GEORGIOS VERGAKIS / 판매자

제품 게시

이 지표는 주간 전환점(기간을 0으로 설정)과 일일 반전(기간을 4로 설정)을 모두 예측할 수 있습니다.

이 지표는 2019년에 개발되어 많은 개선을 거쳤으며 6개의 다른 쌍의 데이터를 사용하여 EURUSD만 예측합니다.

얼마나 좋은가요?

1년 동안 최대 6배의 수익을 낼 수 있으며, 손실은 합리적이며 통제할 수 있습니다. 레버리지는 100대 1 이하를 권장합니다.

이 지표가 얼마나 좋은지 믿기지 않을 것이며 다른 곳에서는 찾을 수 없을 것입니다.

이 지표는 시장 간 분석에 기반한 지표로 놀라운 우위를 제공합니다!

이 지표는 몇 년 후에 제거될 예정이므로 사용 가능 여부는 한시적으로 제한됩니다. 고객들은 조금 더 오랫동안 사용자 지정 버전과 안내를 통해 지원을 받을 수 있습니다.

대부분의 안내를 영어로 제공하며 동시에 최대 3명의 고객을 지원할 수 있습니다(최대).

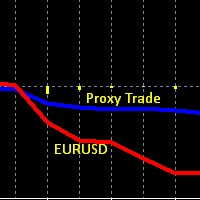

This is an obscure Hedge Fund like strategy, based one of our early indicators on EURUSD originally intended for day trading, while developing and testing the indicator we found out that the data used in this indicator (set of 4 currency pairs) follows EURUSD in a very peculiar way. On one hand these two are correlated, but the 4 currency proxy set tends to lag behind EURUSD, it lags on a day to day basis, and then catches up eventually after several days. And therefore can be used as a proxy