Fractal U

- Experts

- Jason Edward Todt

- 버전: 1.0

- 활성화: 5

The Fractal U is a fractal EA based on a simple price pattern that is frequently seen in financial markets. A fractal is a recurring geometric pattern

that is repeated on all time frames. From this concept, the fractal indicator was devised. The indicator isolates potential turning points on a price chart.

The Fractal U trades the possibility of a trend change. This is because fractals are essentially showing a "U-shape" in price. A bearish fractal has the price

moving upward and then downward, forming an upside-down U. A bullish fractal occurs when the price is moving down but then starts to move up, forming a U.

Then instead of plotting these values directly, We smooth them out using BoilingerBands, MACD and Multiple Moving Averages to filter out the true momentum.

A fractal is only acted on if it aligns with the other three indicators and potentially the longer-term price direction.

It is best to plot fractals in multiple time frames. For example, only trade short-term fractals in the direction of the long-term ones. As discussed, focus on long trade

signals during larger uptrends, and focus on short trade signals during larger downtrends. The longer the time period of the chart, the more reliable the reversal.

It's also important to note that the longer the time period, the lower the number of signals generated.

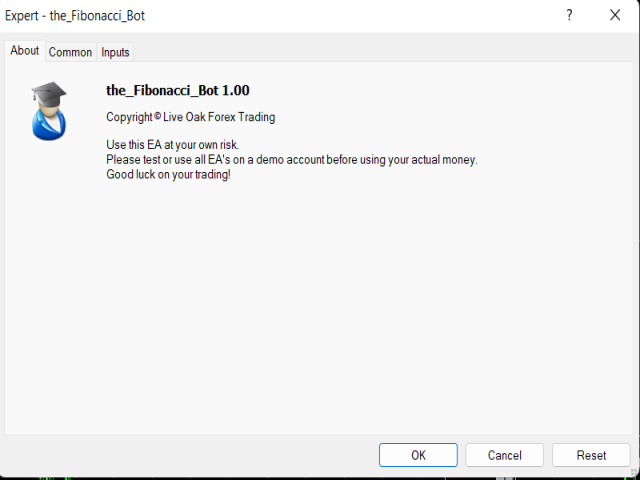

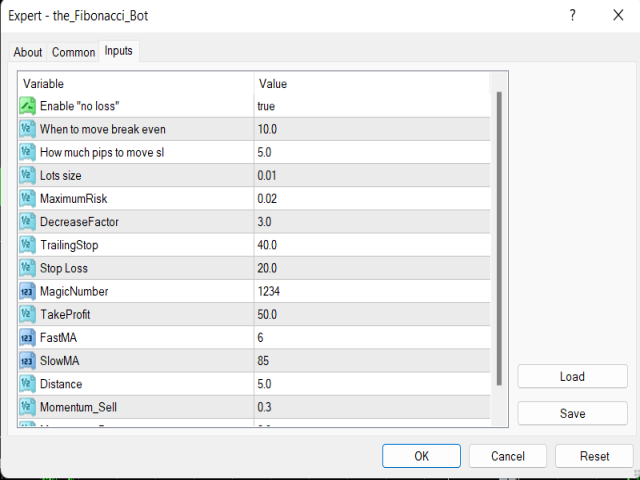

This EA offers the user a few options to secure profitable trades by breaking even or trailing the stop. These two options are enabled by default.

If an open trade gains at least 30 pips, its stop loss is moved to the entry price for a risk-free trade. Later if the trade gains more pips, the trailing stop function comes in.

Trailing stop maintains a distance between market price and trade stop loss of 40 pips. At some point, price will hit either the adjusted stop loss or take profit of 50 pips.

In both cases the trade ends up a winner.

Anyone interested to know the robot’s true potential must consider implementing the robot in a demo account or running parallel tests in various trading instruments to

determine which markets would give it more winning chances.

Please use a different magic numbers on each pair to avoid order issues. Also, please check the max spread limit number to avoid entering trades during high spread sessions.