Jimmy Peter Eriksson / 판매자

제품 게시

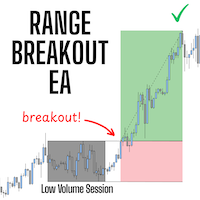

This bot utilizes a proven trading concept: markets often see significant movements during active periods, particularly around the London and New York sessions. Instead of predicting market direction, the strategy sets a range during the quieter Asian session hours and trades the breakout, riding the momentum until the New York session slows down. What Makes This EA Special? Unlike other breakout bots, this EA includes a unique filtering system designed to improve performance by avoiding trades

The Idea Behind the Box Reversal EA Markets often reverse strongly after overextended price movements, especially during specific hours of the day. These reversals typically result from profit-taking or corrections from extreme price levels. The Box Reversal EA uses the Average True Range (ATR) to dynamically define a " box " around the current price: The box size is determined by the ATR, multiplied by an adjustable value for customization. The top and bottom of the box are placed at half t

FTMO Risk Manager EA is designed to provide unparalleled protection for your trading account by securing you against common yet often overlooked drawdown risks that can result in account loss. This EA safeguards against three critical threats: Equity Drawdown Protection : The EA actively monitors your equity and ensures that if it falls below your set daily loss limit (e.g., 4% or 4.5%), it immediately closes all open positions. This prevents you from breaching FTMO's daily drawdown rules based

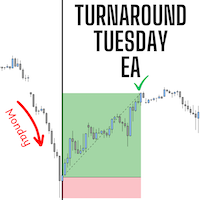

The Turnaround Tuesday bot is based on a time-tested, well-known concept that has consistently proven its robustness over the long term. The strategy is built on a fundamental market principle: fear often creeps into the market after a weekend, when trading has been on pause for two days. This fear, coupled with the potential for significant news events over the weekend, can lead to a sharp gap down when the market opens on Monday. Historically, the market tends to bounce back from this initial

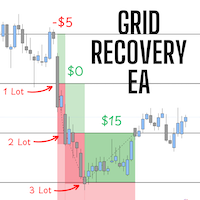

Grid Recovery EA – Adaptive Grid Recovery System Grid Recovery EA is an automated trading system for MT5 that executes a grid-based trading approach. It opens an initial trade and places additional trades at predefined intervals if the price moves in the opposite direction. The lot size increases with each new trade based on a user-defined increment, allowing positions to close in profit when the price moves back in favor.

How It Works Opens an initial trade with the selected lot size. Closes

배포된 시그널

1. Portfolio 2

- 성장

- 1%

- 구독자

- 0

- 주

- 20

- 트레이드

- 271

- 이익

- 48%

- 수익 요인

- 1.00

- 최대 DD

- 19%

2. Portfolio 3

- 성장

- -14%

- 구독자

- 0

- 주

- 8

- 트레이드

- 217

- 이익

- 50%

- 수익 요인

- 0.92

- 최대 DD

- 31%