Orion II

- Experts

- Emanuele Vazzoler

- 버전: 2.0

- 업데이트됨: 30 6월 2022

- 활성화: 5

Orion II is a multi-strategy Expert Advisor: 20 different strategies has been embedded into a single Advisor with a logic able to select the best algorithm for each market phase!

Multi-strategy allows to achieve a smooth equity line keeping at the same time the risks at an acceptable level.

Money Management can be based on fixed lot size or on a variable lot size. The lot size is determined according the a maximum risk % based on available Balance. The EA is set to use variable lot size with the risk of 1% of available balance, min 0.01 max 5 lots (i.e., investing 1000$, each position cannot lose more than 1% or 10$).

This EA has been developed for EURUSD with 1H time interval. May be used also for other currencies, but requires deep backtesting.

Orion II can also be found also as a signal on MQL5 signal market here.

IMPORTANT: Before testing it, set correctly the money management section of parameters:

- UseMoneyManagement --> if true, it will set the MM based on a % of available balance, if false will use mmLotsIfNoMM as size

- mmLotsIfNoMM --> used only if UseMoneyManagement is false

- mmRiskPercent --> max % of available balance at risk in each operation. Good values from 1 to 5%

- mmDecimals --> depents on your account type: 0 = lots, 1 = minilots, 2 = microlots

- mmMaxLots --> limit the size of a transaction to this number. You can keep it high

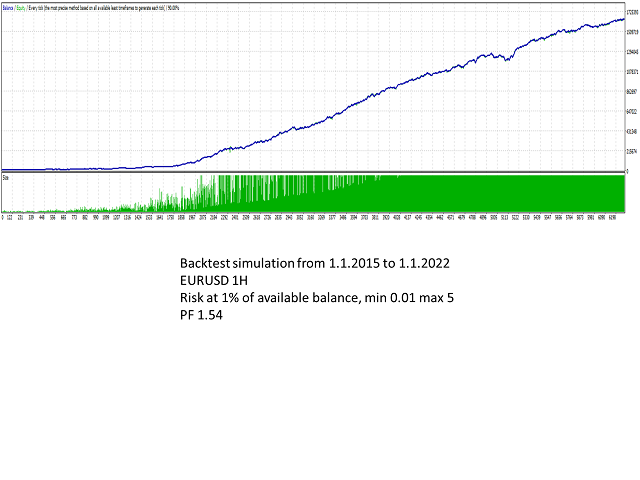

| Symbol | EURUSD (Euro vs US Dollar) | ||||

| Period | 1 Hour (H1) 2015.01.02 09:00 - 2022.01.07 22:00 (2015.01.01 - 2022.01.09) | ||||

| Model | Every tick (the most precise method based on all available least timeframes) | ||||

| Bars in test | 44599 | Ticks modelled | 126806110 | Modelling quality | 90.00% |

| Mismatched charts errors | 28 | ||||

| Initial deposit | 1000.00 | Spread | 5 | ||

| Total net profit | 892223.83 | Gross profit | 2557792.87 | Gross loss | -1665569.05 |

| Profit factor | 1.54 | Expected payoff | 141.96 | ||

| Absolute drawdown | 245.67 | Maximal drawdown | 61816.55 (10.55%) | Relative drawdown | 32.49% (921.15) |

| Total trades | 6285 | Short positions (won %) | 3418 (61.18%) | Long positions (won %) | 2867 (57.52%) |

| Profit trades (% of total) | 3740 (59.51%) | Loss trades (% of total) | 2545 (40.49%) | ||

| Largest | profit trade | 8983.17 | loss trade | -7823.63 | |

| Average | profit trade | 683.90 | loss trade | -654.45 | |

| Maximum | consecutive wins (profit in money) | 33 (71756.64) | consecutive losses (loss in money) | 18 (-10758.39) | |

| Maximal | consecutive profit (count of wins) | 71756.64 (33) | consecutive loss (count of losses) | -18839.98 (10) | |

| Average | consecutive wins | 3 | consecutive losses | 2 | |