Gary Comey / 프로필

- 정보

|

10+ 년도

경험

|

0

제품

|

0

데몬 버전

|

|

0

작업

|

3

거래 신호

|

788

구독자

|

I am a former stockbroker and Treasury Manager. I have worked in the industry for some time including at IG Group and Fidelity.

Managed Account: https://secure.blackwellglobal.bs/register/?lid=432&amp ;pid=12210

WhatsApp: https://whatsapp.com/channel/0029VakHsWE4NVifIczOSN2u

Telegram: https://t.me/BlackwaveTheReal

TWITTER: https://twitter.com/BlackwaveFx

YouTube: https://youtube.com/@BlackwaveFX

Website: https://www.Blackwave-Forextrader.com

Managed Account: https://secure.blackwellglobal.bs/register/?lid=432&amp ;pid=12210

WhatsApp: https://whatsapp.com/channel/0029VakHsWE4NVifIczOSN2u

Telegram: https://t.me/BlackwaveTheReal

TWITTER: https://twitter.com/BlackwaveFx

YouTube: https://youtube.com/@BlackwaveFX

Website: https://www.Blackwave-Forextrader.com

Gary Comey

So as I write we finish the week with a circa 3% DD in the high risk account. My EURGBP trade was in profit yesterday but not by much and not enough to be honest given the BOE rate decision was pending and I figured the volatility around that would give me more. With the benefit of a time machine I'd have taken the profit because now that position is largely responsible for the DD small enough as it is. Therefore I am into a grid as the Pound strengthened into oversold territory H1,H4 and D1. This is the strategy. So far today the market has traded a little higher so the DD has been improving as it works off some of the H1,H4 oversold conditions. I'm not much concerned and hopefully this domino falls like the others next week. USDJPY is partly a play on the S&P500 which is at all time highs again. USDJPY has destroyed many a trader over the years because of it's capacity to really move so I will be slow to sell more and quick to really space out the entries in the grid if it continues to move against me. Otherwise I'm pretty relaxed and patient about the positions. Have a good weekend.

소셜 네트워크에 공유 · 7

전체 댓글 표시 (11)

Lucas Marques Mendonca

2021.02.09

Gary, why don't you create a group just for subscribers to discuss news and macro economics?

Gary Comey

2021.02.09

Why Lucasmargues. That's just noise. People don't care what I say as long as they make money.

[삭제]

2021.05.21

[삭제]

Gary Comey

Hi Guys,

As you can see in the link in the forum Paypal is no longer available in MQL5 and there is a forum discussion about it https://www.mql5.com/en/forum/361791. As my bank is in Europe (Ireland) none of the other methods of withdrawal are available to me. This means that while you are still charged a subscription fee I am not able to withdraw it so for now at least I am effectively working for free while you are being charged.

I will give MQL5 until the beginning of March to resolve their issue though some in the MQL5 forum say Paypal will never come back the fact is that it was gone before and DID come back.

If it is not back by March I will not allow the situation to go on further and will delete my signals.

WHAT CAN YOU DO? This is a shame for the 600 or so subscribers that I have slowly built over the years but I am still a popular trader at Signalstart.com who do use Paypal and have never had any downtime with their payment processors in the five years I have been using them. IF you want to be sure I would suggest you open an account at signalstart.com and search for Blackwave Pacifc, Blackwave California or Blackwave Alpine.

For now I am happy to work for free for another month however if you should be made aware of the slightly unfair situation where you are being charged.

As you can see in the link in the forum Paypal is no longer available in MQL5 and there is a forum discussion about it https://www.mql5.com/en/forum/361791. As my bank is in Europe (Ireland) none of the other methods of withdrawal are available to me. This means that while you are still charged a subscription fee I am not able to withdraw it so for now at least I am effectively working for free while you are being charged.

I will give MQL5 until the beginning of March to resolve their issue though some in the MQL5 forum say Paypal will never come back the fact is that it was gone before and DID come back.

