Volatility indicator no lagging

- 지표

- Anton Polkovnikov

- 버전: 1.2

- 업데이트됨: 12 1월 2022

- 활성화: 5

Non-lagging VOLATILITY indicator

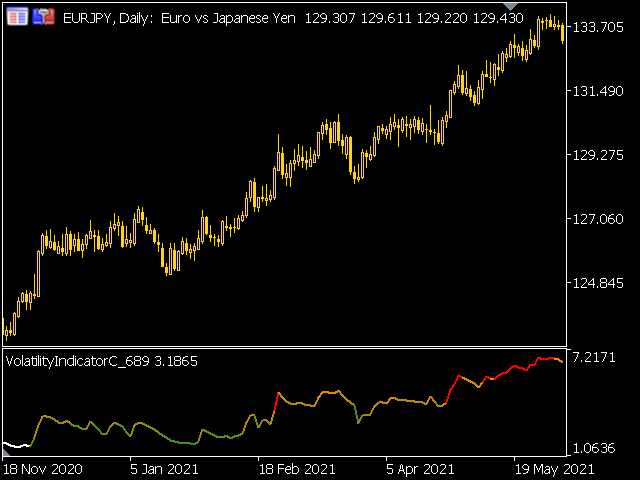

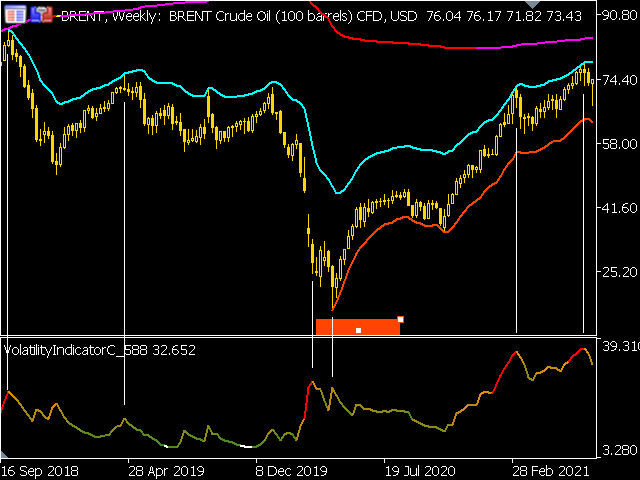

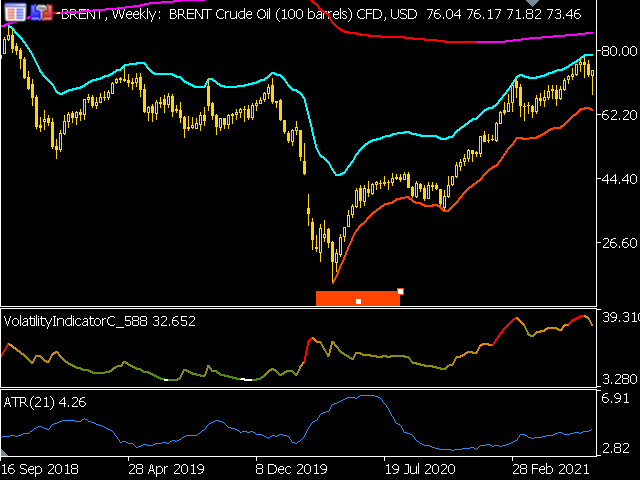

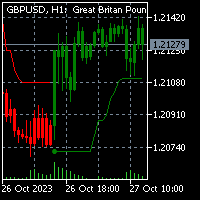

A radical modification of the ATR indicator, which corrected all of its shortcomings (the picture shows the difference with ATR). The indicator shows the swing size of the current market movement.

Features:

- does not have a time window period, i.e. any subjective settings

- non-delayed, the extremums of the indicator always coincide with the extremum of the price (note the picture)

- is normalized by means of a color solution, i.e. it has the properties of an oscillator, while showing absolute values correlated with the price

- works with any instrument (stocks, futures, currencies, crypto) and with any TF

- choice of indicator calculation units - percentage or absolute value

Usage options:

- Similarly ATR - getting the values of the potential range of the price movement. To set TP or SL.

- Identification of indicator extrema in order to detect price extrema - they coincide. It is possible to use diverters.

- Normalizing through the color scheme allows you to understand how close the indicator is to its extreme value. In this area the curve has a bright red color.

- Position management through analysis of current volatility. Low volatility implies a subsequent strong move. So in the area of low volatility it is reasonable to enter in larger size. We have a potentially low stop level and a large possible profit. In the areas of high volatility, you should not enter into a position with a large volume, at least in the direction of the current movement, because it can end at any moment. And coloring the indicator red will allow you to avoid such situations.

- Any other option that is used when working with ATR

Colors:

- White - the lowest level of volatility

- Gradient (adjustable) - volatility increase from low to high

- Red - the highest level of volatility

The MaxQuantsNum settings item is responsible for the number of candles on which the indicator will be displayed.

You can turn on alerts on reaching low and high areas of volatility.