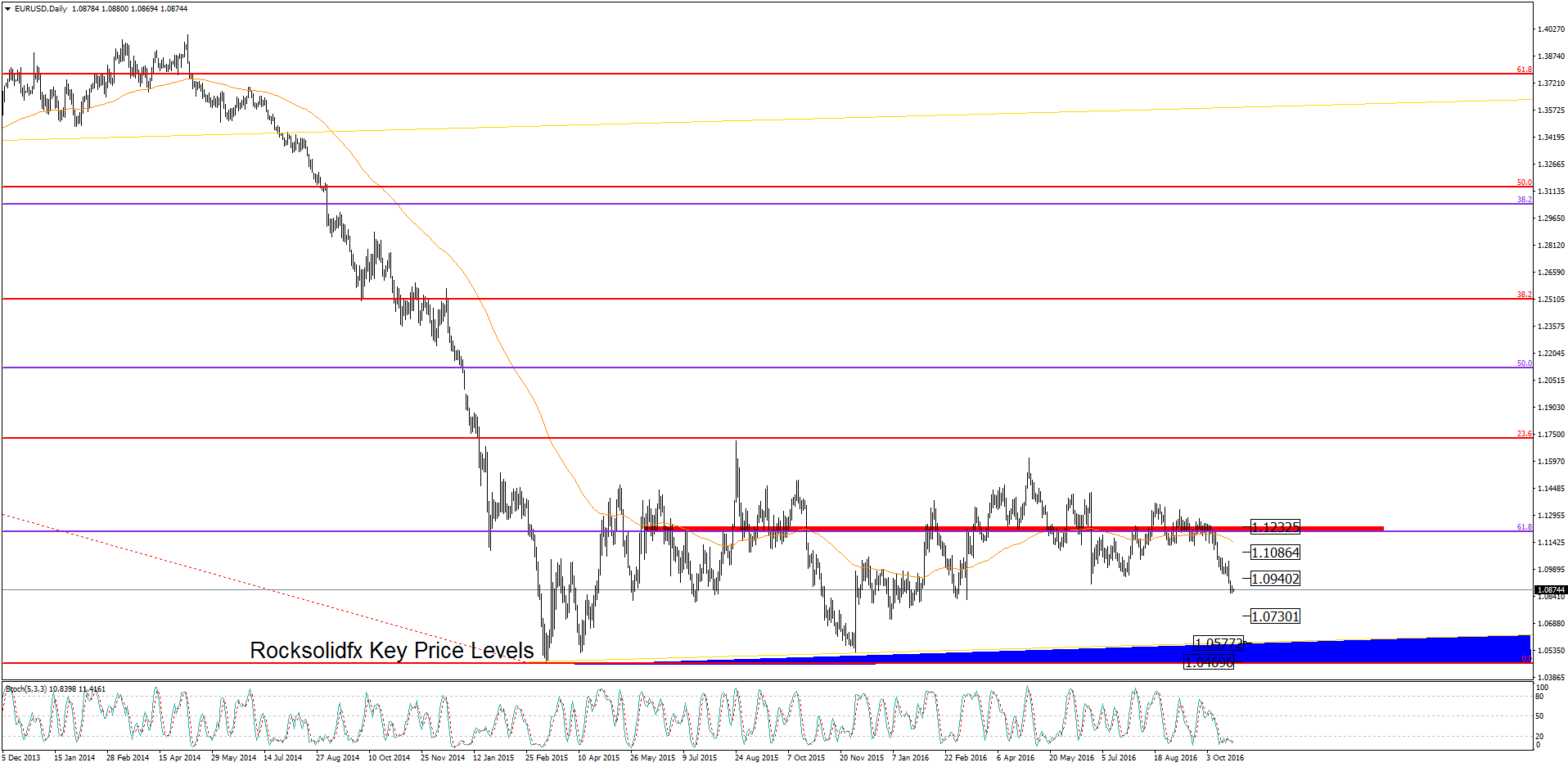

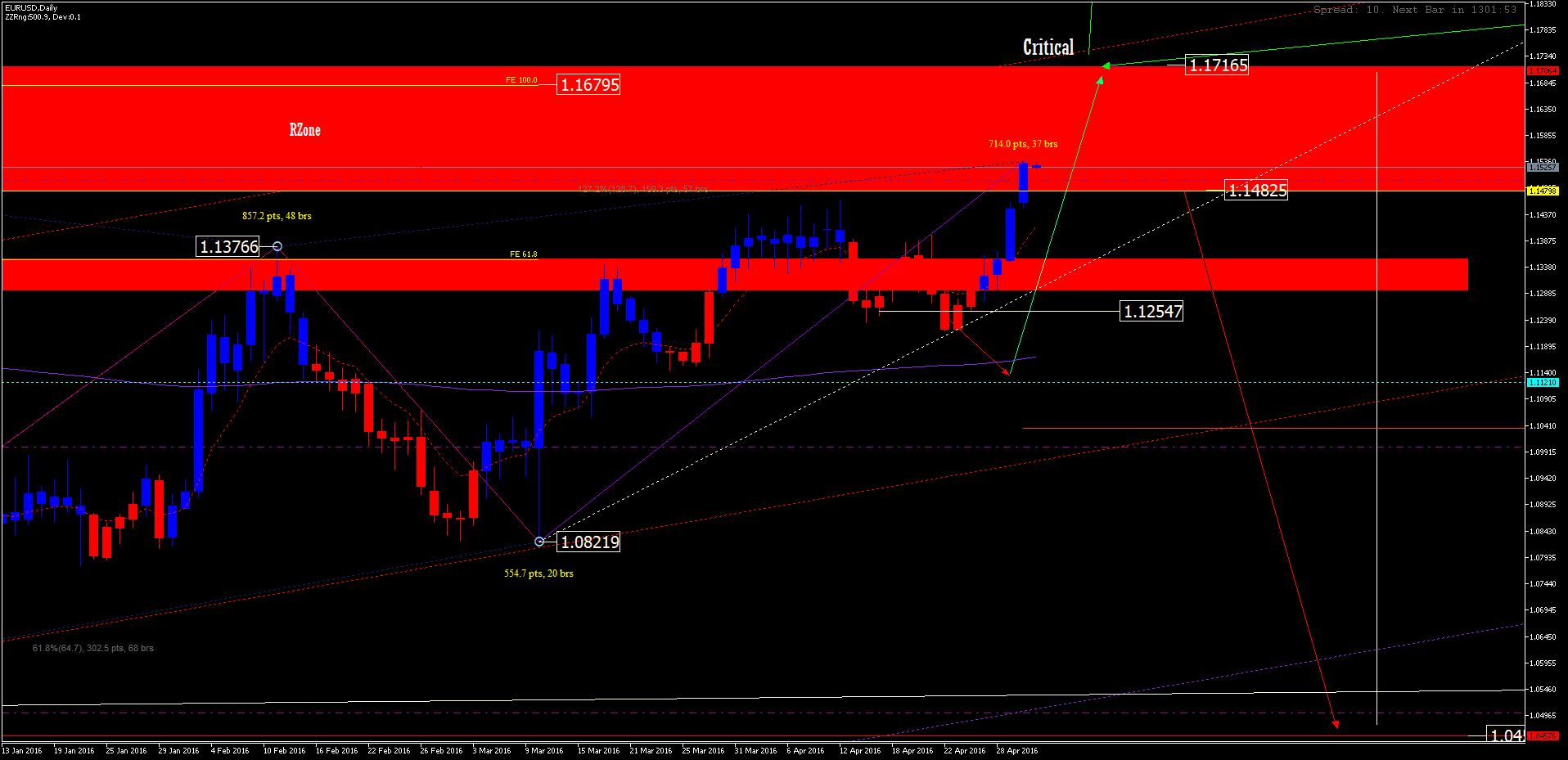

