Indicator ForexMatrixPro

- 지표

- Aleksey Maltsev

- 버전: 1.1

- 활성화: 5

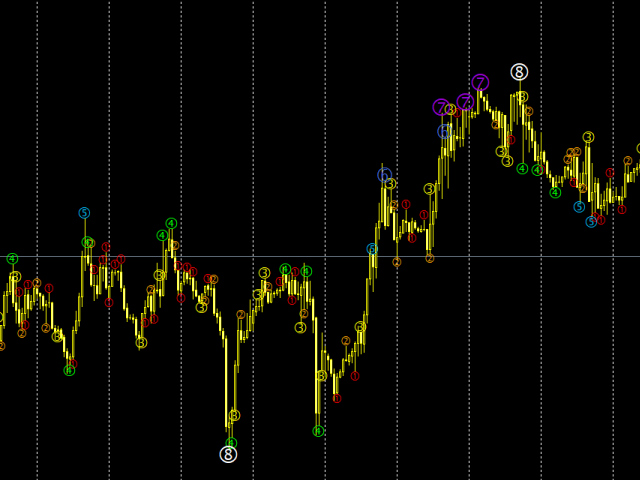

This indicator shows the pivot points of corrections, trends and trends. Matrix calculation system shows 8 types of reversal of the currency pair chart.

Signal classification:

Category 1 - the basic signal. Provides corrective movement between the phases of the graph. On the D1 timeframe it is possible to apply for trading on each bar.

Category 2 - the most basic signal on the graph. In a calm market with a small ATR (for example, night trading), its signals will be major. In impulse movements it performs a correctional role;

In impulse movements, it is recommended to use it only in the direction of the trend, as a set of positions along the trend;

Category 3 - boundary signal of the exit of the trend channel. This signal can alternate with the main signal inside the pulse, which makes it possible to add new positions with virtually no risk. In a calm market serves as a good reversal signal.

4-6 Categories - impulse categories, they show how far the price has gone from the center of gravity of the price, as well as the strength to consolidate the positions of market participants. The larger the number of the signal category, the less frequently the exchange of counter signals occurs. And the larger category we see the number, the closer in time the end of the trend will be;

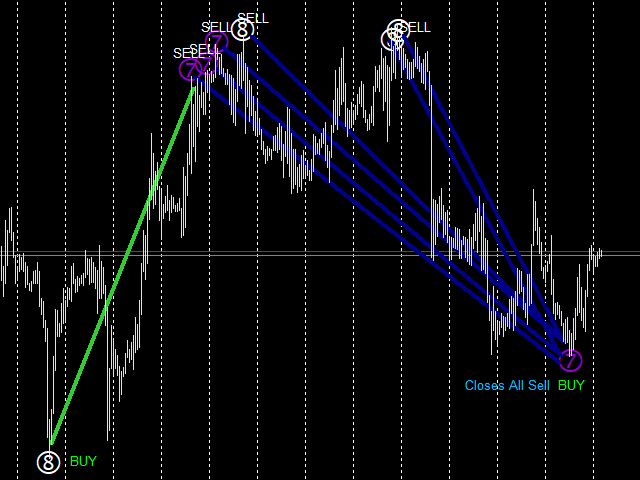

7-8 categories - reversal signals. Show an approaching trend or trend reversal.

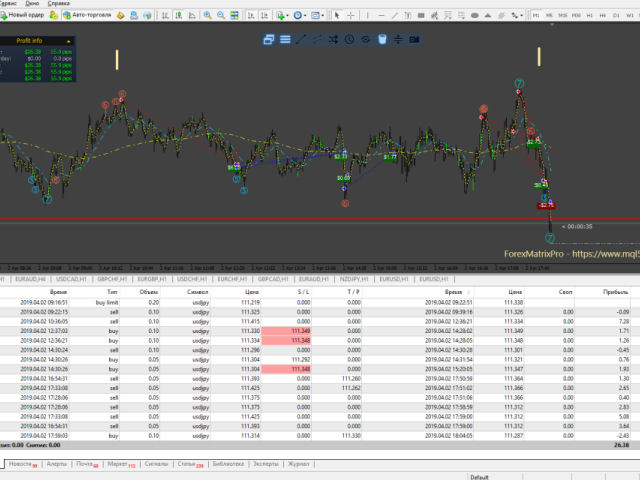

The indicator has enough settings to adjust to your trading style.

The indicator does not redraw on history. When trading, be sure to try on the rules of money management. The higher the category of the signal, the greater the likelihood of a trend change.

When using the indicator, it is necessary to draw the current trend or trend. It is best to use the H1 timeframe and higher. The screenshots show the use of the indicator.

Optimal trading with an indicator is the use of 4.7 and 8 signals only.

Consolidation and trend accumulations can be seen from the accumulation of signals of the same category.

In all cases, it is recommended to work with partial closing of the position, for example, 2/3 of 3 to increase the stop loss in the breakeven.