If it is not back by March I will not allow the situation to go on further and will delete my signals.

WHAT CAN YOU DO? This is a shame for the 600 or so subscribers that I have slowly built over the years but I am still a popular trader at Signalstart.com who do use Paypal and have never had any downtime with their payment processors in the five years I have been using them. IF you want to be sure I would suggest you open an account at signalstart.com and search for Blackwave Pacifc, Blackwave California or Blackwave Alpine.

For now I am happy to work for free for another month however if you should be made aware of the slightly unfair situation where you are being charged.

소셜 네트워크에 공유 · 4

Gary Comey

2021.02.08

Wikum. I’d like to say March 1st at 16:06hrs but they won’t let me disconnect while there are open trades so it’s partly in the lap of the markets. It’s also partly in the lap of mql5 who may or may not restore PayPal.

Jack Ye

2021.02.20

Signal start will cost 94usd per month (account fee and Singhal subscription), that is really expensive for smaller trading accounts.

Gary Comey

January 8.78%. As I decided to stop trading last Wednesday I completely forgot about trading for a few days to the point that I forgot to send the Friday update so here it is. January's 8.78% is actually the best monthly performance since March 2019 (8.87%). With the few gains we've had so far by February 2nd we are looking at a 10% gain since January 1st. So the year has begun well and I at least will be more than happy to compound the bigger balance for the next eleven months. The trick here is keeping it going without going off the rails. I want a good Q1 2021. It's easy to push down on the accelerator but as soon as you do you hand control over to unpredictable events to a greater extent. Therefore position size will remain firmly in control as our primary weapon for risk control and no more than two pairs at a time. This is where system trading comes into play versus betting. A system does not get you rich overnight. It's methodical and forgive me a little boring however a system that you are comfortable with gives you confidence and competence when things are not going your way. Anyway on with February.

소셜 네트워크에 공유 · 9

Gary Comey

A couple of trades look interesting. #GBPUSD and #AUDNZD on the short side, perhaps #USDCAD and #EURGBP on the long side, however nothing is too compelling. Markets have moved off the extreme levels that give me more confidence, Biden is in, there's been no Trump Coup D'Etat.....for now so all is well with the world which doesn't suit us at all. We prefer "war, peace, famine and upheaval..." - Wall Street 1987, or to put it more delicately a grid strategy requires markets to get a bit insane from time to time. We never have to wait long. For now it's back to cash and in excess of 6.5% so far for the month in the high risk account with a week to go.

소셜 네트워크에 공유 · 9

Junichi Sato

2021.01.28

Thank you for your answer. I have a few more questions about the operating funds for running Blackwave Pacific. 1. In your previous explanation, the position size is different.

Does it mean that the same volume will be traded at the position size (1.40 to 1.55) shown in the transaction history when Blackwave Pacific is operated ? 2. If the answer is Yes, how much is the minimum investment fund ? 3. How much money would you recommend to handle such a position size (1.40 to 1.55) ? 4. I consider up to 33% of the funds to be the allowable amount of loss. What is the guideline for operating funds in that case ?

Does it mean that the same volume will be traded at the position size (1.40 to 1.55) shown in the transaction history when Blackwave Pacific is operated ? 2. If the answer is Yes, how much is the minimum investment fund ? 3. How much money would you recommend to handle such a position size (1.40 to 1.55) ? 4. I consider up to 33% of the funds to be the allowable amount of loss. What is the guideline for operating funds in that case ?

Gary Comey

2021.02.01

1. Position size is different because as explained a few weeks ago I will be taking more risk in Q1. 2. $1700 suggested

3. There is no stop loss so if you have one then your strategy is different to mine.

3. There is no stop loss so if you have one then your strategy is different to mine.

hratts

2021.02.09

for those who have doubts about the lots referring to their account balance.

