Filatov Arthur / 프로필

CFTe

에

Sweden

Certified Financial Technician (CFTe)/ Certified Financial Planner(CFP)/Chartered Alternative Investment Analyst(CAIA), with ability to consistently deliver on multiple commitments, have the advantage of solid foundations and a strong heritage. But I take a fresh, transparent and personal approach to financial planning. I aim to provide clients with clarity and transparency in everything I do. This includes using technology to explain how long-term financial planning can add value to people’s lives; to give people access to information about their financial well being. Through a rigorous and proprietary bottom-up investment process I aim to build a portfolio that combines excellent economic characteristics and great management.

Filatov Arthur

Overall, AUD/USD is ranging across. Recently, AUD/USD broke below the key level of 0.72.

The Australian flash PMI data released earlier today indicated a faster rate of expansion of the manufacturing sector. Also, the services sector has recovered from the previous contraction.

Flash Manufacturing PMI (Actual: 57.6, Forecast: NA, Previous: 55.1 revised from 55.3)

Flash Services PMI (Actual: 56.4, Forecast: NA, Previous: 46.6 revised from 45.0)

AUD/USD’s next support zone is at 0.71000 and the next resistance zone is at 0.73000.

Look for short-term selling opportunities of AUD/USD .

The Australian flash PMI data released earlier today indicated a faster rate of expansion of the manufacturing sector. Also, the services sector has recovered from the previous contraction.

Flash Manufacturing PMI (Actual: 57.6, Forecast: NA, Previous: 55.1 revised from 55.3)

Flash Services PMI (Actual: 56.4, Forecast: NA, Previous: 46.6 revised from 45.0)

AUD/USD’s next support zone is at 0.71000 and the next resistance zone is at 0.73000.

Look for short-term selling opportunities of AUD/USD .

Filatov Arthur

Overall, EUR/USD is ranging across.

The eurozone ZEW Economic Sentiment data (Actual: 48.6, Forecast: 54.4, Previous: 49.4) released yesterday indicated a further decline in the surveyed investors and analysts’ sentiment on the economic outlook for eurozone.

The eurozone flash employment change q/q data released yesterday indicated a slowdown in the number of jobs added into the eurozone economy during the fourth quarter of 2021. The flash GDP q/q data released showed continued expansion in the eurozone economy at the same pace.

Flash employment change q/q (Actual: 0.5%, Forecast: 1.0%, Previous: 1.0% revised from 0.9%)

Flash GDP q/q (Actual: 0.3%, Forecast: 0.3%, Previous: 0.3%)

Currently, EUR/USD is trading towards the resistance zone of 1.13800 and the next support zone is at 1.12000.

Look for short-term buying opportunities of EUR/USD only if it breaks the resistance zone of 1.13800

The eurozone ZEW Economic Sentiment data (Actual: 48.6, Forecast: 54.4, Previous: 49.4) released yesterday indicated a further decline in the surveyed investors and analysts’ sentiment on the economic outlook for eurozone.

The eurozone flash employment change q/q data released yesterday indicated a slowdown in the number of jobs added into the eurozone economy during the fourth quarter of 2021. The flash GDP q/q data released showed continued expansion in the eurozone economy at the same pace.

Flash employment change q/q (Actual: 0.5%, Forecast: 1.0%, Previous: 1.0% revised from 0.9%)

Flash GDP q/q (Actual: 0.3%, Forecast: 0.3%, Previous: 0.3%)

Currently, EUR/USD is trading towards the resistance zone of 1.13800 and the next support zone is at 1.12000.

Look for short-term buying opportunities of EUR/USD only if it breaks the resistance zone of 1.13800

Filatov Arthur

Overall, EUR/JPY is ranging across. Recently, EUR/JPY traded into the resistance zone of 131.500.

The eurozone ZEW Economic Sentiment data (Actual: 48.6, Forecast: 54.4, Previous: 49.4) released yesterday indicated a further decline in the surveyed investors and analysts’ sentiment on the economic outlook for eurozone.

