EnvelopesM

- 지표

- Andriy Sydoruk

- 버전: 1.0

- 활성화: 5

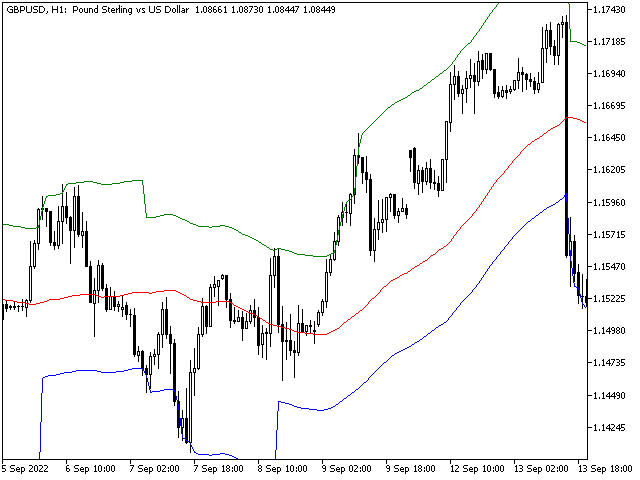

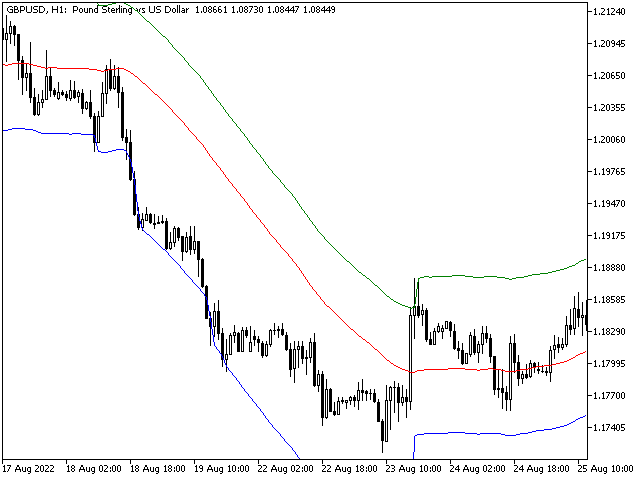

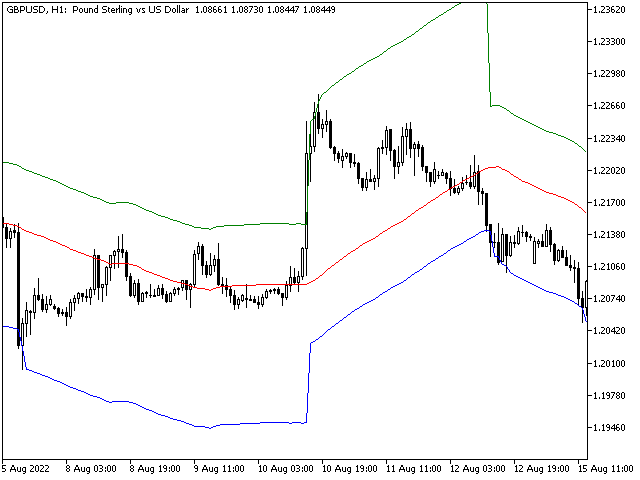

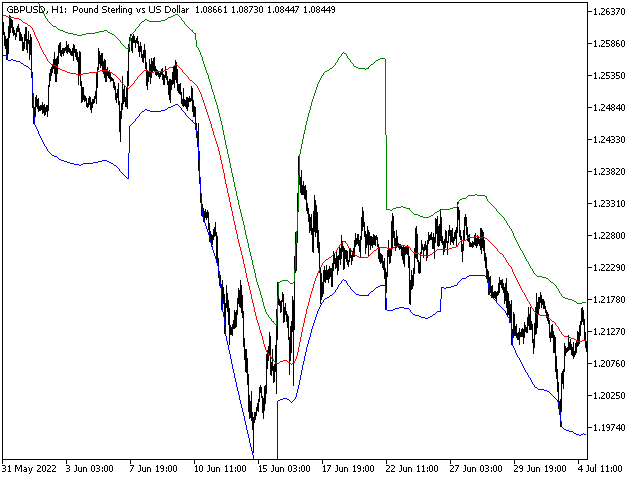

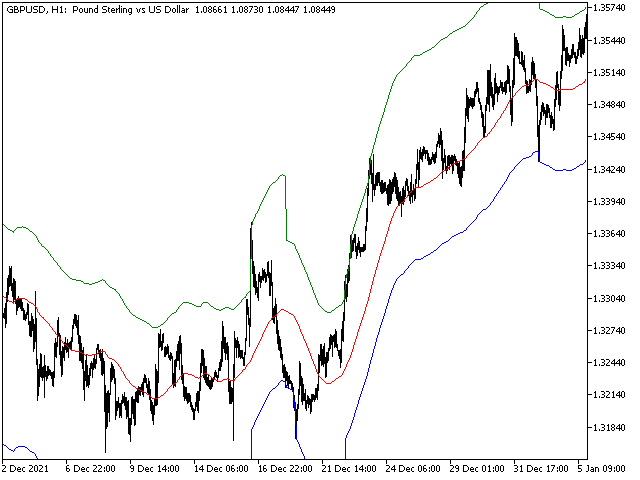

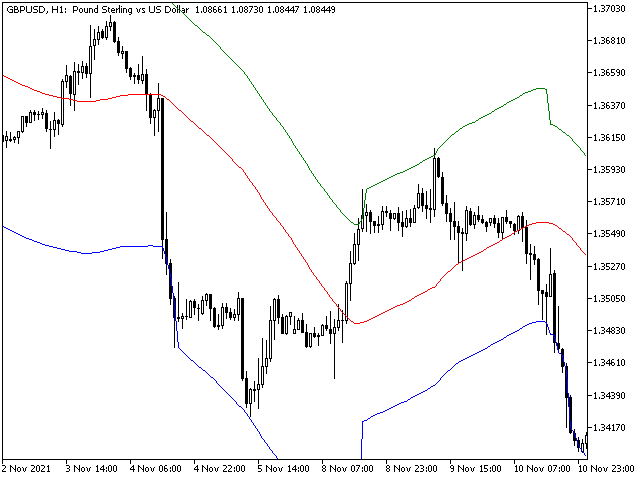

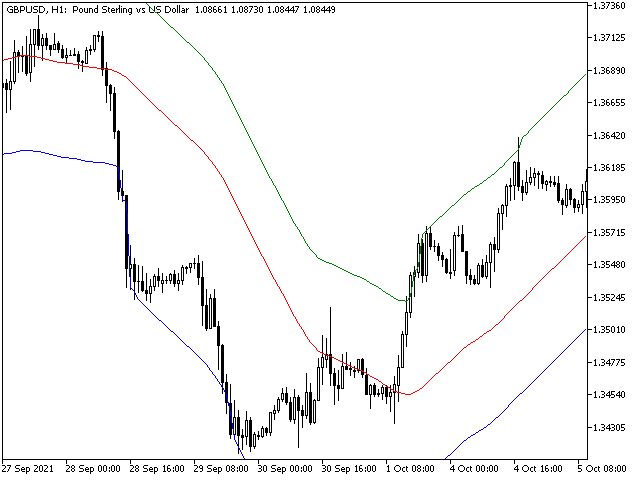

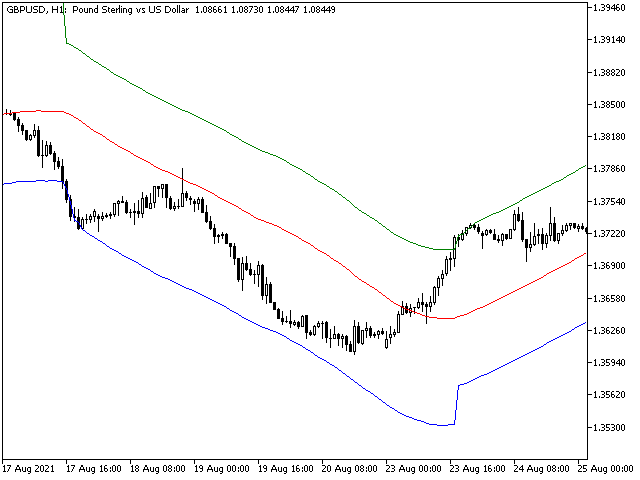

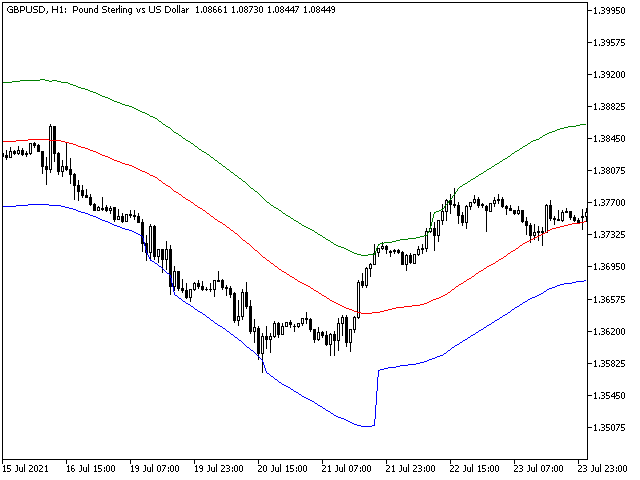

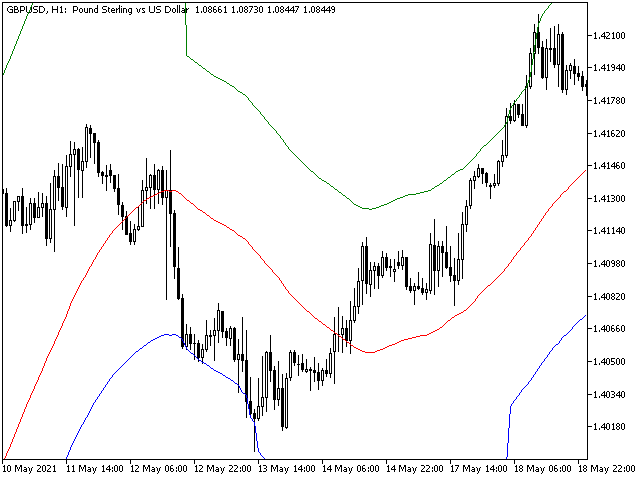

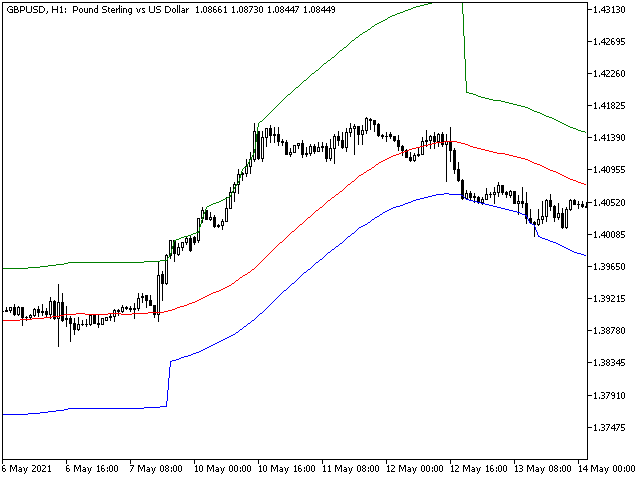

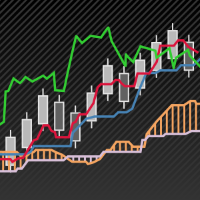

The Envelopes M indicator is based on the popular Envelopes technical indicator, which is used to create flexible channels where prices stay most of the time. The boundaries of these corridors are two moving averages. But the application that the price is in the channel most of the time is not completely correct, since the channel often breaks out and the price falls far beyond the channel. The main difference of this indicator is that with each new channel breakout, the channel line expands forming a new maximum, and this happens until the opposite channel line is broken, after which the indicator starts working again within the initial channel. When the opposite channel line is broken, it is corrected, while the correction of the other line will be reset to zero and another line will be formed by default.

Parameters

- Period - the number of bars used for calculation or just the MA period. The smaller this parameter, the faster the signals are generated. Long periods are slower, but the quality of messages is better.

- Shift - "shift" relative to the candle.

- Method - Moving Average type.

- Applied price - Applied to prices.

- Deviation - coefficient or deviation from the central MA in percent. It is from this indicator that depends on how wide the boundaries of the channel will be. The baselines of the channel are shifted by the value of the Envelopes coefficient (measured as a percentage) down and up from the moving average. The latter is also present on the chart as a central line to enhance visibility. The classic variance calculation does not take volatility into account.

- Breakdown - reaction to breaking through the channel.