Ilan Universal is an automatic advisor (trading robot) used for trading in all financial markets. It is in demand among beginners and experienced traders due to such advantages as the exact execution of the trading rules of the chosen strategy, the reduction in the number of subjective errors, and the release of the user's time. The recommended deposit is $10,000.

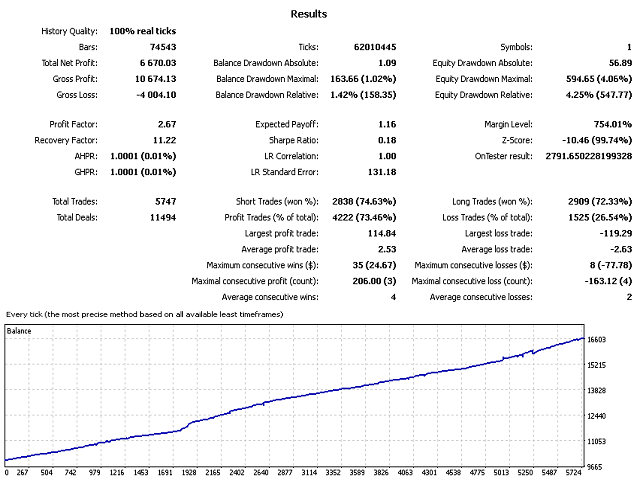

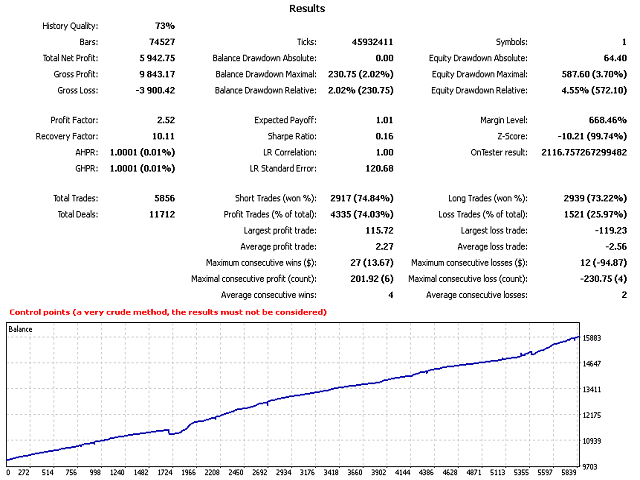

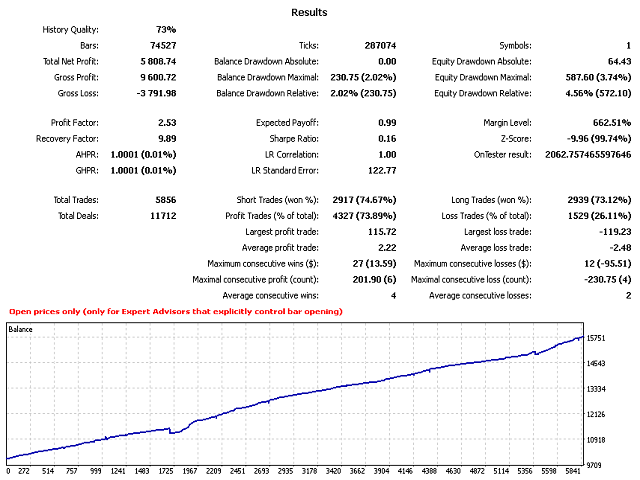

The great value of this algorithm is the possibility of optimizing by opening prices and correctness after such optimization of work on real ticks. This significantly speeds up optimization and makes working with this strategy as real and deterministic as possible in different modes.

Most of the developed Expert Advisors that use various market analysis tools (for example, indicators) demonstrate a significant dependence on changing market conditions. As a result, a trading robot that has made a profit in the recent past or has shown positive results when tested on historical data may trade negatively in the current market situation. To eliminate this problem, periodic optimization of the parameters of the automatic vehicle or a change in the strategy rules is required. As a result, this type of algorithmic trading turns out to be profitable only if the trader has experience and the appropriate amount of theoretical knowledge. Accordingly, many people prefer trading robots, whose work does not depend on the market situation, and when concluding and closing transactions, they use algorithms that do not involve market analysis tools. Such methods include, for example, the method of the Ilan trading system - this is one of the most well-known methods that implement it.

Ilan Universal trading system based on the principles of short-term (no more than several periods of the price chart) trading. The idea of the strategy used is to make a profit on fast, including insignificant in amplitude, market fluctuations. To complete an in-the-money trade, the EA closes an open position when it reaches the TakeProfit level specified in the settings. When the market moves in the direction opposite to the direction of the deal, additional positions are opened in the same direction (a grid of averaging orders is formed, the weighted average opening price of which is better than the price of the initial entry into the market). The grid is closed when a given profit is received.

Let's focus only on the differences of this product, so that it is clear why you should buy it.

- 1. The bot enters the market in series in order to make a profit, closing the entire series in a total plus.

- 2. The bot uses three regression indicators to provide market entry. Three regressions are used to make the first entry into the series. For further work with the series, two smaller regressions are already used.

- 3. The first two regressions jump in the direction of the trend. The third regression, which is the smallest, works against the trend. This is done so that when the market is moving, it is not necessary to enter the market at the peak just before the reversal and not to pull the big anchor of the series that started at an inconvenient moment.

- 4. A competent approach to the implementation of devices and all the functionality of the bot. You can optimize the bot by opening prices, you need to choose a smaller timeframe used in the bot settings. After that, you can test for all ticks or for real ticks and the work will be the same, usually the same work will be in real mode. To do this, the functionality of the bot is made in such a way that any action is rounded up to the opening price of the specified timeframe, or the price of the shadow of the previous bar, for example, when trailing or any other calculations, the bot uses exactly this approach. This approach provides the maximum determinism of the algorithm.

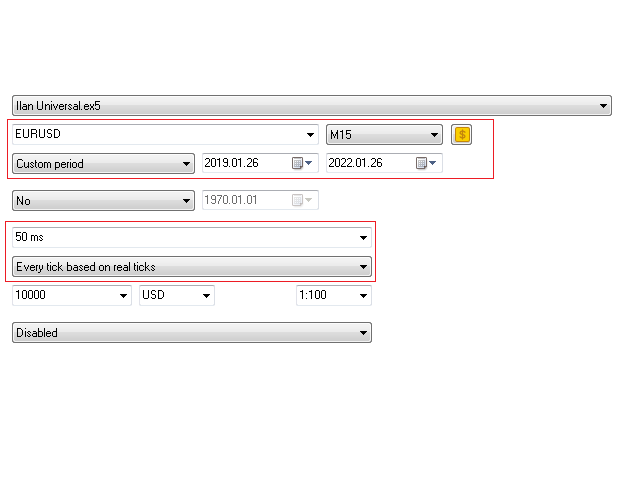

It is proposed to optimize as indicated in the screenshot. Work for up to 3 months. Then carry out a new optimization again. The lower timeframe can be reduced to m5 or hover m1, by default it is m15.

Bot parameters are simple and intuitive, if necessary, please contact in private correspondence for clarification. The optimization setting will be attached at the beginning of the discussion.