The eurozone flash employment change q/q data released yesterday indicated a slowdown in the number of jobs added into the eurozone economy during the fourth quarter of 2021. The flash GDP q/q data released showed continued expansion in the eurozone economy at the same pace.

Flash employment change q/q (Actual: 0.5%, Forecast: 1.0%, Previous: 1.0% revised from 0.9%)

Flash GDP q/q (Actual: 0.3%, Forecast: 0.3%, Previous: 0.3%)

Currently, EUR/JPY is testing the resistance zone of 131.500 and the next support zone is at 130.000.

Look for short-term buying opportunities of EUR/JPY if it breaks the resistance zone of 131.500.

The eurozone ZEW Economic Sentiment data (Actual: 48.6, Forecast: 54.4, Previous: 49.4) released yesterday indicated a further decline in the surveyed investors and analysts’ sentiment on the economic outlook for eurozone.

The eurozone flash employment change q/q data released yesterday indicated a slowdown in the number of jobs added into the eurozone economy during the fourth quarter of 2021. The flash GDP q/q data released showed continued expansion in the eurozone economy at the same pace.

Flash employment change q/q (Actual: 0.5%, Forecast: 1.0%, Previous: 1.0% revised from 0.9%)

Flash GDP q/q (Actual: 0.3%, Forecast: 0.3%, Previous: 0.3%)

Currently, EUR/JPY is testing the resistance zone of 131.500 and the next support zone is at 130.000.

Look for short-term buying opportunities of EUR/JPY if it breaks the resistance zone of 131.500.

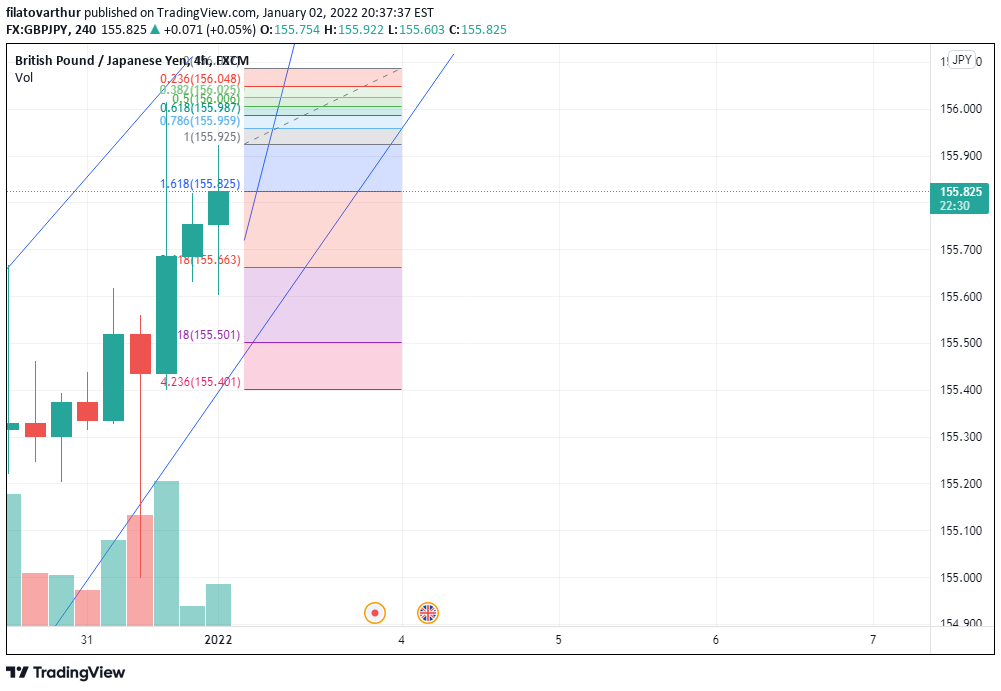

Filatov Arthur

Overall, GBP/JPY is ranging across. Recently, GBP/JPY broke below the key level of 147 after the escalation of the Russia-Ukraine geopolitical tension, leading to the strengthening of JPY.