4000 USD - LOTES 0.02 / 0.03

4000 USD - LOTES 0.04 / 0.04

8000 USD - LOTES 0.06 / 0.05

10000 USD - LOTES 0.07 / 0.07

4000 USD - LOTES 0.02 / 0.03

4000 USD - LOTES 0.04 / 0.04

8000 USD - LOTES 0.06 / 0.05

10000 USD - LOTES 0.07 / 0.07

Gary Comey

Slightly bizarre week with a FAT finger trade slowing me down. The DD yesterday didn't bother me at all, it's nothing compared to what the strategy is designed to withstand but I would have hoped to have more to show for it. Officially we are higher for the week but the performance doesn't exactly tie in with me wanting to take more risk for more reward in the first few months of the year. There was definitely more risk. We were close to profit on EURGBP earlier but it may have to wait. Also that EURAUD was showing a fairly okay profit at 1.5732 but upon beginning my selling it quickly dropped 10 pips before I could get out of everything to the point where I had to stop selling in the low risk Blackwave California account and now a few hours later it's down in the 1.5660's! So for all accounts except California (which still has the first basket) I'm buying it again. The fact that the low risk account ended up holding the first basket is largely random, it could have been any other account. I guess it's only the first two weeks of the year so plenty of time for a good January, February and March.

소셜 네트워크에 공유 · 9

Gary Comey

Happy New Year. Around this time last year I declared that I was looking for a good January/February because due to the nature of compounding that would set us up nicely for a good year. As you know I have my "$1m by April 2023 Project" for my three combined accounts who's combined balances this evening now sit just under $250K and it obviously helps that project too. In recent times we've seen how the Australian regulator can interfere in our plans and my mission now is to be independently wealthy before the regulator, a broker or a law maker has another brain fart. In the end last Jan/Feb were not that impressive so I will make the same effort again this year. If that requires me taking on a bit of risk then you know why. The buck remains fairly beaten down as you can see with EURUSD still above 1.22. This is reflected across the spectrum of dollar pairs. The last few days have seen something of a rally but I am essentially keen to buy it on weakness and buying USDCHF and USDCAD is where we made money this week. Close to TP on GBPNZD tonight too.

소셜 네트워크에 공유 · 11

Sinaalipasandi ali pasandi

2021.01.10

happy New Year gary

Thank you very much for your good service

I hope you always continue to work with great motivation

We appreciate your efforts

What you do brings not only money but also happiness to families

Thank you very much for your good service

I hope you always continue to work with great motivation

We appreciate your efforts

What you do brings not only money but also happiness to families

[삭제]

2021.01.15

Hi Gary, how much money should i have to subscribe your Blackwave Pacific Signal?

Gary Comey

That time of year to reflect and look forward.

This year

70% ROI.

$4m client money.

Second Portuguese apartment bought by Blackwave.

Blackwave absorbed into a new company Blue Wave Equity & Investments.

$230K Blackwave Funds.

€35K committed to St Kevin's Boys School, Kilnamanagh, Tallaght, Dublin.

€2K to fund school meals in disadvantaged schools.

Next Year

Equity Investments

Property Investments

Continuing the goal of $1m Blackwave money by April 2022.

Breaking through more obstacles than the Dukes Of Hazzard :-).

Merry Christmas to clients, partners and friends.

This year

70% ROI.

$4m client money.

Second Portuguese apartment bought by Blackwave.

Blackwave absorbed into a new company Blue Wave Equity & Investments.

$230K Blackwave Funds.

€35K committed to St Kevin's Boys School, Kilnamanagh, Tallaght, Dublin.

€2K to fund school meals in disadvantaged schools.

Next Year

Equity Investments

Property Investments

Continuing the goal of $1m Blackwave money by April 2022.

Breaking through more obstacles than the Dukes Of Hazzard :-).

Merry Christmas to clients, partners and friends.

소셜 네트워크에 공유 · 27

Alan Kemp

2021.01.05

Hi Gary

I've been following your Blackwave Pacific signal for several months however I've been unable to renew my signal for a few days now.

MQL5 seem to be having ongoing issues with taking payments - is there a way I can follow your signal on a different platform?

