PZ Correlation

- 지표

- PZ TRADING SLU

- 버전: 2.2

- 업데이트됨: 21 10월 2020

- 활성화: 20

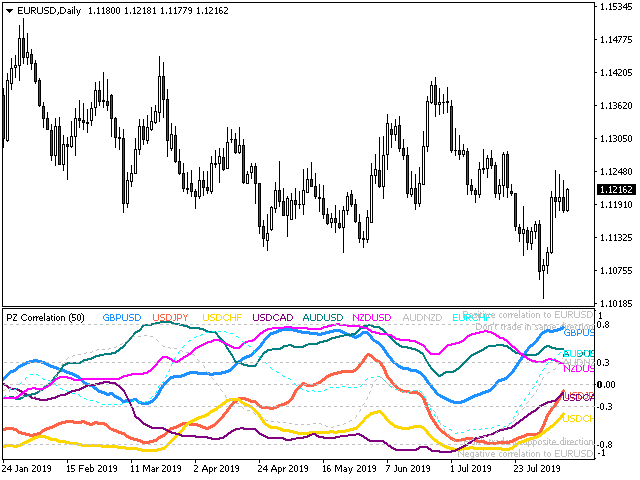

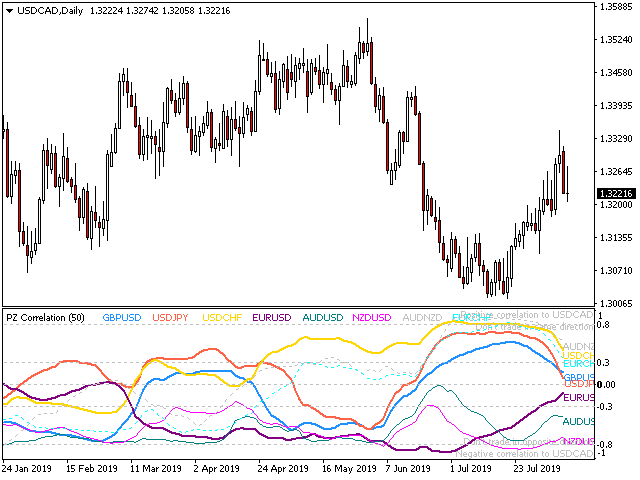

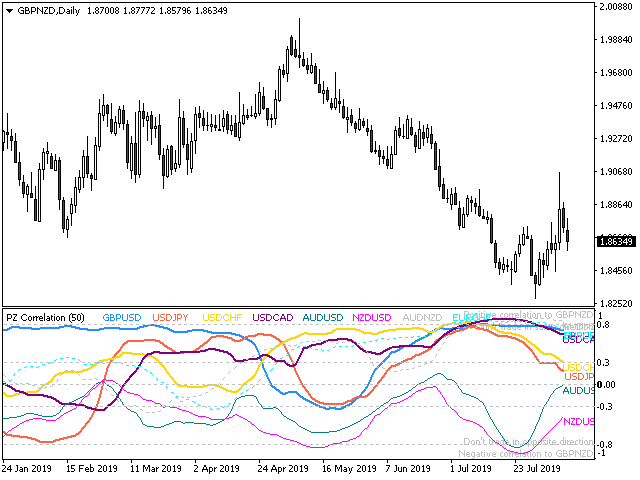

In the world of finance, correlation is a statistical measure of how two securities move in relation to each other. Correlations are used in advanced portfolio management. This indicator measures how different securities move in relation to a reference one, thus making portfolio management easier. [ Installation Guide | Update Guide | Troubleshooting | FAQ | All Products ]

- Avoid concurrent trades in highly correlated instruments

- Find trading opportunities among highly correlated instruments

- Correlation is positive when two securities rise in price together

- Correlation is negative when one security increases and the other decreases

The correlation between two securities is measured by a correlation coefficient.

- A coefficient of zero is neutral correlation

- A coefficient of 0.3 is low positive correlation

- A coefficient over 0.8 is high positive correlation

- A coefficient of -0.3 is low negative correlation

- A coefficient over -0.8 is high negative correlation

Input Parameters

- Max History Bars: Amunt of bars to evaluate to the past upon loading.

- Correlation Period: Amount of bars to use to calculate the correlation.

- 1st Symbol to 8th Symbol: Enter the symbols to calculate the correlation.

Author

Arturo López Pérez, private investor and speculator, software engineer and founder of Point Zero Trading Solutions.

还行,主要是看货币之间关联性的强弱,做对冲方法上可以尝试。

QQ:445114213

关注我的信号:https://www.mql5.com/zh/signals/530849