The Preliminary GDP q/q data (Actual: 1.0%, Forecast: 1.1%, Previous: 1.1% revised from 1.3%) released last Friday indicated a slight slowdown in economic growth during the fourth quarter of 2021.

Currently, GBP/JPY is bouncing off the support zone of 156.000 and the next resistance zone is at 158.000.

Look for short-term selling opportunities of GBP/JPY only if it trades below the support zone of 156.000.

The Preliminary GDP q/q data (Actual: 1.0%, Forecast: 1.1%, Previous: 1.1% revised from 1.3%) released last Friday indicated a slight slowdown in economic growth during the fourth quarter of 2021.

Currently, GBP/JPY is bouncing off the support zone of 156.000 and the next resistance zone is at 158.000.

Look for short-term selling opportunities of GBP/JPY only if it trades below the support zone of 156.000.

Filatov Arthur

Overall, EUR/USD is ranging across.

The eurozone CPI flash estimate y/y data will be released later at 1800 (GMT+8).

CPI Flash Estimate y/y (Forecast: 4.8%, Previous: 4.9%)

Core CPI Flash Estimate y/y (Forecast: 2.5%, Previous: 2.6%)

Currently, EUR/USD is testing to break below the key level of 1.13. Its next support zone is at 1.12000 and its next resistance zone is at 1.13800.

Look for short-term selling opportunities of EUR/USD if it breaks below the key level of 1.13.

The eurozone CPI flash estimate y/y data will be released later at 1800 (GMT+8).

CPI Flash Estimate y/y (Forecast: 4.8%, Previous: 4.9%)

Core CPI Flash Estimate y/y (Forecast: 2.5%, Previous: 2.6%)

Currently, EUR/USD is testing to break below the key level of 1.13. Its next support zone is at 1.12000 and its next resistance zone is at 1.13800.

Look for short-term selling opportunities of EUR/USD if it breaks below the key level of 1.13.

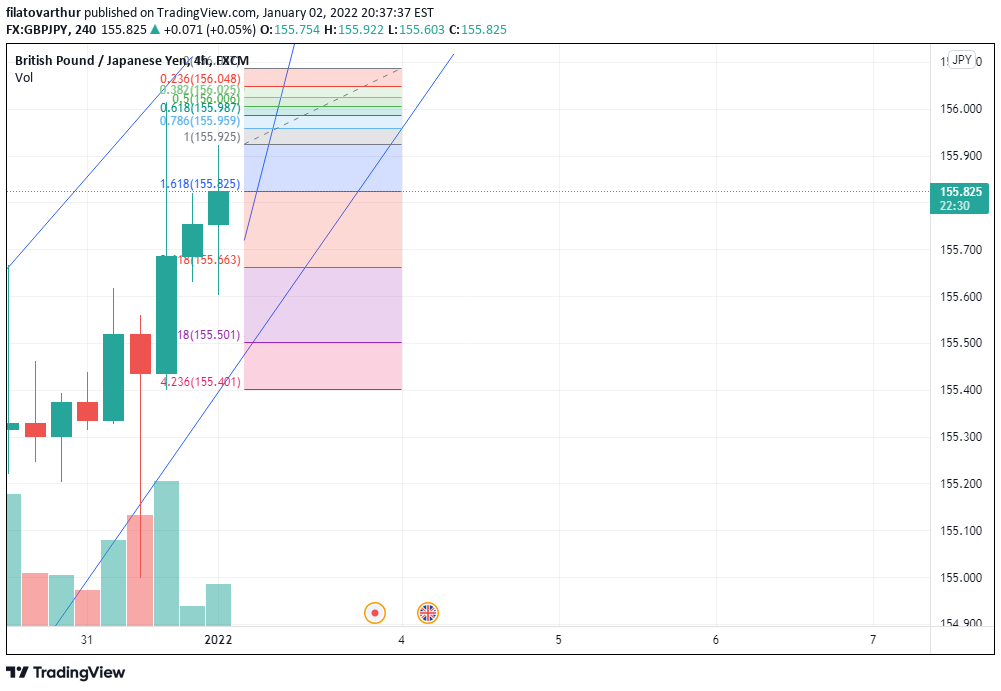

Filatov Arthur

Overall, GBP/JPY is trending upwards. Recently, GBP/JPY trended into the resistance zone of 156.000.

