Gbpjpy H1 Subportfolio

- Experts

- Simon Ocko

- 버전: 1.0

- 활성화: 5

5 in 1 GBPJPY H1 SUBPORTFOLIO

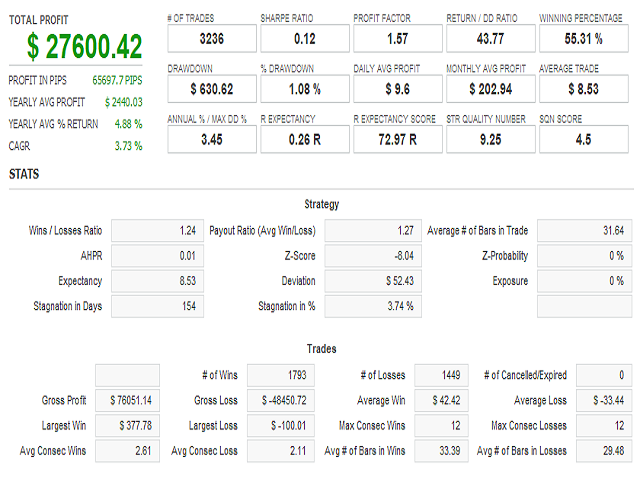

GBPJPY H1 Subportfolio is is a longterm oriented EA that combines not one, but five different EAs.

The EA was developed through countless days to deliver the best product to you. Combining five EAs into one ensures that that the drawdown is minimal at every point in time as the strategies included are completely uncorrelated. That means, that you will actually get five EAs for a smaller price that most other EAs.

It is a set and forget EA that will serve you for years to come, especially if you take the time and optimize it every couple of months to ensure, that the EA is fitted to the current market situation.

Although this EA is optimized for Gbpjpy H1 chart you can also try and use it on other timerframes and symbols, but you will probably have to reoptimize it first.

I would recommend you to first play with money management settings to set them to your risk tolerance. By default risk is 5% per trade. I would recommend to lower the risk per trade to 0.4% = 2% max risk at any point - 0.4% * 5 = 2%).

This EA works great with my other subportfolio EAs since they're all highly uncorelated.

- EA works best on brokers that have time UTC+02

- EA was tested using high slippage and spread. It's performance was also tested on an out of sample data.

- EA passed numerous Montecarlo robustness tests (Price data manipulation, spread and slippage manipulation, parameter values manipulation...).

- EA combines 5 EAs into one. Some strategies trade with the trend, some trade counter trend. All are highly uncorrelated. Using portfolios is the safest way to trade, as all strategies fail sooner or later. Portfolio ensures that risk is diversified while still attaining high profit.

- Specially made to ensure small Drawdown.

- EA was developed using highly advanced machine learning.

- Low price so that anyone can afford it.

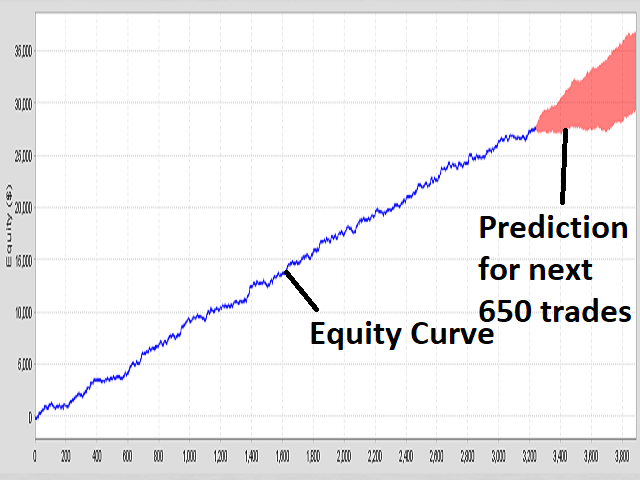

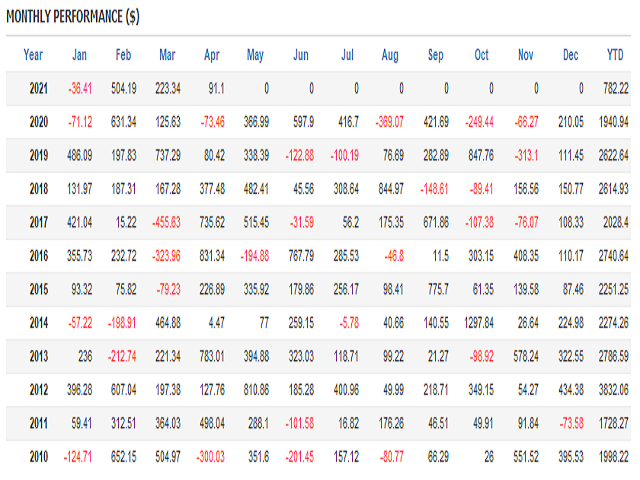

- EA was tested on Gbpjpy H1 2010-2021, Dukascopy price data. There were no negative years in that period.

- Longterm oriented.

- Works on any timeframe and symbol, but you will first have to reoptimize it.

- Be careful of the current spread if you're backtesting during the weekend.