Vortex MT4

- 지표

- KEENBASE SOFTWARE SOLUTIONS

- 버전: 1.1

- 활성화: 5

The Vortex Indicator was first presented by Douglas Siepman and Etienne Botes in January 2010 edition of Technical Analysis of Stocks & Commodities. Despite its based on a complex implosion phenomenon, the vortex is quite simple to interpret.

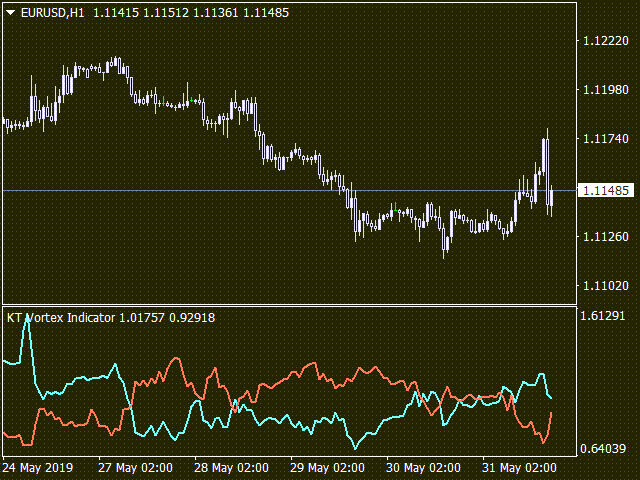

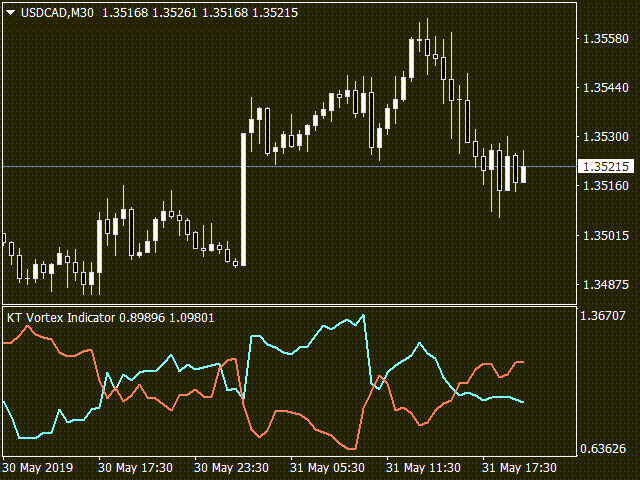

A bullish signal is generated when +VI line cross above the -VI line and vice versa. The indicator is mostly used as a confirmation for trend trading strategies.

The Vortex was inspired by the work of Viktor Schauberger, who studied the flow of water in turbines and rivers. Etienne Botes and Douglas Siepman found that movements in financial markets are similar to the vortex motion found in water.

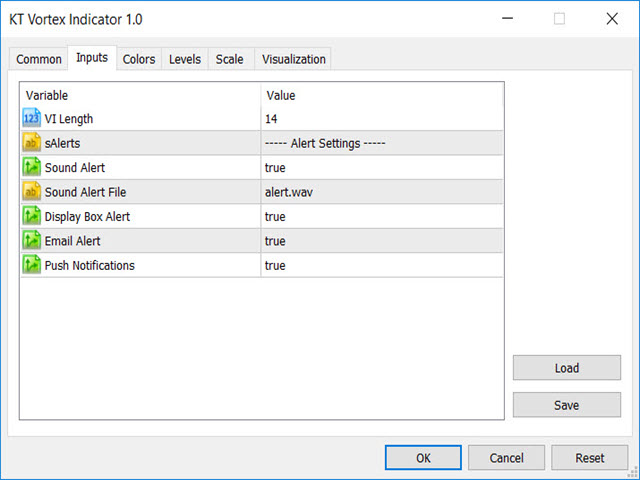

Features

- Seamlessly pick the market trend using the position of positive and negative line concerning each other.

- It works great as a filter for trend trading strategies — only long trades when +VI line is above the -VI line and vice versa.

- Receive alerts on each crossover of plus VI and minus VI lines.

Vortex Formula

+VM = Current Period’s High – Previous Period’s Low (absolute value)

-VM = Current Period’s Low – Previous Period’s High (absolute value)

+VM14 = 14-period Sum of +VM

-VM14 = 14-period Sum of -VM

Calculating the true range of last 14 periods

TR14 = 14-period Sum of TR

Normalizing the positive and negative trend movement:

+VI14 = +VM14/TR14

-VI14 = -VM14/TR14