Connors TPS

- Experts

- MATTHEW STAN WILLS

- 버전: 2.1

- 업데이트됨: 10 2월 2025

- 활성화: 20

🇰🇷 한국어 – Larry Connors TPS - 자동화된 트레이딩 시스템

Larry Connors TPS - 자동화된 트레이딩 시스템

버전 2.0 – Matthew Wills 제작

이 Expert Advisor (EA) 는 Larry Connors의 시간, 포지션 및 스케일링(TPS) 트레이딩 시스템을 자동화한 것으로, 그의 책에서 처음 소개되었습니다.

📘 “High Probability ETF Trading”

🔗 Amazon 링크

📌 전략 개요

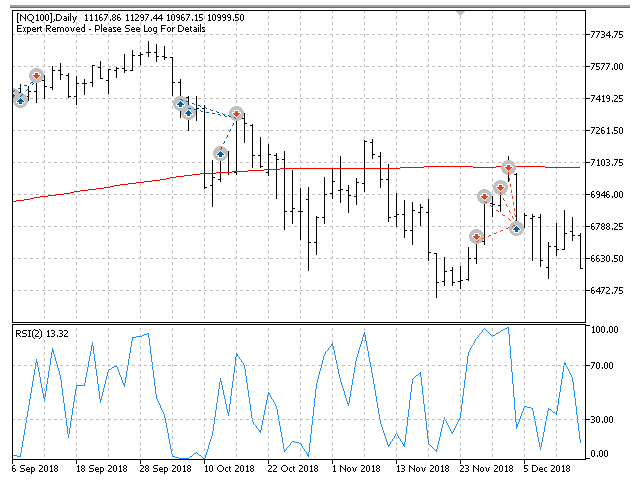

Larry Connors의 TPS 시스템은 시장 되돌림(Pullback) 을 활용하여 단계적으로 포지션을 확장 하면서 최적의 리스크 대비 수익률을 제공합니다.

🔹 ETF, 현금 지수, 개별 주식 및 기타 평균회귀(mean-reverting) 자산에 적용 가능

🔹 200일 이동평균(SMA) 위에서 거래할 때 가장 효과적

🔹 RSI 신호 및 스케일링 규칙에 따라 매매 실행

🔹 표준 TPS 트레이딩 규칙:

1️⃣ ETF, 현금 지수 또는 주식을 거래합니다.

2️⃣ 지수가 200일 SMA 위에 있어야 합니다.

3️⃣ RSI(2)가 25 이하로 2일 연속 유지되면 전체 포지션의 10%를 매수합니다.

4️⃣ 가격이 추가 하락하면 기존 포지션의 20%를 추가 매수합니다.

5️⃣ 가격이 다시 하락하면 기존 포지션의 30%를 추가 매수합니다.

6️⃣ 가격이 더 하락하면 기존 포지션의 40%를 추가 매수합니다.

7️⃣ RSI(2)가 70 이상으로 상승하면 모든 포지션을 청산합니다.

8️⃣ 숏 트레이딩의 경우 동일한 규칙을 반대로 적용합니다.

🚀 버전 2.0의 새로운 기능

새로운 버전은 더 높은 유연성, 사용자 맞춤 설정 기능, 향상된 트레이드 실행 기능을 제공합니다.

✅ 커스텀 스케일링 레벨 – 최대 10단계 설정 가능

✅ 동적 포지션 크기 조정 – 3가지 포지션 관리 모드 제공

✔️ DEFINED_LOTS – 고정된 로트 크기 (예: 0.1 로트)

✔️ FIXED_VALUE – 고정된 달러 가치 (예: $1,000)

✔️ ACCOUNT_PCT – 계좌 잔액의 일정 비율 (예: 5%)

✅ 멀티 심볼 지원 – 여러 자산을 동시에 거래 가능

✅ 3가지 트레이드 실행 모드 지원

✔️ OPEN_OF_NEXT_BAR – 다음 캔들의 시작점에서 진입 (기본값)

✔️ CLOSE_OF_THIS_BAR – 일봉 마감 1분 전에 진입 (책의 원본 전략)

✔️ EXACT_TIME – 사용자가 정확한 실행 시간을 설정 가능

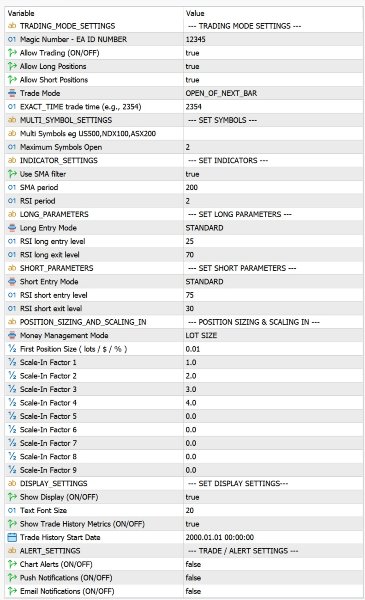

⚙️ EA 설정

🟢 트레이딩 모드 설정

🔹 롱 포지션 활성화: ✅ ON / ❌ OFF

🔹 숏 포지션 활성화: ✅ ON / ❌ OFF

🔹 트레이드 실행 모드:

✔️ OPEN_OF_NEXT_BAR (기본값)

→ 신호 발생 후 다음 캔들 시작 시 진입

→ 슬리피지를 방지하고 안정적인 실행 가능

✔️ CLOSE_OF_THIS_BAR (Connors의 원본 전략)

→ 일봉 마감 1분 전에 트레이드 실행

⚠️ 브로커가 마켓 클로징 시간을 제공하지 않으면 이 모드가 작동하지 않습니다 – "EXACT_TIME"을 사용하세요.

