Correlated MT5

- Experts

- Ulises Calderon Bautista

- 버전: 1.0

- 활성화: 10

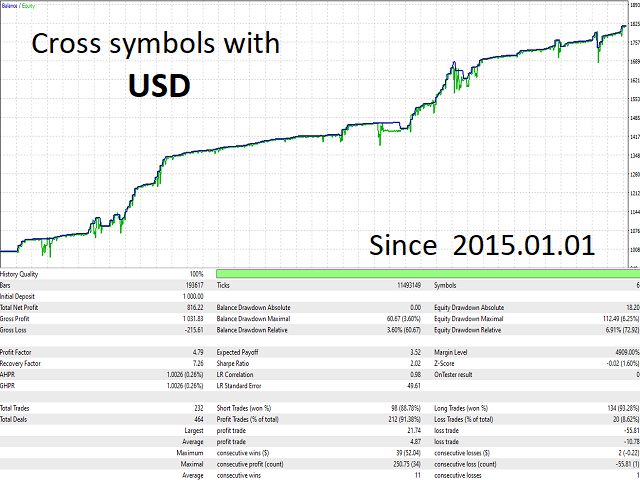

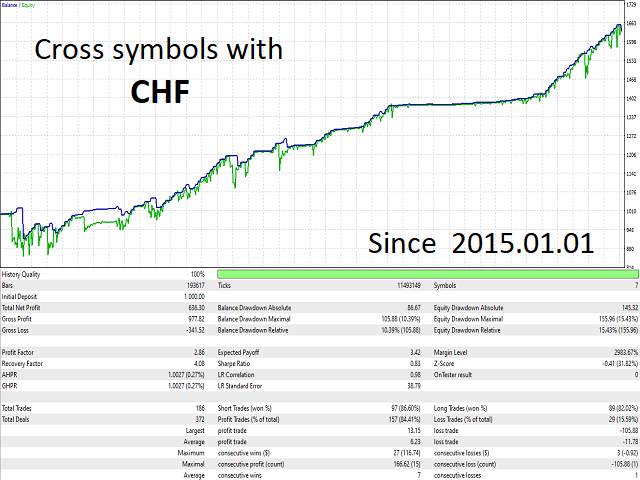

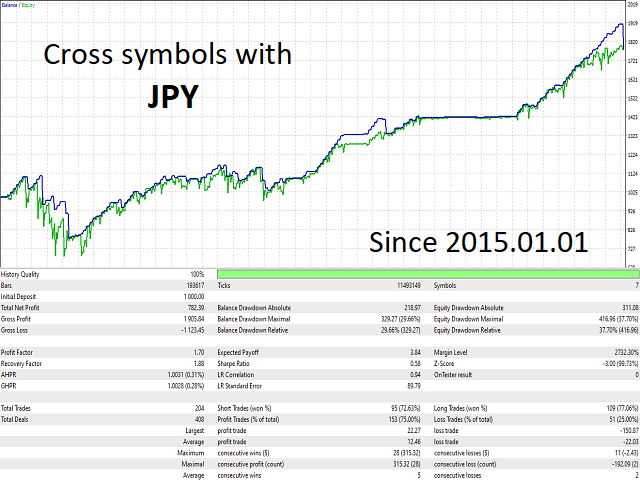

Correlation occurs when the price of two or more currency pairs move together. Being positive correlation, where prices move in the same direction or negative correlation, where they move in opposite directions. As a trader, it's important to understand that relation, as it can unconsciously affect your account's risk exposure.

Correlated is an Expert Advisor that identifies and takes advantage of divergent movements in strongly correlated currency pairs. It also shows a table of yields, standard deviations and the matrix of correlation in real time according to the user's specifications to carry out manual operations with a greater amount of information at their disposal.

Applied data type: Type of data (or price) of the history to make the calculations.

Timeframe: Timeframe to which the data corresponds.

Target correlation: Symbols whose correlation index is greater than this number (or less multiplied by -1), are applied for the trading strategy.

Number of correlated symbols: Minimum number of symbols that meet the "Target Correlation" to proceed with the trading strategy.

Moving Average Period: Period of the moving average used to determine the trend.

Use standard deviation: If set to "true" gives preference to the symbol with the lowest standard deviation to make a trade, use this option only if all symbols belong to Forex. Select "false" if at least one of the symbols belongs to stocks, futures, metals, cryptocurrencies or any other sector other than Forex.

To use a smaller amount, select "Allow Symbol #" = "false" before the name box. If this is the case, start by denying the number 7, then 6, and so on.

Color 1 and Color 2: Colors of the tables.

Timeframe 1,2,...,5: Timeframes for the returns table.

Magic Number: Give a different MagicNumber to each activated EA.

Correlated is an Expert Advisor that identifies and takes advantage of divergent movements in strongly correlated currency pairs. It also shows a table of yields, standard deviations and the matrix of correlation in real time according to the user's specifications to carry out manual operations with a greater amount of information at their disposal.

Attention! Starting Price: $30.00.

In order to preserve the intrinsic value of this code and reward early adopters, the price will increase as sales are completed and updates are made. The time to acquire it is now! Test it!

In order to preserve the intrinsic value of this code and reward early adopters, the price will increase as sales are completed and updates are made. The time to acquire it is now! Test it!

Presets:

Drive: bit.ly/3gaUafO

MEGA: bit.ly/3EDGF2c

Recommended timeframe: M15

Description of the input parameters:

- Specifications for calculations

Applied data type: Type of data (or price) of the history to make the calculations.

Timeframe: Timeframe to which the data corresponds.

Target correlation: Symbols whose correlation index is greater than this number (or less multiplied by -1), are applied for the trading strategy.

Number of correlated symbols: Minimum number of symbols that meet the "Target Correlation" to proceed with the trading strategy.

Moving Average Period: Period of the moving average used to determine the trend.

- Deals Parameters

Use standard deviation: If set to "true" gives preference to the symbol with the lowest standard deviation to make a trade, use this option only if all symbols belong to Forex. Select "false" if at least one of the symbols belongs to stocks, futures, metals, cryptocurrencies or any other sector other than Forex.

- Allow or deny symbols and their names

To use a smaller amount, select "Allow Symbol #" = "false" before the name box. If this is the case, start by denying the number 7, then 6, and so on.

- Data visualization and navigation

Color 1 and Color 2: Colors of the tables.

Timeframe 1,2,...,5: Timeframes for the returns table.

- Other Parameters

Magic Number: Give a different MagicNumber to each activated EA.

DISCLAIMER: Never forget that past performance is no guarantee for the future; The mathematical tools used in this EA are statistically effective, but when trading live, other random variables appear that directly influence performance and are difficult to quantify, such as market manipulation by central banks, unexpected or extraordinary news , mass psychology, fear, euphoria, etc. It is recommended to first work with a demo account or a real account with very low leverage to better understand how the EA works.