Rodrigo Malacarne / 뉴스피드

- 정보

|

10+ 년도

경험

|

0

제품

|

0

데몬 버전

|

|

61

작업

|

0

거래 신호

|

0

구독자

|

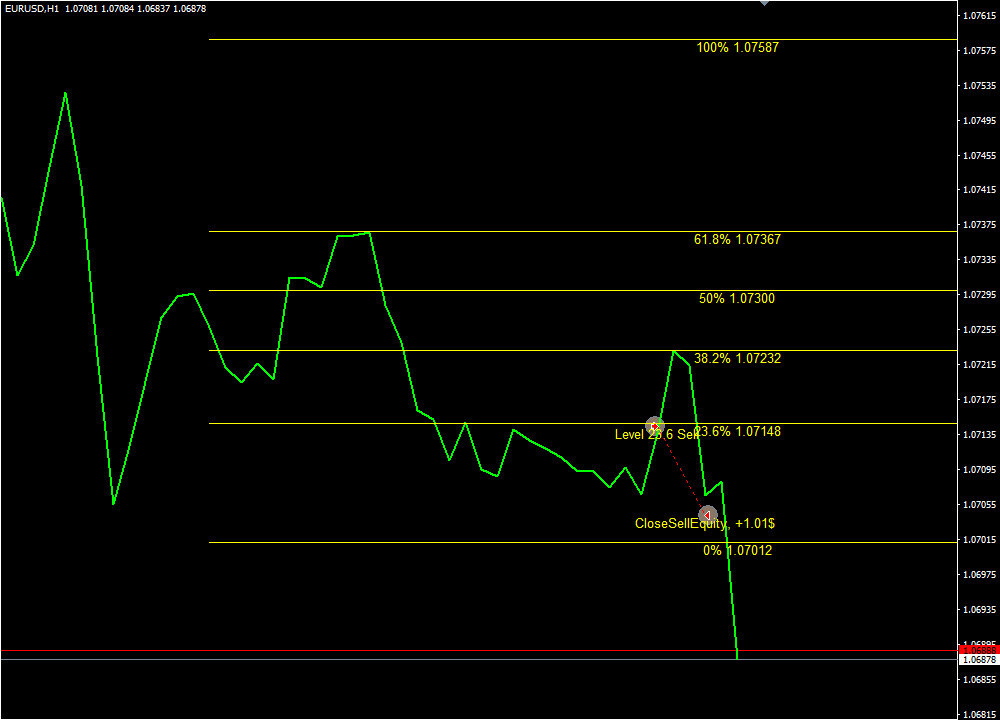

Check it out! Automated and very flexible in configuration advisor on Fibonacci levels! //////////////////////////////////////////////////////////////////////////////////

https://www.mql5.com/ru/market/product/120167

FiboSens AI – has modern solutions for automating trading strategies based on Fibonacci levels. With a wide range of features, it allows for precise order management and adaptability to a variety of trading strategies and ideas. Key Features · Analysis of Fibonacci levels: customization for any currency pair and chart period. · Trend analysis: the ability to trade with or against the trend. · Automatic closing: customizable parameters for take profit, stop loss, closing based on the total

В данной статье мы поговорим об использовании пространственно-временных преобразований для эффективного прогнозирования предстоящего ценового движения. Для повышения точности численного прогнозирования в STNN был предложен механизм непрерывного внимания, который позволяет модели лучше учитывать важные аспекты данных.

https://www.mql5.com/pt/market/product/118885

After many years of the first R Factor release and its continue portfolio growth with several strategies added every year and hundreds of possible parameters to be explored, it was time to bring some of its essential strategies back to the game.

This version contains some of the oldest and time proven strategies: The Night Mean Reversal, The Breakout and The Weekend Trading strategies. All of them with years of live results showing how it performs in different market conditions in real life. There is nothing to hide and no fancy things. Check the live results of each strategy and see for yourself:

https://www.mql5.com/en/signals/743742

https://www.mql5.com/en/signals/1543577

https://www.mql5.com/en/signals/1454074

One the things that make R Factor unique is its proprietary dynamic portfolio management system that works like a natural selection of the best pairs for each strategy as the time passes. It was inspired by Kelly Criterion management, which automatically adds more weight to the winning pairs, while lessening the impact of losses by losing pairs in the period.

Therefore, according to the developed R Factor algorithm, the winning pairs grow in the portfolio independently, pulling more weight and responsibility over the global portfolio, thus increasing the potential current and future gains, while the losing pairs have their significance and impact on profits reduced. This of course tends to increase the volatility of the portfolio, however the potential profit that is achieved makes the equation much more favorable to take greater risks and consequently greater gains.

