GCA Scalping Ranges Indicator

- 지표

- James Peyton Jr Page

- 버전: 2.0

- 업데이트됨: 2 2월 2022

- 활성화: 5

General Description

In the simplest terms this is a contrarian intra-day scalping system. Built to try and let correct trades run as far as possible and flip the trade when indicated. The indicator looks at historical daily trading ranges to lay out levels at which it takes long and short positions based on the statistical levels.

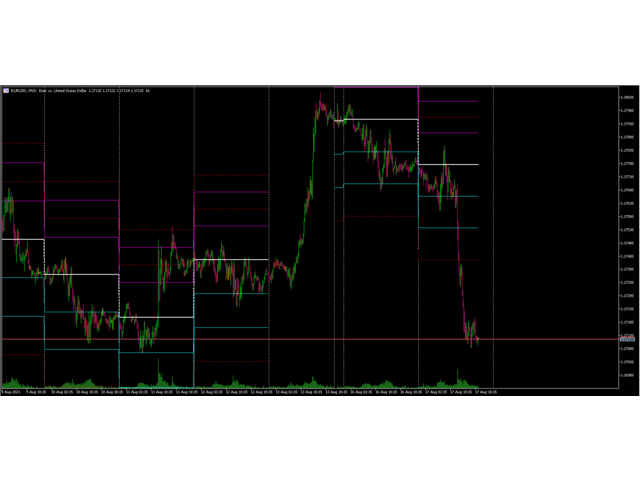

The indicator is built around index futures, mainly around S&P and the DOW but can be used an any futures contract mainly using AMP Futures to trade. The indicator is based on a statistical math equation so it should function on any underlying that is a tradeable instrument such as crypto, forex, stocks, futures, even binary options could be interesting.

I believe the optimal time frame is 15min but I have used the 5min as well

How do I trade it?

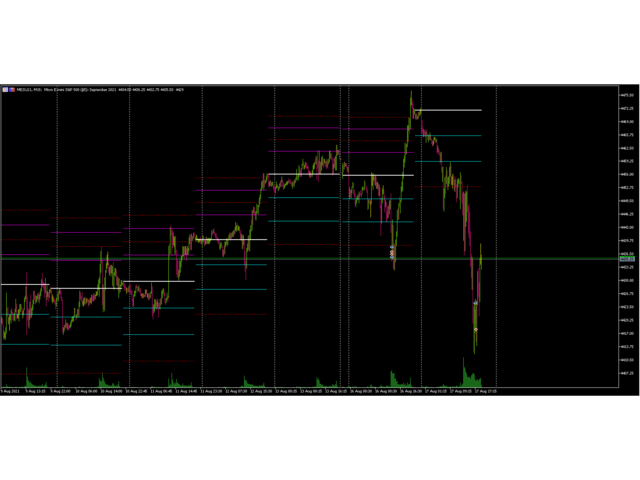

The idea here is that the levels indicate reversal trading levels (please refer to the attached image of the levels) at which the underlying price might revert. Below I will try to run through a few scenarios on how the system should be traded.

Trading Off The Levels: Entry and Initial Stop Loss

- +LVL 2 Stop Loss (dashed red line) = set a stop loss at this level for any short trade entered at +LVL 2 line

- +LVL 2 Short Entry (solid magenta line) = enter a short position when the price has a close above the level and retraces and either touches or passes through, usually by placing a sell stop at the level once a bar close has happened above the level

- +LVL 1 Stop Loss (dashed red line) = set a stop loss at this level for any short trade entered at +LVL 1 line

- +LVL 1 Short Entry (solid magenta line) = enter a short position when the price has a close above the level and retraces and either touches or passes through, usually by placing a sell stop at the level once a bar close has happened above the level

- Opening Price (fat dashed white line) = this is the first tick of the session and is a good point to aim to take profits on all trades, or at least move stops to once a profit level has been reached

- -LVL 1 Long Entry (solid cyan line) = enter a long position when the price has a close below this level and retraces and either touches or passes through, usually by placing a buy stop at the level once a bar close has happened below the level

- -LVL 2 Long Entry (solid cyan line) = enter a long position when the price has a close below this level and retraces and either touches or passes through, usually by placing a buy stop at the level once a bar close has happened below the level

- Long Trade Stop Loss (dashed red line) = all long trades are to have a hard stop loss at this level

- The initial stop loss for each trade can be set at the actual level, but if you are watching the trade actively you could opt to use a candle close crossing the stop loss line instead of a touch the line exit

- Move your stop loss, change the stop loss after the price has reached the mid-point, or opening tick line. For example, if you are long on the -LVL 2 and long on the -LVL 1 levels, you are hold 2 lots and the price goes all the way up to mid-point/open price, you should then move the stop loss to the -LVL 1 line and continue to move the stop loss up one level as the price moves in or direction, be ready to flip the trade when the upper levels are breached.

- Take profits on a moved stop loss or lock in profits ASAP when price reaches mid-point

General Information

- You should not be in more than 2 positions at a time

- Stay mechanical for best results

Settings

Scalping Range Indicator Settings

- Use With EA (Keep False): keep this false

- Max Chart Data Pull: this is how far back the EA will calculate the levels, increase this number to widen the levels and have less but possibly more accurate trade set ups

- Trading Session Lookback: this setting determines the daily session range lookback, larger numbers increase the number of sessions that it pulls to determine the levels

- Trading Session Open/Close: this is a time setting, telling the system when to start trading, close positions, and when create the daily trading range. This is set for CST/Chicago for trading the index futures translated to CST it is 5:00pm to 4:55pm

- Session Box: used more for debugging, but is a nice visual to see session and make sure your time settings are correct

- Session Box Color: changes the color of the box