✔️ EXACT_TIME (사용자 지정 시간 설정)

→ 시간을 네 자리 숫자로 입력 (예: 2135 = 21:35, 오후 9:35)

→ 고정된 시간에 트레이딩하고 싶은 사용자에게 적합

📈 지표 및 진입 로직

🔹 이동 평균 필터 (SMA 200) 사용: ✅ ON / ❌ OFF

✔️ 롱 포지션: 가격이 200일 SMA 위에 있어야 함

✔️ 숏 포지션: 가격이 200일 SMA 아래에 있어야 함

🔹 RSI 기간: (기본값 = 2)

✔️ RSI를 계산할 기준 기간

🔹 RSI 진입 및 청산 기준:

✔️ 롱 진입: RSI(2) < 25 (2일 연속) → 매수

✔️ 숏 진입: RSI(2) > 75 (2일 연속) → 매도

✔️ 롱 청산: RSI(2) > 70 → 포지션 종료

✔️ 숏 청산: RSI(2) < 30 → 포지션 종료

🔹 트레이드 진입 모드:

✔️ STANDARD (기본값) → RSI(2)가 2일 연속 신호 기준을 충족해야 함

✔️ AGGRESSIVE → RSI(2)가 한 번만 신호 기준을 충족해도 진입 가능

💰 포지션 크기 및 스케일링 인 전략

🟢 3가지 포지션 크기 조정 옵션:

✔️ DEFINED_LOTS – 고정된 로트 크기 사용

✔️ FIXED_VALUE – 일정 금액(USD) 기준으로 매매

✔️ ACCOUNT_PCT – 계좌 잔액의 일정 비율 적용

🔹 스케일링 인 기능 – 최대 10단계 설정 가능

✔️ 기본값: 1 → 2 → 3 → 4

✔️ 다음 스케일링 인 단계의 값이 0 이하이면 스케일링 중단

📊 스케일링 예시 (기본 4단계)

✅ DEFINED_LOTS = 0.1 로트

✔️ 포지션 1: 0.1 로트

✔️ 포지션 2: 0.2 로트

✔️ 포지션 3: 0.3 로트

✔️ 포지션 4: 0.4 로트

✔️ 총계: 1.0 로트

📊 멀티 심볼 및 자산 관리

🔹 MultiSymbols (쉼표로 구분된 심볼 리스트 입력 가능)

✔️ 예시: "US500, NDX100, ASX200"

✔️ 입력하지 않으면 현재 차트의 심볼이 사용됨

🔹 MaxSymbolsOpen (최대 오픈 가능 심볼 수)

✔️ 기본값 = 2

✔️ 2개의 심볼에서 포지션이 열려 있으면 추가 트레이드는 대기

📊 화면 표시 및 리포팅 설정

🔹 화면 표시 활성화: ✅ ON / ❌ OFF

🔹 텍스트 크기 조정: (기본값 = 20)

🔹 트레이드 히스토리 표시: ✅ ON / ❌ OFF

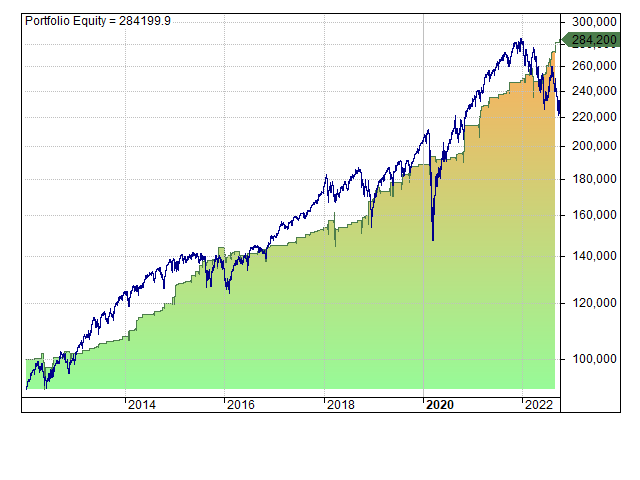

✔️ 표시 데이터:

✔️ 총 트레이드 개수

✔️ 승률 및 손익비

✔️ 최대 손실(Drawdown)

✔️ 총 수익 및 계좌 성장률 (%)

📌 결론

✅ Larry Connors TPS EA – 자동화된 트레이딩 시스템

✅ 멀티 심볼 지원 – 다양한 자산을 동시에 거래 가능

✅ 사용자 지정 스케일링 – 최대 10단계

✅ RSI 신호 및 SMA 200 필터 기반 진입 전략

✅ 실시간 성과 모니터링 가능

🚀 Connors TPS 전략을 자동으로 실행하고 싶으신가요?

👉 지금 다운로드하고 스마트한 트레이딩을 시작하세요! 🎯

This EA is one of the better ones I've come across on MQL5! It doesn’t open trades every day but the underlying strategy is solid and focuses on quality over quantity. It works well on higher liquidity ETFs (like QQQ and SPY) and indices (test with your broker first). Matthew is highly responsive and provides great support. Definitely recommend!