Simple Bollinger Bands

- Experts

- Teng Qi Sheng Joshua

- 버전: 1.1

- 업데이트됨: 12 5월 2022

This is a simple Bollinger Band EA

This works by activating a trade whenever the input parameters are met, including the Bollinger Band parameters

The Bollinger Band Parameters determines when a buy or sell trade is opened:

- If the price is outside the lower bounds of the activated bollinger bands, a buy trade is opened (given that all other criteria are met)

- If the price is outside the upper bounds of the activated bollinger bands, a selltrade is opened (given that all other criteria are met)

Key features

- Extremely lean code and very fast strategy testing

- Unique and well programmed parameters designed to mitigate risk based on the user's preference

- Optional Stop Loss parameter allows users to turn the martingale recovery method off:

- you'll be surprised at the lack of a stop loss function on most martingale EAs

- to do that, ensure that the "Stop Loss" input parameter has a value that is lower than the "Point Step" input parameter

INPUT PARAMETERS

Trade Settings

- Lots - The lot size of the first trade. If input is less than 0.01, it will be rounded to 0.01 which is the smallest lot tradable with most brokers

- Lot Exponent - The rate at which the lot size increases

- Lot Exponent Multiplier - The rate at which the Lot Exponent increases

- Take Profit - Amount of profit (in points) that has to be earned (per mini-lot) before the trade closes.

- TP Multiplier - The rate at which the 'Take Profit' level changes (this should preferably be less than 1.)

- Point Step - The minimum distance (in points) before the next trade is allowed to be placed

- Point Step Multiplier - The rate at which the Point Step increases

Risk Management

- Stop Loss - The amount of loss (in points) that has to be incurred before the trade closes. An input of zero nullifies this input.

- (To turn the martingale recovery method off, ensure that the "Stop Loss" input parameter has a value that is lower than the "Point Step" input parameter) - Max Open Orders - Maximum open orders allowed, after which, the EA will not open new orders

- Open Subsequent trades on new candle - If set to true, all recovery (average-down) trades can only open at the start of a new candle

- Open only if current price is worse off than previous trade - If set to true, all recovery (average-down) trades can only open if all the trades in the set are in a loss

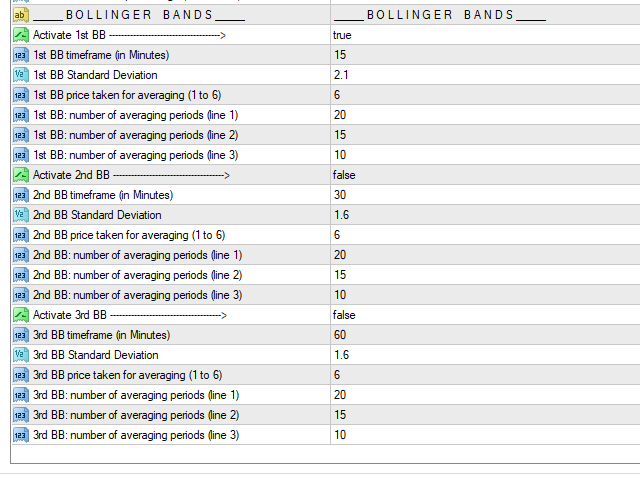

EA Settings

- Activate BB - Activate this Bollinger Band. There are 3 all together (1st, 2nd, and 3rd BB). If all 3 are activated, the price has to be below all of the lower bands, or above all of the upper bands for a buy or sell trade to be opened.

- BB timeframe - It doesnt matter what timeframe your chart is set at, use this parameter to determine the timeframe which you want the BB to operate in

- BB Standard Deviation - This is straightforward, needs no explanation

- Price taken for averaging - (Number 1 to 6) this indicates the type of price used to form the moving average curve

- Open price

- The maximum price for the period

- The minimum price for the period

- Median price, (high + low)/2

- Typical price, (high + low + close)/3

- Weighted close price, (high + low + close + close)/4

- Number of averaging periods (line 1,2 & 3) - There are effectively 3 bollinger bands you can create within each BB activation. With this parameter, you can choose the number of averaging periods for each bollinger band