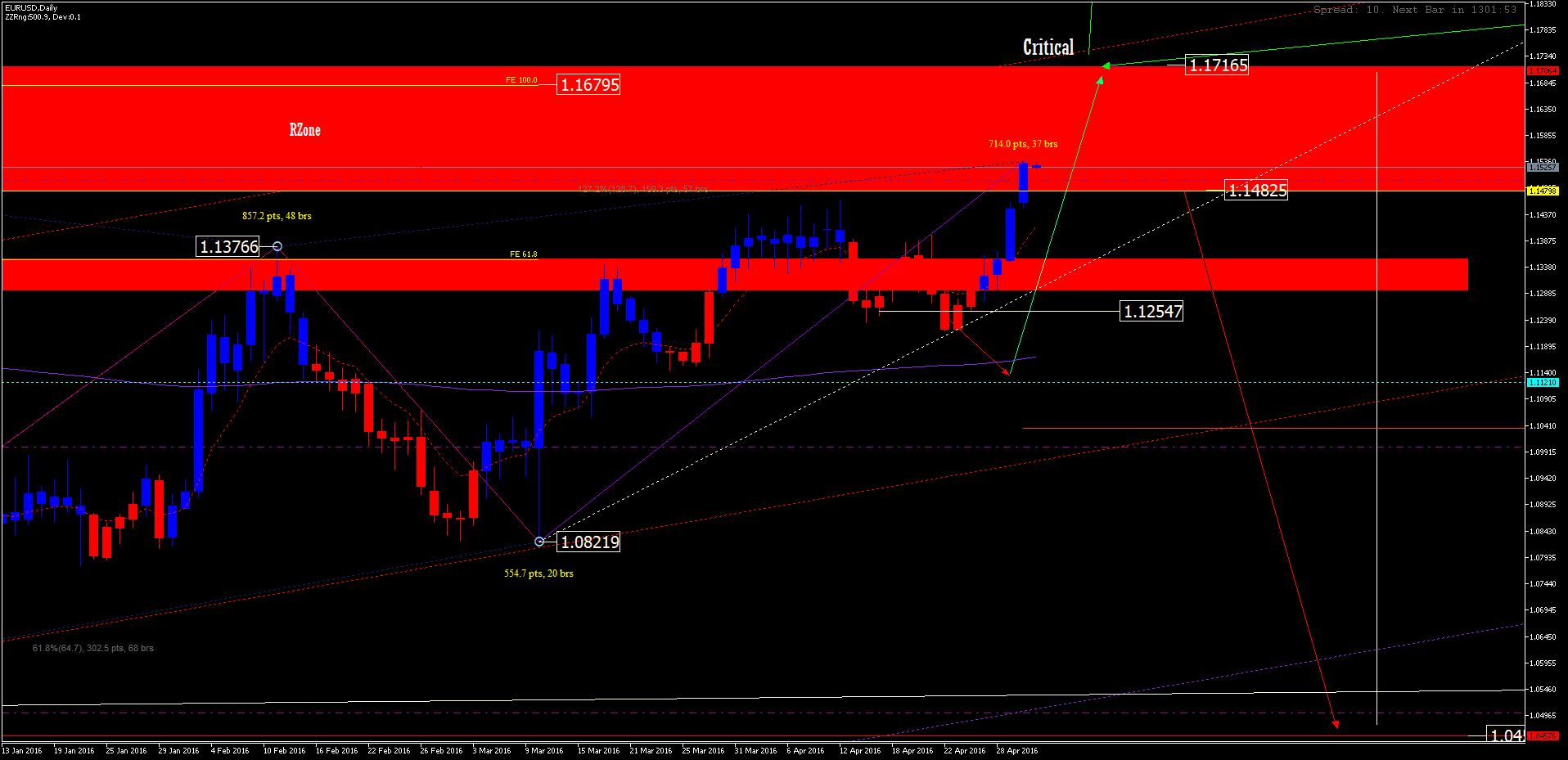

Correctively bullish to the 1.1765 area break above here we will re establish our position and outlook

: