CurrencyTrader

- 유틸리티

- Antonio Renteria Arce

- 버전: 1.0

- 활성화: 5

This tool has been designed for macroeconomic investors. It allows you to observe and operate currency indices that are more uncorrelated instruments than currencies, that do not share the same noise level as pairs and are totally uncorrelated with each other.

CurrencyTrader is a tool that allows you to trade the DXY, EURX, JPYX, GBPX, CADX, AUDX, CHFX and NZDX currency indices

Currently I use this tool for my swintrading in darwinex MACRO for MetaTrader 5 - Antonio Renteria Arce

WHAT ARE CURRENCY INDICES?

When viewing a graph of a currency pair, you see the price of a lot of currency in relation to the other.

EURUSD: 1.2066

You have to give 1.2066 lots of dollar to get 1 lot of euro.

While a pair looks like this.

A currency index allows view the true movement of each currency and have an idea about future development whit out noise of pairs, and whit more conection whit the economy behind some movement.

HOW TO BUILD A CURRENCY INDEX?

First you have to go to Symbols link

Afther that you have to name the symbol and put their synthetic formula construction.

For this example im build the equiponderated dollar index that would eliminate the noise of the large weight of the euro in the DXY and give an objective view of the situation and structure of the price.

If you do a good fundamental analysis, you can predict the price movement with certainty and much better than the others, wedges, accumulation / distribution zones and breaking of guidelines are also evident.

PRACTICAL USE OF CURRENCY INDICES

As you can see, correct index can give you a better knowledge of what can be the market.

CONCLUSION

As you can see, correct index can give you a better knowledge of what can be the market.

I share some index that i build for my broker : This link.

To install the symbols you just have to select import custom group and select the file.

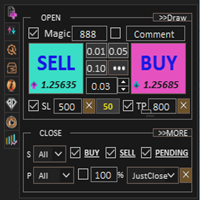

This tool places positions in an equalized way in the main currency and its seven major pairs, distributing the lot in the same way that the construction of the equalized chart does.

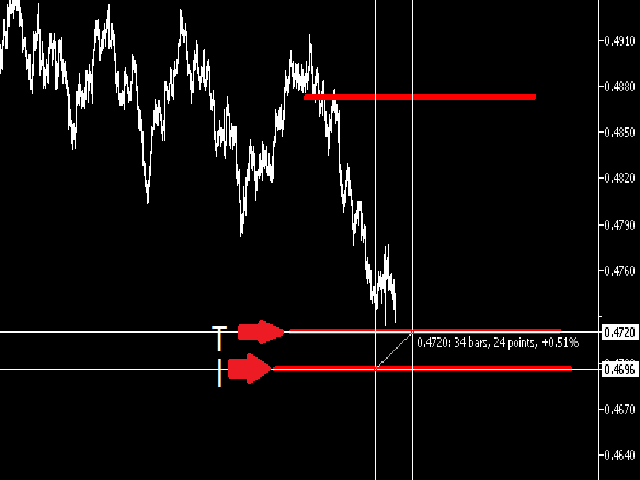

To place orders in the weighted currencies the first step is to draw 3 trend lines that will be our entry, our exit in loss and our target

In this case I want to sell dollars vs the basket of the other 7 pairs

How I want to sell, I go to the dxy sells chart draw 3 trendlines

Entry whit description "T"

Profit whit description "P"

Loss whit description "l"

After that we calcule de distance between Entry point(T) and stoploss(l) in percentage

Dont close the terminal like and wait the price get to your Entrypoint, after that wait for an exit in profit or stoploss

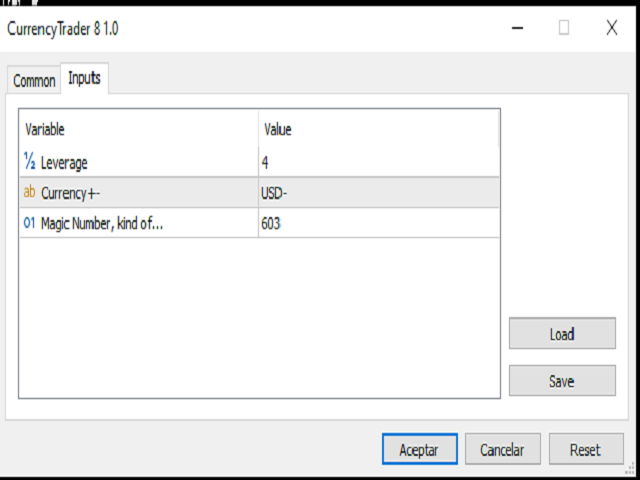

After that you have to select your leverage since your balance

If i have a stop to my entry point 0.5% and i wanna risk 2% of my balance the leverage should be "4"

You can change your trendlines of entrypoint(T) profit(P) and stoploss(S) if your trade is already done

For do buy currencies Indices you have 8 Index

USDINDEX, EUROINDEX, JPYINDEX, GBPINDEX, CADINDEX, AUDINDEX, CHFINDEX, NZDINDEX

For buy you have to place the three lines (l), (T), (P)

and text in the Currency input

USD+, EUR+,JPY+,GBP+,CAD+,AUD+,CHF+,NZD+

depend of your chart.

For do short currencies Indices you have other 8 Index

USDINDEX INVERTED, EUROINDEX INVERTED , JPYINDEX INVERTED , GBPINDEX INVERTED , CADINDEX INVERTED , AUDINDEX INVERTED , CHFINDEX INVERTED , NZDINDEX INVERTED

For short you have to place the three lines (l), (T), (P)

and text in the Currency input

USD-, EUR-,JPY-,GBP-,CAD-,AUD-,CHF-,NZD-

depend of your inverterd chart.

Every open expert have to have a different magic number

Some examples here

If you have any dude just ask dm