UK banks will be closed today in observance of New Year’s Day. Expect lower trading volume and volatility during the usual UK market hours.

Currently, GBP/JPY is testing the resistance zone of 156.000 and the next support zone is at 151.800.

Look for buying opportunities of GBP/JPY if it breaks the resistance zone of 156.000.

UK banks will be closed today in observance of New Year’s Day. Expect lower trading volume and volatility during the usual UK market hours.

Currently, GBP/JPY is testing the resistance zone of 156.000 and the next support zone is at 151.800.

Look for buying opportunities of GBP/JPY if it breaks the resistance zone of 156.000.

Filatov Arthur

USD/JPY is ranging across. Recently, USD/JPY bounced down from the key level of 114.

The Bank of Japan will be announcing their monetary policy decision today at an unannounced timing. It is expected that the central bank will be keeping monetary policy unchanged.

A press conference will be held shortly after the announcement. During this time, there may be volatility in JPY.

USD/JPY’s next support zone is at 112.800 and the next resistance zone is at 115.300.

Look for short-term buying opportunities of USD/JPY.

The Bank of Japan will be announcing their monetary policy decision today at an unannounced timing. It is expected that the central bank will be keeping monetary policy unchanged.

A press conference will be held shortly after the announcement. During this time, there may be volatility in JPY.

USD/JPY’s next support zone is at 112.800 and the next resistance zone is at 115.300.

Look for short-term buying opportunities of USD/JPY.

Filatov Arthur

Overall, GBP/USD is trending downwards.

The UK GDP m/m data (Forecast: 0.4%, Previous: 0.6%) will be released later at 1500 (GMT+8).

Currently, GBP/USD is testing the support zone of 1.32200 and its next resistance zone is at 1.33800.

Look for short-term selling opportunities of GBP/USD if it breaks the support zone of 1.32200.

The UK GDP m/m data (Forecast: 0.4%, Previous: 0.6%) will be released later at 1500 (GMT+8).

Currently, GBP/USD is testing the support zone of 1.32200 and its next resistance zone is at 1.33800.

Look for short-term selling opportunities of GBP/USD if it breaks the support zone of 1.32200.

Filatov Arthur

Overall, USD/CAD is trending upwards. Recently, USD/CAD bounced off the support zone of 1.26100.

The Bank of Canada (BoC) kept its monetary policy unchanged during their meeting yesterday. On the matter of COVID Omicron variant, the central bank highlighted the renewed uncertainty caused by it “could weigh on growth by compounding supply chain disruptions and reducing demand for some services”. Nonetheless, the BoC is still expecting its 2% inflation target to be sustainably achieved in the middle quarters of 2022.

The Canadian Governing Council member Gravelle will be speaking tomorrow at 1500 (GMT+8). During this time, there may be volatility in CAD.

USD/CAD’s next support zone is at 1.26100 and the next resistance zone is at 1.29000.

Look for short-term buying opportunities of USD/CAD.

The Bank of Canada (BoC) kept its monetary policy unchanged during their meeting yesterday. On the matter of COVID Omicron variant, the central bank highlighted the renewed uncertainty caused by it “could weigh on growth by compounding supply chain disruptions and reducing demand for some services”. Nonetheless, the BoC is still expecting its 2% inflation target to be sustainably achieved in the middle quarters of 2022.

The Canadian Governing Council member Gravelle will be speaking tomorrow at 1500 (GMT+8). During this time, there may be volatility in CAD.

USD/CAD’s next support zone is at 1.26100 and the next resistance zone is at 1.29000.

Look for short-term buying opportunities of USD/CAD.

: