Trend Second Derivative RSI Ex

- Experts

- Tatiana Savkevych

- 버전: 1.1

- 활성화: 5

Trend Second Derivative RSI Ex is a forex trending bot based on the Trend Second Derivative RSI indicator.

Principle of operation.

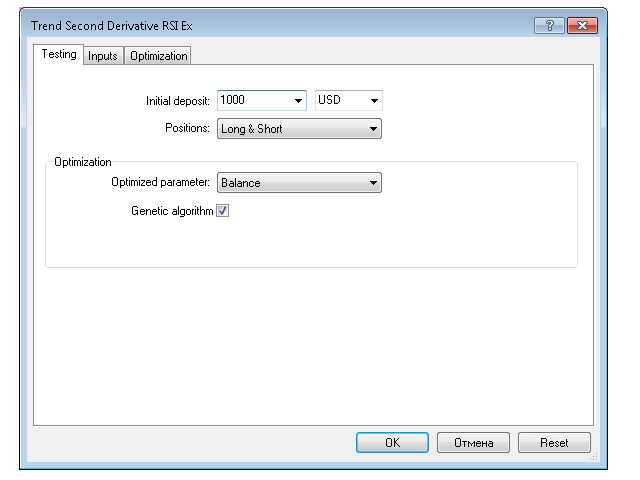

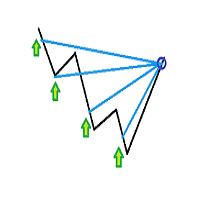

A bot created on the basis of this Trend Second Derivative RSI indicator and working on the principle - if there is an indicator signal, then the bot has closed the opposite deal and opened a new deal in the specified direction. It is also possible to work only for buy or sell, in which case the bot will simply close the deal without opening it in the opposite direction. The bot is also equipped with an adaptive position exit system. If the indicator does not give a positive signal for a long time, the bot, having calculated the average holding time of a trade by the indicator and knowing the average profit indicators of the trade, will automatically look for the moment of exiting the trade when the price is approaching even without a signal. In this form, the bot can be bought, downloaded and used for work. The bot is as simple as possible! The bot fully reflects the work of the indicator. Moreover, the bot can be optimized (by optimizing the parameters of the indicator itself) and thus automatically obtain the most optimal indicator indicators for the required period of history.

You can buy an indicator and create a bot based on it without buying this development. The principle of operation is fully described in this description. In fact, the whole principle is described in the previous paragraph, just modify the money management to it as desired, error control, control of the averaged output and correct signal processing.