To achieve a good performance, we highly recommend the use of brokers with very low spreads and fair commission. PM me for recommendations.

Top Characteristics of the R Factor Essential Strategies:

- One Chart Setup for The Night Mean Reversal and The Weekend strategies

- Defined Stop Loss and Dynamic Take Profit on all trades

- Just One trade per pair at a time. No Averaging, No Martingale.

- Dynamically portfolio balance proprietary algorithm that changes the weight and responsibility of each pair

- Intelligent Trade Exit System

- More than 3 years live proved algorithm

- Low starting capital required (starting at 30 USD for one pair or 100 USD for the complete portfolio w/ 12 pairs)

고저 강도 지표 개요 고저 강도 지표는 새로운 일일 고점과 저점의 빈도를 추적하고 표시하도록 설계된 강력한 도구입니다. 이 지표는 시장 동향 및 잠재적 반전을 강조하여 투자자, 데이 트레이더 및 정량적 트레이더가 고급 기능 엔지니어링을 통해 시장 분석 및 거래 전략을 향상시키는 데 필수적입니다. 주요 특징 이 지표는 "Count New Daily Highs and Lows" 및 "Count Highs and Lows"라는 두 가지 다른 방식으로 작동합니다. "Count New Daily Highs and Lows" 모드에서는 새로운 일일 고점과 저점을 추적하여 일일 시장의 피크와 트로프에 대한 통찰력을 제공합니다. "Count Highs and Lows" 모드에서는 현재 기간 내의 고점과 저점을 계산하여 즉각적인 가격 행동 분석을 제공합니다. 각 모드는 누적 고점, 누적 저점 및 고저 강도라는 세 가지 파생 지표를 생성합니다. 지표는 포괄적인 분석을 위해 9개의 유용한 Buffer도

바디 사이즈 강도 지표 개요 바디 사이즈 강도 지표 는 일일 가격 변동을 분석하는 포괄적인 계산 세트를 제공하여 거래 전략을 크게 향상시킬 수 있는 실행 가능한 통찰력을 제공합니다. 주요 기능 5개의 광범위한 버퍼 : BodySize, BodySizeROC, Sum_POS_BodySize, Sum_NEG_BodySize 및 Diff_SUM_POS_NEG_BodySize 버퍼를 포함하여 시장 역학에 대한 상세하고 미묘한 보기를 제공합니다. BodySize 계산: 종가와 시가 사이의 절대 차이를 측정하여 일중 거래에 필수적인 가격 변동성에 대한 명확한 통찰력을 제공합니다. BodySizeROC: 사용자 정의 곱셈으로 스케일링된 가격 움직임의 변동률을 평가하여 트레이더가 시장 강도와 추세 강도를 측정할 수 있습니다. 누적 메트릭: 양수 및 음수 가격 변동의 누적 합계를 각각 추적하고 매일 리셋하여 정확한 일중 분석을 위한 신선하고 관련성 있는 데이터를 제공합니다. 순이동 분석: 색상으로

고급 트리거 옵션을 갖춘 트루 레인지 강도 지표 이 지표는 일일 가격 변동과 관련된 다양한 메트릭을 계산하고 표시합니다: 메트릭 트루 레인지 (TR): (고가 - 저가, |고가 - 이전 종가|, |저가 - 이전 종가|)의 최대값 TR 변화율 (TR_ROC): 일일 기준 가격에 대한 TR의 백분율 변화 일일 긍정적 TR ROC 합계: 하루 동안 긍정적인 TR ROC 값의 누적 일일 부정적 TR ROC 합계: 하루 동안 부정적인 TR ROC 값의 누적 일일 긍정적 및 부정적 TR ROC 합계 차이: TR ROC의 순 누적 사용법 지표를 별도의 차트 창에 추가하세요 입력에서 원하는 플롯 유형, 값 유형 및 트리거 유형을 선택하세요 지표를 사용하여 일일 변동성과 가격 이동 추세를 평가하세요 색상 히스토그램은 순 누적 추세에 대한 빠른 시각적 참고 자료를 제공합니다 참고: 이 지표는 각 거래일 시작 시 계산을 초기화합니다

