EA Pivot SMA

- Experts

- Antoine Diego Horak

- 버전: 1.0

- 활성화: 5

- Strategy quick description :

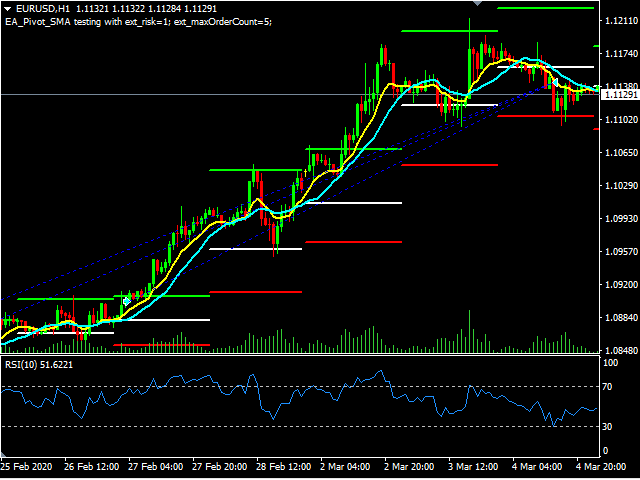

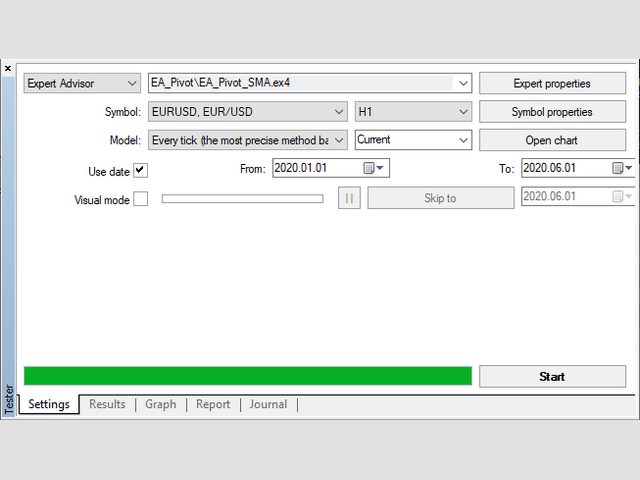

- Forex trading on H1 time unit

- The daily pivot point (DPP) defines the trend

- Buy or Sell when SMA15 cut with DPP regarding SMMA5 and RSI10 and the last candle values

- Close positions when SMA15 cut-reversed DDP

- Do not take position before the 02:00 AM

- Multiple positions are allowed, default = 5 positions

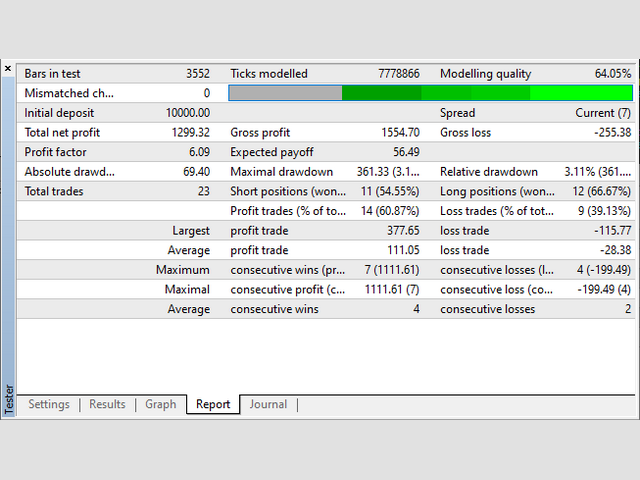

- Risk management, default Exposure = 1% for each order

- Use of a Stop Loss

- Positions can stay opened several days

- Do not take position if there is not enough money

- Close all pending orders of the current symbol and remove the EA if the balance is Null or Negative

- Trend definition :

This strategy uses the daily pivot point (DDP) to define the trend.

DDP is calculated with one level of support and resistance.

Trend is Bullish when DPP and support are respectively upper than last ones.

Trend is Bearish when DPP and resistance are respectively lower than last ones.

Trend is Null in other cases. - Conditions to Buy :

The Trend is Bullish

The SMA 15 cut up the DPP

The SMMA 5 is lower than the DPP resistance

The last closed candle has open and close prices higher than the SMMA 5

The RSI value is lower than 70% - Conditions to close Buy positions :

The SMA 15 cut down the Resistence, or DPP, or Support possibly few days later. - Conditions to Sell :

The Trend is Bearish

The SMA 15 cut down the DPP

The SMMA 5 is higher than the DPP support

The last closed candle has open and close prices lower than the SMMA 5

The RSI value is higher than 30% - Conditions to close Sell positions :

The SMA 15 cut up the Resistence, or DPP, or Support possibly few days later.