Confirmation Klinger Volume Oscillator

- 지표

- Demetrios Kostopoulos

- 버전: 2.0

- 업데이트됨: 17 12월 2018

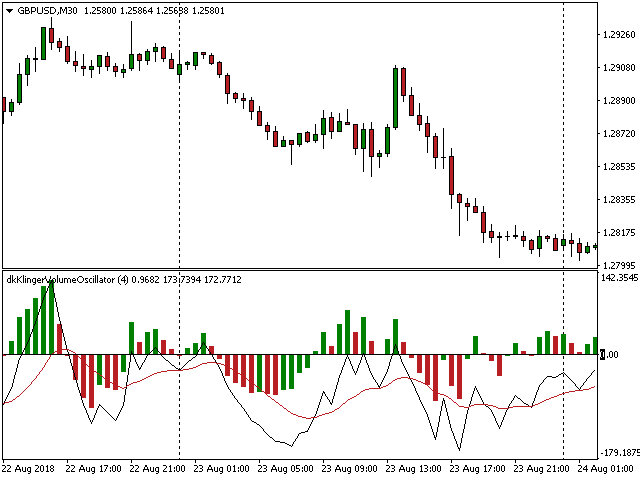

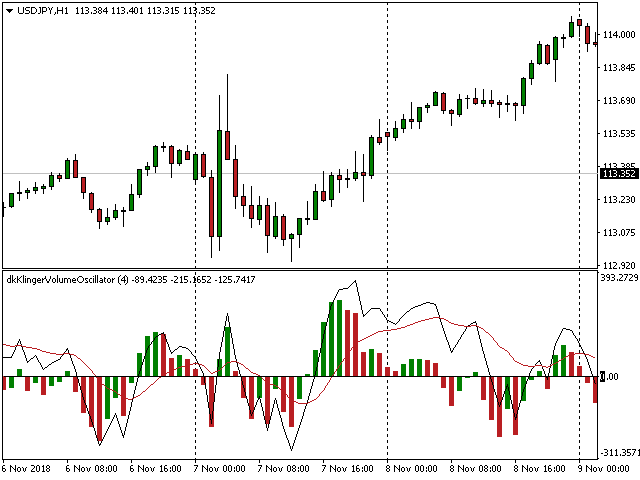

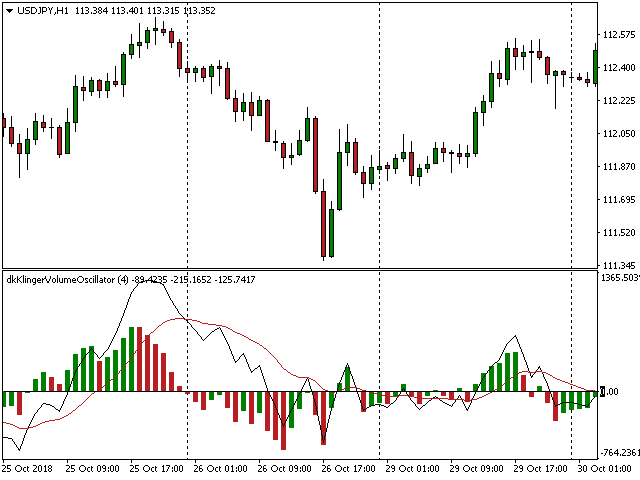

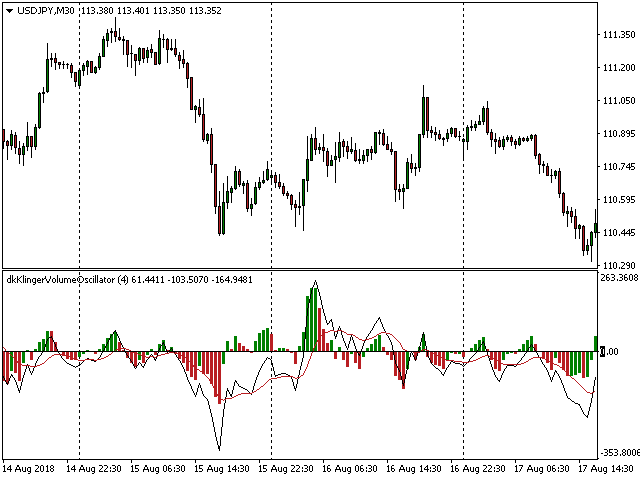

- 활성화: 10

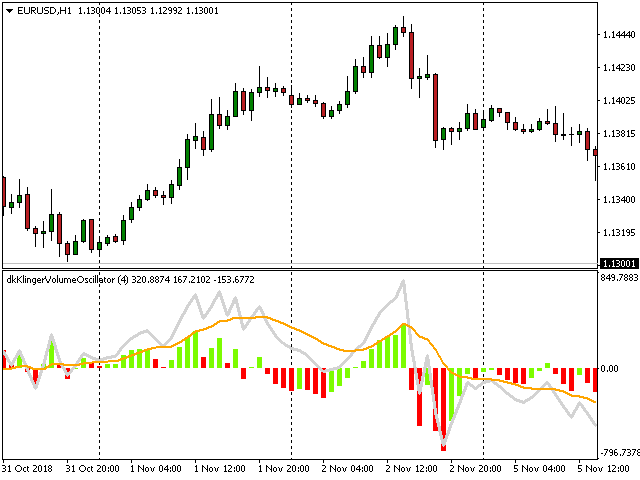

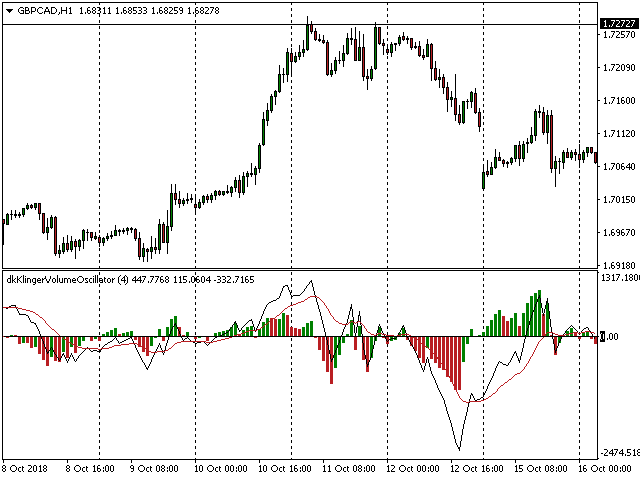

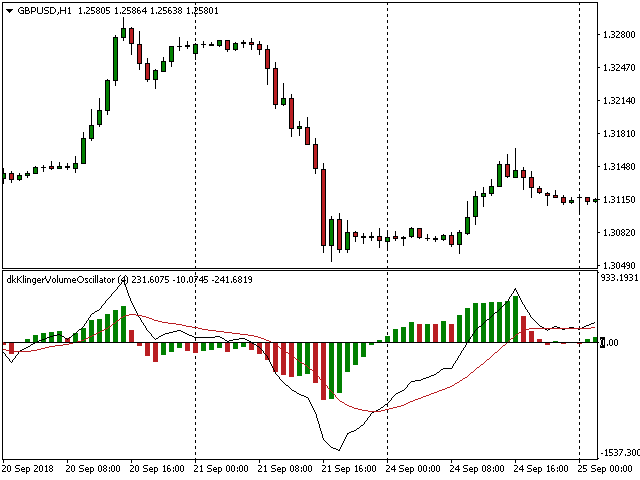

Or (KVO) determines the long-term trend of money flow while remaining sensitive enough to confirm short-term reversals.It uses the key price, and increasing and decreasing bars compared to the prior bar's key price and increasing and decreasing bars to assign volume and the trend as positive or negative values. Volume is a measure of how many units of a pair are trading per unit of time, while the increasing and decreasing bars are a measure strength of the trend the trend.The Klinger Volume Oscillator is a trend reversal confirmation indicator. It relies on the concept of a volume force, and increasing and decreasing bars against the signal line or volume line.

Volume Force = volume * trend * temp * 100

Trading Tips

- KVO uses a signal line (13-period exponential moving average) and increasing and decreasing bars to confirm trend reversal.

- KVO is when the peak or trough of the KVO line, and icreasing and decreasing bars are both through the signal line.

- KVO uses divergence to identify when price and volume are not confirming the direction of the move. It's a bullish sign when the value of the indicator is heading upward while the price of the security continues to fall and vice versa for a bearish sign.

- A crossover of the Klinger line, and increasing and decreasing bars above or below the signal line creates a confirmation buy or sell signal.

Inputs

- Signal Period: 13 Period exponential moving average (default) calculates the signal line.

- Short Cycle: 34 Period exponential moving averages (default) is used to calculate the the volume of the trend

- Long Cycle: 55 Period exponential moving averages (default) is subtracted from the short cycle to give the final value.

Colors and Settings

- Signal Line: Orange (default)

- KVO Line: Light Gray(Default)

- Increasing Bars:

Happy trading.

Regards:

Demetrios Kostopoulos