My signal runs out tonight around 17:00 GMT so a fast response would be most appreciated.

Many thanks

I've been following your Blackwave Pacific signal for several months however I've been unable to renew my signal for a few days now.

MQL5 seem to be having ongoing issues with taking payments - is there a way I can follow your signal on a different platform?

My signal runs out tonight around 17:00 GMT so a fast response would be most appreciated.

Many thanks

Gary Comey

Back to cash today and for Le Weekend. Next week will likely be a low liquidity week though there may be some opportunities in USD pairs given how beat up the Greenback has been recently. Ticking along nicely and not looking for any trouble. At this point many traders would pack up and not risk their end of year bonus by taking on risk so late in December. I however don't work for GS or Barclays. I work for me dinner and my plans and they don't take nearly as much downtime.

소셜 네트워크에 공유 · 6

Gary Comey

Far from withdrawing I will be adding another $10K to my balance in the medium risk account over the weekend. As we are at 100% cash it cannot affect open positions. My goal is to compound as I said this time last year. Running my total balance of all accounts and making an assumption of 5% per month (based on historical data, no more deposits or withdrawals) that puts me at $1m AUM in 28 months. Hmm! They say if you want to make God laugh tell him your plans but on the other hand we must decide what our destination is in order to aim towards it and arrive at it. Erm anyway the high risk account is at 2.63% so far this month and not quite halfway through December and north of 65% for 2020 so far. Have a good weekend.

소셜 네트워크에 공유 · 10

Gary Comey

2020.12.14

Tariqtanoli. Minimum investment $20K. Still interested tell me your email address.

Simon Leiper

2020.12.28

Gary, Im interested in the MAM account. I didnt want to post my email address here publicly so I sent you a follow request on Linkedin. Merry christmas and HNY from Dubai....

ChrisGoh

2021.02.01

hi Gary, just sent you friend request so as to get detail for signing up MAM account. I asked IC Markets partner support and they are not helpful at all. simply ask me to google for it :(

Gary Comey

We've gone from LEVEL 5 lockdown to LEVEL 3 in Ireland which means I can go out and about and see the world outside of my 5km. That is what I'll be doing later and the reason for the early Friday update. November went well and the high risk account knocked out the third greater than 8% month of 2020. I only wish it had happened in the first three months of the year and was allowed compound for the rest of 2020. Still it's fairly good to get it at any point of any year and I suppose it's most definitely a head start on 2021. Performance fees are taken but we've paid back some of that already with the 1% return this week. I wanted to get back to cash for 24 hours to allow for Santa Claus etc but am now back selling into this overbought H1,H4,D1,W1,MN EURUSD. Our grid begins at 1.2157. The buck is beaten up across the board and way off the 14 period M.A, irrespective of the reason nothing goes on forever. Also selling NZDJPY for the same reason. I'll keep going into December and try to squeeze the last out of this incredible year. Have a good weekend.

소셜 네트워크에 공유 · 13

[삭제]

2020.12.12

[삭제]