고급 트리거 옵션을 갖춘 트루 레인지 강도 지표 이 지표는 일일 가격 변동과 관련된 다양한 메트릭을 계산하고 표시합니다: 메트릭 트루 레인지 (TR): (고가 - 저가, |고가 - 이전 종가|, |저가 - 이전 종가|)의 최대값 TR 변화율 (TR_ROC): 일일 기준 가격에 대한 TR의 백분율 변화 일일 긍정적 TR ROC 합계: 하루 동안 긍정적인 TR ROC 값의 누적 일일 부정적 TR ROC 합계: 하루 동안 부정적인 TR ROC 값의 누적 일일 긍정적 및 부정적 TR ROC 합계 차이: TR ROC의 순 누적 사용법 지표를 별도의 차트 창에 추가하세요 입력에서 원하는 플롯 유형, 값 유형 및 트리거 유형을 선택하세요 지표를 사용하여 일일 변동성과 가격 이동 추세를 평가하세요 색상 히스토그램은 순 누적 추세에 대한 빠른 시각적 참고 자료를 제공합니다 참고: 이 지표는 각 거래일 시작 시 계산을 초기화합니다

HURRY! The offer price of $75 is ACTIVE ONLY for the FIRST 5 PURCHASES, after which the price will increase to $129. William Delbert Gann, commonly known as W.D. Gann, was an exceptional market analyst renowned for his unique trading style in the early 20th century. His trading techniques were based on a blend of mathematics, geometry, astrology, and ancient mathematics. Gann believed that stock market movements followed specific patterns and cycles, rather than being random. His

https://www.mql5.com/pt/market/product/118885

After many years of the first R Factor release and its continue portfolio growth with several strategies added every year and hundreds of possible parameters to be explored, it was time to bring some of its essential strategies back to the game.

This version contains some of the oldest and time proven strategies: The Night Mean Reversal, The Breakout and The Weekend Trading strategies. All of them with years of live results showing how it performs in different market conditions in real life. There is nothing to hide and no fancy things. Check the live results of each strategy and see for yourself:

https://www.mql5.com/en/signals/743742

https://www.mql5.com/en/signals/1543577

https://www.mql5.com/en/signals/1454074

One the things that make R Factor unique is its proprietary dynamic portfolio management system that works like a natural selection of the best pairs for each strategy as the time passes. It was inspired by Kelly Criterion management, which automatically adds more weight to the winning pairs, while lessening the impact of losses by losing pairs in the period.

Therefore, according to the developed R Factor algorithm, the winning pairs grow in the portfolio independently, pulling more weight and responsibility over the global portfolio, thus increasing the potential current and future gains, while the losing pairs have their significance and impact on profits reduced. This of course tends to increase the volatility of the portfolio, however the potential profit that is achieved makes the equation much more favorable to take greater risks and consequently greater gains.

To achieve a good performance, we highly recommend the use of brokers with very low spreads and fair commission. PM me for recommendations.

Top Characteristics of the R Factor Essential Strategies:

- One Chart Setup for The Night Mean Reversal and The Weekend strategies

- Defined Stop Loss and Dynamic Take Profit on all trades

- Just One trade per pair at a time. No Averaging, No Martingale.

- Dynamically portfolio balance proprietary algorithm that changes the weight and responsibility of each pair

- Intelligent Trade Exit System

- More than 3 years live proved algorithm

- Low starting capital required (starting at 30 USD for one pair or 100 USD for the complete portfolio w/ 12 pairs)

Example of a medium complexity trade using the TPSproSYSTEM trading strategy. Two different trends on higher timeframes (H4 + H1) + two patterns on the medium timeframe (H1) to confirm opening a trade on M5.

Subscribe to SCHOOL of TRADERS (https://t.me/+4hZaxJcgfRA0NjUy) to learn more news and information.

Let me know if you need any adjustments or further assistance!

As you may have already noticed, there is currently a drawdown in the monitoring of the real account. 2 positions on USDJPY have just been closed at a loss, and the current one on NZDJPY will most likely also be closed at a loss in the next few hours.

But don't rush to get upset.

The EA on my account uses a risk of 40%, and according to statistics, over the past 10 years, absolutely every year with such a risk there was a drawdown of 20% to 30%, and once there was a maximum of 35%. And every time after such a drawdown, the trading robot steadily and confidently restores it, and continues to trade profitably.

Therefore, I strongly recommend that you be patient and continue to use the EA, and soon you will definitely see that what I am saying is true.

You can also test the trading robot yourself on history and see how profitability fluctuates over time.

Below I will attach a screenshot where you can see the results of Your Trading Edge for each month over the past 10 years with a risk of 10%.

Lavoazzie Robotrader operando MiniÍndice com duas configurações...das 09:28 as 11:28 em trades de reversão e das 11:28 as 17:00 em trades na tendência!!

Confira mais aqui 👇

https://www.mql5.com/en/market/product/95044

Sinal em conta real de robô 👇:

https://www.mql5.com/pt/signals/1882709

----------------------------------

MultiPairsEA over than 106%

PendulumEA over than 56%