TunnelVegas

- 지표

- Josue Da Silva Romagnoli

- 버전: 2.0

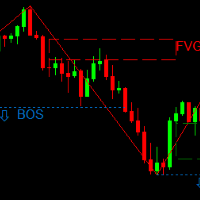

Vegas Tunnel, with up to 20 levels, allowing you to plot or not each level with color change, line thickness and ON/OFF visualization for easy use 100% free and lifetime Recommended use for time frames: Original --> H1 Fractals --> M15, M30, H4, D1 and W1 When the black dots are above the tunnel, start short positions. When the black dots are below the tunnel, start long positions. It's important to remember that just because the market breaks the line of lying doesn't mean it's time to enter a position. We should wait [have patience] for the market to tell us when it's over. We want the market to run out before we enter. After starting a new position and the stops are in place, we try to take 50% of the position in / or around the tunnel. In other words, we reserve half the position to make a profit. The stop on the other 50% of the position is raised to an appropriate profit level or break-even point. The last 50% of the position is held until we get the opposite signal across the tunnel at about the second level of fib . If you have 2 consecutive losing trades, it is a message that the market is in a very strong trend. You, therefore, should not start a new position [with the appropriate stop] until you get a signal at the last level of fib on your chart. For the S&P 500, this would be the fifth [377] fib level. If this leads to a lost trade, we should wait for the market to go back into the tunnel and start over.

Good strategy