Gary Comey

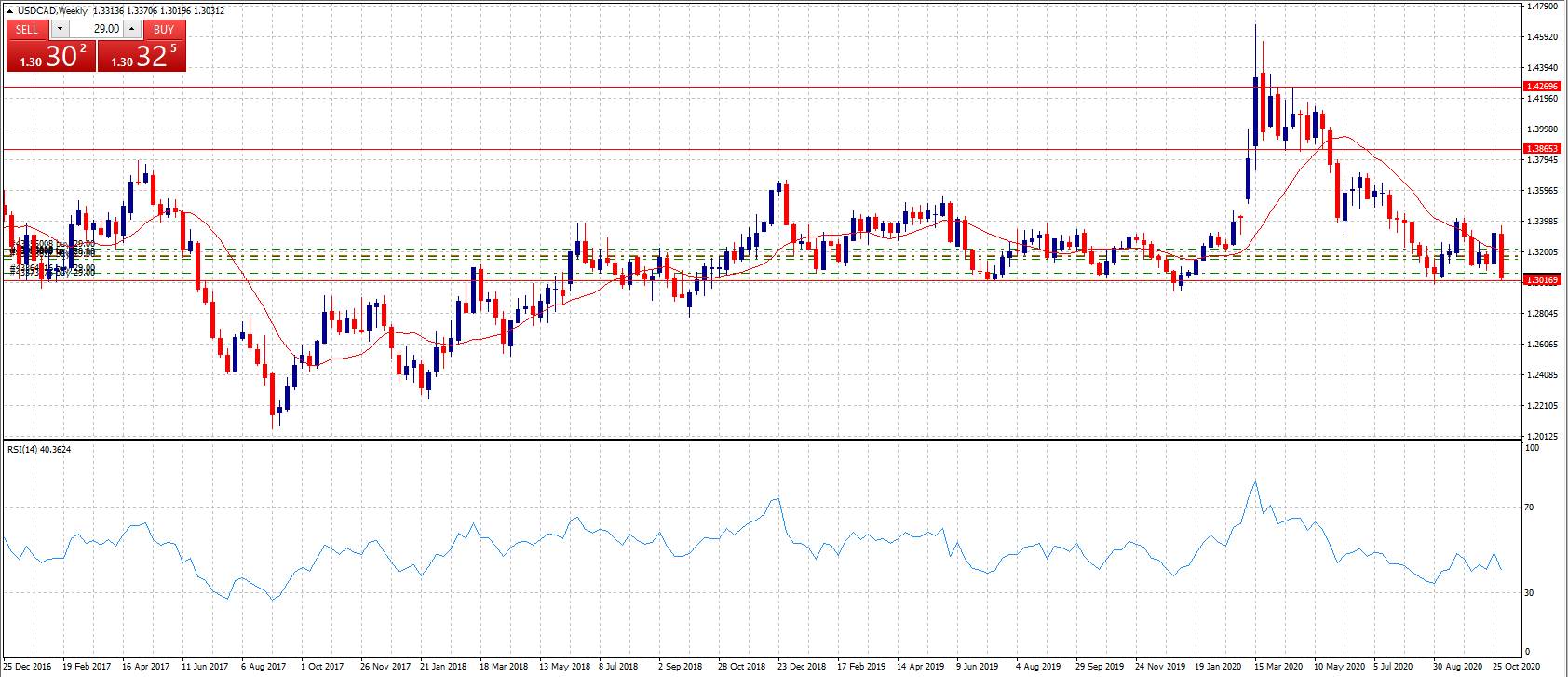

Pretty good week considering it was punctuated with the Thanksgiving holiday and the lower participation that usually brings. Closer now to an 8% month for the high risk account and good performance for all accounts. We cruise towards month end more quietly now and fingers crossed back to cash soon. USDCAD continues to thread medium term support circa 1.30 and AUDNZD having put in a daily hammer formation early in the week has been lacklustre since perhaps giving us a second bite of the cherry 🍒.

소셜 네트워크에 공유 · 5

Gary Comey

An okay week and shaping up to be an okay month circa 6% or more. GBPNZD is a big mover and that can unnerve people when it goes the other way but we pretty much got entries pretty correct. Nobody ever can time it perfectly. We finish the week at a slower pace long AUDNZD and CHFJPY. Notably the Alpine managed account exceeded $3m and the Pacific managed account passed $1m AUM for the first time in the month of November. No doubt that statement will spark large scale withdrawals 🙂 Add in the low risk California managed account and all in that's $4.3m Assets Under Management. What I am trying to say is THANKS. This year won't be the home run that other years have had in terms of performance but in what you might agree was a tricky and unpredictable year and towards the end of it's fifth year of continuous yearly growth, Blackwave Alpine will now easily surpass 60% growth or roughly ten times the growth of the S&P500 this year....so far. Have a good weekend.

