Vero Grid

- Experts

- Andrea Lai

- 버전: 1.0

- 활성화: 5

Vero Grid is an advanced grid system that has been working on real accounts for many months. The system is designed to detect market inefficiencies and find the best entry points to close trades in the positive.

The system supports many pairs but it is recommended to use it on pre-posted pairs:

Supported currency pairs: AUDNZD;NZDCAD;EURCHF WITH TIMEFRAME M15

Supported currency pairs: AUDUSD;AUDCAD;EURAUD WITH TIMEFRAME H1

Features:

Only one chart for setup: You can use EA only on one pair to trade all other pairs

Supports multiple pairs at a time

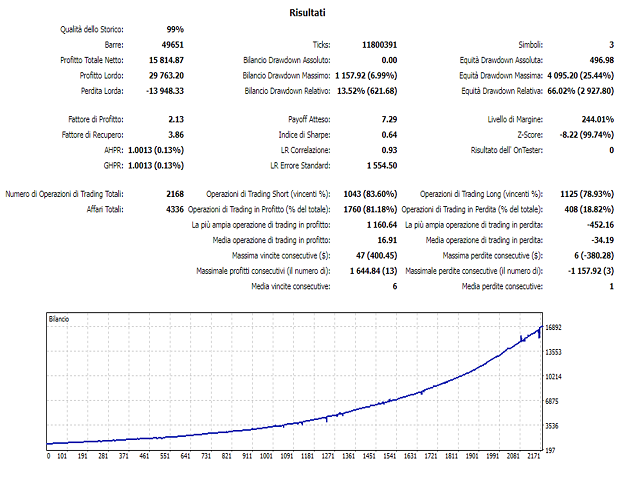

Backtests executed in a wide timeframe

No need to set the GMT

No .set file is needed because all settings are set as default values.

How to install it

EA must be connected to ONLY one M15 chart, AUDNZD is recommended

If your broker uses suffixes in the name of the pairs (e.g. AUDNZD.a) you need to update the appropriate parameter with the list of symbols you are trading on.

If you decide to use the second strategy then in the symbols parameter enter AUDUSD;AUDCAD;EURAUD and connect EA to the AUDUSD chart with 1H timeframe, among the settings you should also change the RSI Period parameter and set it to the value 14.

Requirements

This EA is not sensitive to spread and slippage. However, the use of a good ECN broker is recommended.

This EA must run continuously on a VPS or a PC 24 hours a day

With only 1:30 leverage the system works, but it takes longer to recover positions. The system is optimized to work with a leverage of at least 1:100.

Risk setting

Trading type: Auto lot or Fix lot. Select Fixed Lots to use the same amount of money. In this case you have to specify the parameter 'Fixed volume'. Use this strategy if you want to withdraw your gains after every month. It is recommended to use at least 0.01 lots per 1000 EUR/USD capital.

Auto Lot can calculate the best lot size for you based on your account balance.

Allow to Buy/Sell - on/off Buy/Sell trades

Strategy

Symbols - symbols separated by dot comma

Bollinger Bands Period - period of BB used to calculate the upper/lower levels

RSI Period - period of RSI used to filter out trades with small potential.

Maximum RSI Value - value for the RSI filter