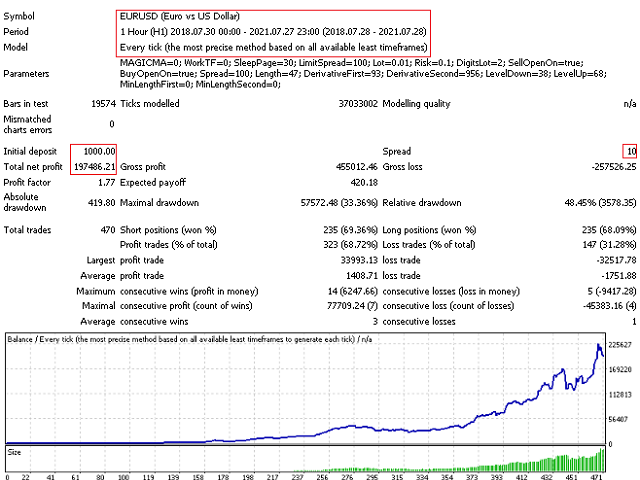

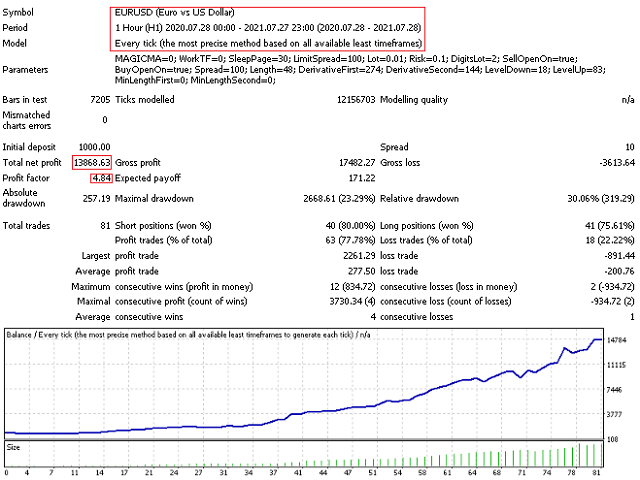

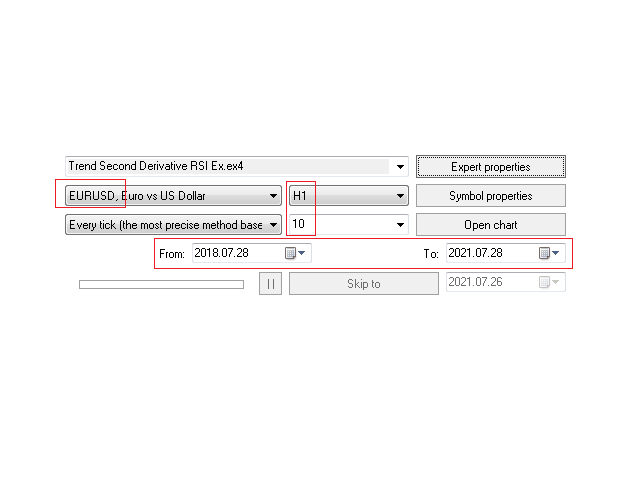

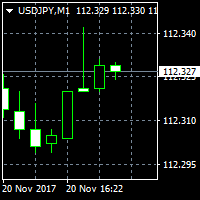

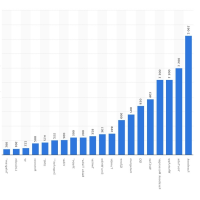

In the screenshots you can see tests that show the bot can work for 1,3,6 years, the timeframe is one hour. These are demo tests that show that it is realistic to go through significant sections of history with a different indicator and simple rules. Below in the text you will see a description of the rules of work. For real work, optimization is proposed for 3-12 months and work up to 1-2 months. Optimization is fast because it is possible at open prices. And since the rules for the bot operation are simple, the optimization set also works for all ticks and, of course, for checkpoints. Also pay attention to the minimum spread for the indicator, it is used to calculate the profitability of signals.

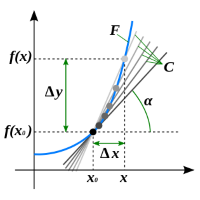

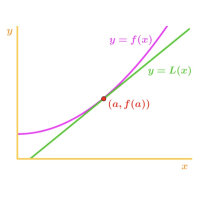

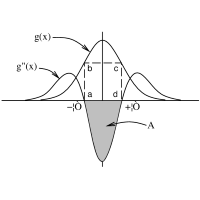

Theoretical Foundations of Basic Entry Logic).

To control the period of the RSI indicator, we will use the derivative of the derivative of the price function at a certain time interval (Length), which is the same as the second-order derivative. In differential, there are numerous second derivative, or second-order derivative, of a function (derivative of a derivative). While the analogy of the first derivative is speed, the analogy of the second derivative is acceleration. Roughly speaking, the second derivative measures how the rate of change of a quantity itself changes; for example, the second derivative of the vehicle's position in time is the instantaneous acceleration of the vehicle, or the speed at which the vehicle's speed changes with respect to time. In the graph of the function, the second derivative corresponds to the curvature or concavity of the graph. The graph of a function with a positive second derivative is concave upward, while a graph of a function with a negative second derivative bends in the opposite way.

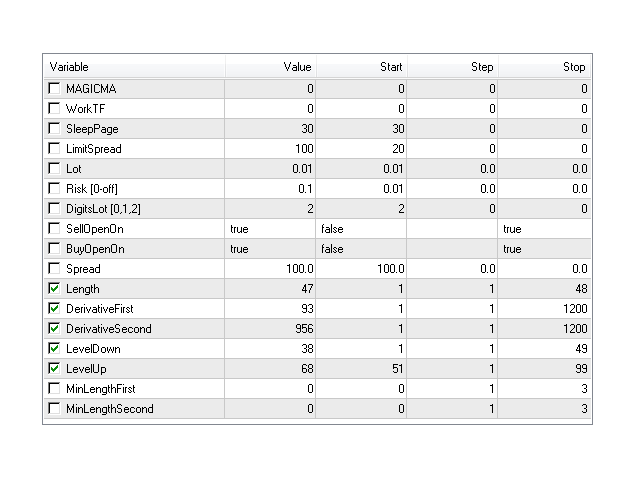

After the mathematical transformation is made, we transform the result using the coefficient (DerivativeFirst and DerivativeSecond) to a value acceptable for the RSI indicator, and that's it! It is also possible to set the minimum oscillator level using the parameter (MinLengthFirst and MinLengthSecond).

The configuration files for the demonstration are listed in the discussion. The main thing to understand is that the indicator parameters must be optimized for each instrument and each timeframe.