소셜 네트워크에 공유 · 13

Logan-FX2020

2020.11.27

Hi Gary Comey. Everyone is very grateful to you. I really thank you so much. I subscribed your signal side signalstar. It's amazing. You are doing a job that blesses many people. thank you

Gary Comey

2020.11.27

Shgustavo, California is low risk. 0.01 lots per $3000. You say you want to “copy exactly” but you are taking more risk than me in that account.

waelmeta1988

2020.12.03

hi Gary comey..i will subscribe soon california with 3000$..but i will have the same volume of you ( volume=0.13)..how i can do this..any idea plz and thnx king

Gary Comey

So back to cash for the weekend. USDCAD worked out okay and I got circa 100 pips from GBPNZD in the early hours before the London session began at 8am. On my radar for next week are EURCHF, almost overbought and given the valuations of the stock market etc. Probably GBPNZD again which is almost oversold and threading rising multi-year support going back to 2016. I'll keep an open mind as always and see what events transpire to give us panic, pestilence, disease, anxiety and doom as I do in any other given week. Have a good weekend.

소셜 네트워크에 공유 · 9

Julien Bernard Claude Boiteau

2020.11.15

Yeay ! I love your trading Style Gary, mine is pretty similar to yours

Gary Comey

We're off the mark for November and looking at the accounts from managed clients point of view the performance fees for October are already paid for. What's left going into the weekend is only one pair namely USDCAD, and just five positions into it spread over nearly 200 pips. From the graph it appears that the 1.30 handle has at various times since 2017 been resistance and then multi-year support so I am trading that fact. Also RSI is close to oversold so I am also trading that fact. Finally the election aftermath is turning out to be volatile so I am trading that fact too. I can not tell you if the buck will rally in response to a resolution to the Presidential election but I can tell you that a volatile market is good for a grid strategy. So we pick our battles and manage our position size. It's not much more complicated than that.

소셜 네트워크에 공유 · 6

Gary Comey

2020.11.07

First goal is to open an account at IC Markets as you appear to be in the U.S so that’s complicated. Only Blackwave Pacific and Blackwave California are still open. Minimum balance is $20K. https://www.icmarkets.com/?camp=4352

Lucas Marques Mendonca

2020.11.09

Hi, Gary. I want to subscribe, I just don't understand yet, what is the minimum deposit? Is 4k dollars possible?

Gary Comey

2020.11.09

$4K is fine for any of the three strategies. Check the strategy description for specifics.

Gary Comey

So far a quiet end to the week. Next week will be interesting needless to say with the U.S election and a likely RBA rate cut both on Tuesday November 3rd. If the winds are blowing in our favour we will get back to cash and if not then AUDNZD is likely to be the only position we have. No USD trade will be opened until at least Tuesday/Wednesday. I think the markets are relaxed enough about a Biden win and we all know what we'll get if the incumbent president wins....more of the same so either way that seems to be taken account of. The issue arises if we get a close run thing and it ends up in the Supreme Court as it did with Bush vs Gore after the Florida debacle back in 2000 or begins to test the now fairly outdated parts of the U.S Constitution. I was in New York in 2000 and the New York Times called it for Gore and then had to do a reprint. I'm old enough to recall "hanging chads, and pregnant chads" but perhaps that's gibberish to some of you. Gore won the popular vote but lost the election. The point here is that I think we are in a good position going in and I have no desire to jeopordise it.

소셜 네트워크에 공유 · 6

JakkalsVanDieJSE

2020.10.30

Thanks for the update Gary! :-) Looking forward to next week, I think it will be a big one!

Gary Comey

I said a few weeks ago "it's useful to be flat or at least have very few positions going into a weekend where the President of the United States apparently has Covid-19 a few weeks out from the election." Now that The Donald is cured we still have the election next weekend and I am comfortable that we are ticking over making money but not creating a large basket of trades going into next weekend. It will be my focus to keep it that way and try to find the balance between making money and taking on too much. The equity markets and the Dollar itself seems comfortable with the opinion polls and I'd almost say they don't care who wins, but there's always the unplanned, unknown unknowns, the once in a hundred years kind of thing.....again.

소셜 네트워크에 공유 · 5

Gary Comey

Not a lot out there that’s too compelling as of tonight. Given the latest BREXIT deadline not to mention the impending U.S election I’d rather not find myself 10 positions deep into a currency when I didn’t love the idea in the first place. We never have to wait too long for a move that’s interesting so it’s no big deal.

소셜 네트워크에 공유 · 9

Gary Comey

Taking advantage of a fairly week dollar and unusually I've ended the week trading two US Dollar related pairs. It's not a breach of the strategy but I try not to do it as an informal rule. After a significant decline USDCHF attempted a rally off weekly technically oversold levels three weeks ago that has almost been taken completely back this week and I think represents an opportunity. As I mentioned earlier in the week there's a slight carry trade with USDCHF so we may as well have the broker pay us rather than the other way around. There's also multi-year support in the 0.90's going back to 2015. USDCAD is close to multi-year support too in the 1.30's going back to circa 2018. That is not to say multi-year support cannot be breached but to do so EURUSD will likely have to make a run at 1.25 being the February 2018 swing lower high and not just run at it but run at it in a straight line that does not let us out of our trades. Right now the DD is 2.5% in the high risk account (so lower in all the others) and I feel it is an acceptable risk given the relatively few positions we have.

소셜 네트워크에 공유 · 8

KilleX

2020.10.16

Hi Gary, I am considering to user your signal subscription services. I would like to get in touch with you since I am new to copy trading. Where can I reach you (send message button is disabled)? I would like to discuss what initial deposit to use and what leverage should I use.

Gary Comey

There may be an opportunity with USDCAD later in the day but looking around I am not seeing anything that fits my typical set-up amongst major and minor forex pairs. It's been a decent enough beginning to the month which only started yesterday and indeed September recorded an 8.61% growth in the Alpine managed account. The bad news is that performance fees are due but between today and yesterday they are sort of paid for in advance. Lets see what NFP's gives us but it's useful to be flat or at least have very few positions going into a weekend where the President of the United States apparently has Covid-19 a few weeks out from the election. I guess when he beats it he can look like a strong man vs "old man Biden". :-) Have a good weekend.

소셜 네트워크에 공유 · 6

Gary Comey

The predominant theme this week as with all weeks is risk trends. Equity markets are 10% off their highs and while officially that is correction territory the S&P500 has been having a bit of difficulty with following through much lower up to now. If I'd stayed with GBPNZD we'd have made a good deal more by now but I am actually happy to leave some for the next guy. That market moves quickly as I am sure you recall from last month and we had two nice goes at it, took our money and left the table. We finish off the week selling into a relatively strong Yen (at least as measured on daily timeframes by RSI) which is of course risk correlated with the S&P500. Good week and good month to date and relatively painless too which is not always the case. End of month is next Wednesday and according to myfxbook the Alpine Managed account is up over 8% for the month so trying to tick over without getting into any hot water by month end.

소셜 네트워크에 공유 · 7

Imtiaz73

2020.09.30

Hi Gary,

Imtiaz here from Melbourne. i want to subscribe and copy your signal through mql5 on my mt4 live platform. money is sitting in my account but fail to activate. i am trying from last 2 weeks but unsuccessful . i watched the video how to activate but some how link is not working. plz help me.

Kind Regards

my email imtiazkiwi@hotmail.com

Imtiaz here from Melbourne. i want to subscribe and copy your signal through mql5 on my mt4 live platform. money is sitting in my account but fail to activate. i am trying from last 2 weeks but unsuccessful . i watched the video how to activate but some how link is not working. plz help me.

Kind Regards

my email imtiazkiwi@hotmail.com

Gary Comey

2020.10.01

Imtiaz I’m afraid I’m the trader, I’m not mql5 so I don’t know what you are doing wrong. I’ve never copied anyone on mql5. Perhaps someone in the forum can help.

: